In a recent statement, Cathie Wood, CEO of ARK Invest, highlighted a significant shift in investor sentiment from gold to Bitcoin following the introduction of spot Bitcoin Exchange-Traded Funds (ETFs), intensifying bitcoin vs gold arguments.

Wood emphasized the growing appeal of Bitcoin relative to gold, attributing this trend to a more streamlined and accessible means of acquiring the digital asset through the newly launched ETFs.

Bitcoin vs Gold: “Risk-Off” Alternatives

During a recent discussion with chief futurist Brett Winton on ARK Invest’s YouTube channel, Wood drew parallels between bitcoin and gold, asserting that both assets serve as “risk-off” alternatives when the traditional banking sector displays signs of vulnerability.

Reflecting on the March 2023 regional bank crisis in the United States, Wood pointed out the notable 40% surge in bitcoin at the time.

Drawing attention to the current state of the regional bank index, Wood noted its recent erratic behavior. She commented on the prevailing narrative of Bitcoin being a “flight to quality or a flight to safety,” asserting that this notion is once again gaining prominence in the market.

Fidelity’s Report

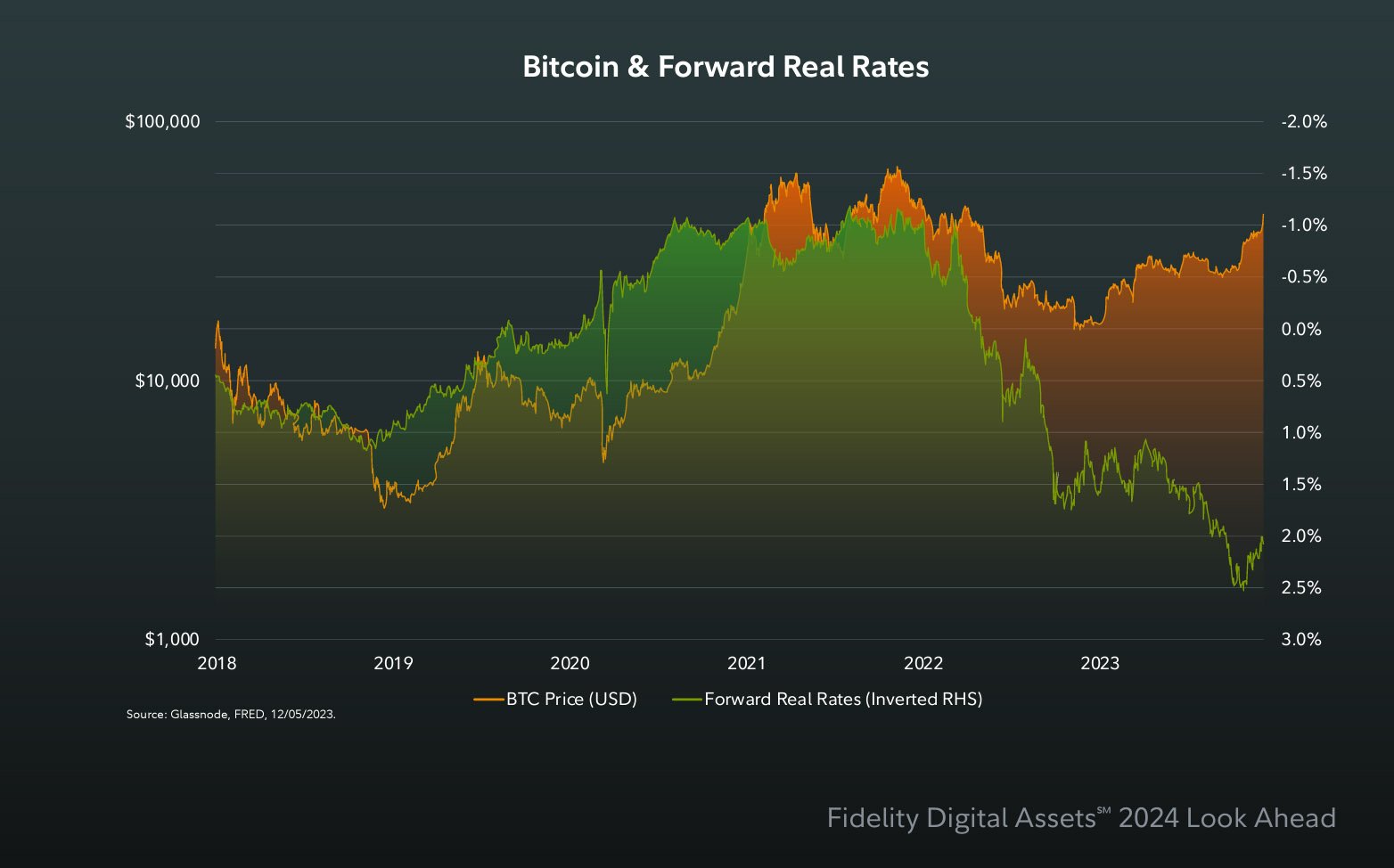

Notably, a recent analysis by Fidelity underscored a changing correlation landscape, revealing that bitcoin’s correlation with gold increased in 2023, diverging from its previously inverse relationship with increasing global interest rates, which generally leads to a drop in demand for risky assets.

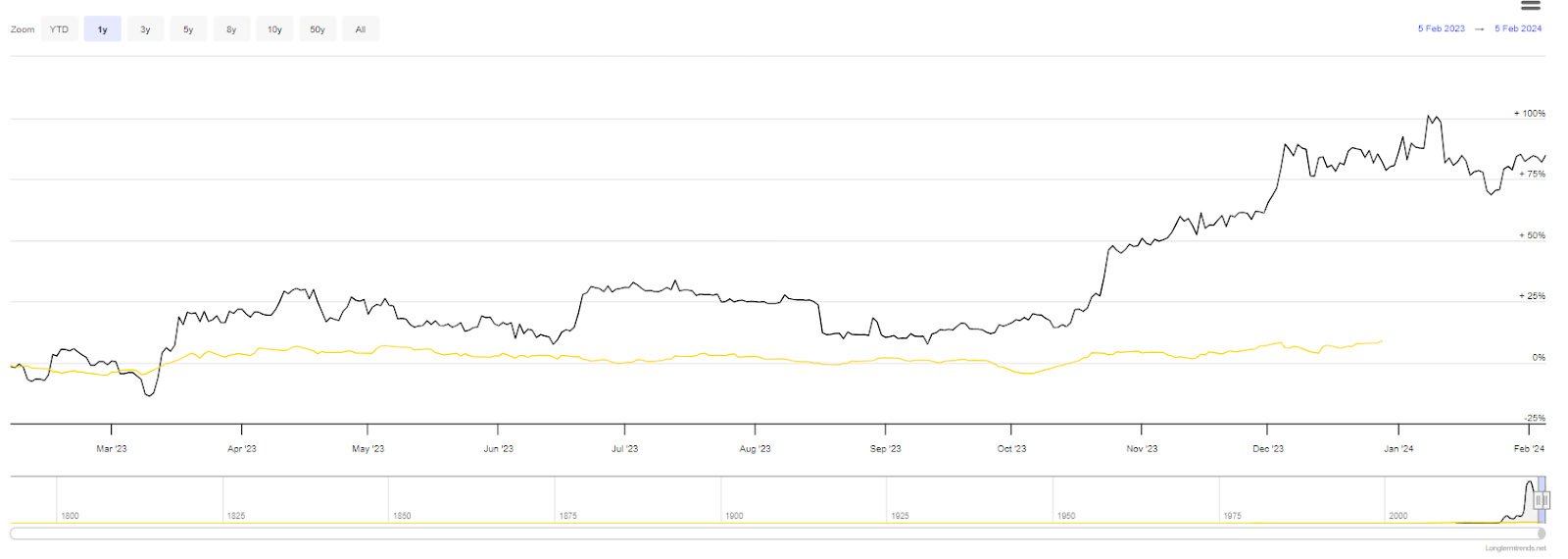

The one-year rolling correlation between bitcoin and gold now stands at 0.80, marking its highest recorded level, according to the data by Longtermtrends.

15 Million BTC Untouched Despite Recent Price Drop

Wood addressed the price correction following the spot Bitcoin ETF launch, expressing no surprise at the 20% decline from $48,500 to $38,740 on January 24. She stated:

“The reason we believe Bitcoin went down after the ETFs were introduced is because there was a lot of anticipatory buying before the ETFs came out. There was a bit of ‘sell-on-the-news’, these are the trading types who just are very opportunistic in that way.”

ARK Invest’s CEO pointed out that a significant portion of the 19.5 million circulating bitcoin, specifically 15 million, are in strong hands and have remained untouched for 155 days, suggesting a resilient and long-term perspective among most bitcoin holders.

Despite many big names calling the Securities and Exchange’s (SEC) ETF approval a flop, CryptoQuant data clearly shows that the trading volume of ETFs is already commanding a significant share as compared to that of centralized exchanges.

Notably, ARK Invest launched the ARK 21Shares Bitcoin ETF on January 11, which has quickly amassed over $705 million in bitcoin holdings. According to BitMEX Research data, only BlackRock’s IBIT and Fidelity’s FBTC products have attracted more investors than ARK’s 21Shares.

Interestingly, Wood’s firm has been actively involved in the digital asset space, not only as an ETF issuer but also as a significant buyer of Coinbase stock. As of February 2022, ARK Invest held 7.187 million shares of Coinbase stock valued at around $840 million across various ETFs.

Wood’s insights shed light on the evolving dynamics between traditional safe-haven assets and the emerging role of Bitcoin, particularly in times of regional banking turbulence. The increased correlation with gold and the resilience displayed by bitcoin holders post-ETF launch indicate a maturing and enduring interest in the digital asset as a viable alternative investment.