The recent approval of spot Bitcoin Exchange-Traded Funds (ETFs) in the United States has sparked a notable uptick in retail interest in Bitcoin among Australians, a recent survey reveals.

Independent Reserve Report

Conducted as part of the fifth annual Independent Reserve Cryptocurrency Index (IRCI), the survey sheds light on shifting sentiments and digital asset adoption trends in the land down under. Notably, its findings are based on insights from 2,100 adults, unveiling a nuanced picture of the Australian digital asset landscape.

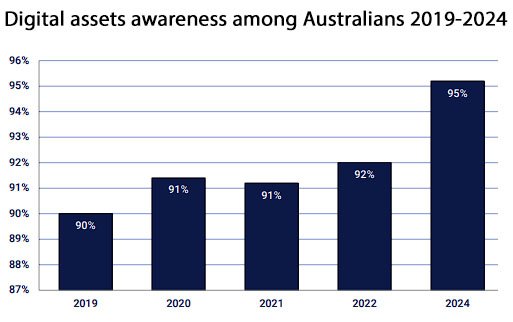

Digital asset awareness among Australians has risen to a new peak, reaching 95%, a notable increase from 92% in 2022, marking a 3% growth over the past five years.

The age group exhibiting the highest awareness, at 98.6%, falls between 35 and 44 years old. Independent Reserve CEO Adrian Przelozny’s team states:

“Despite the challenges the crypto industry faced in 2023, such as the fallout from the FTX saga and the collapse of Signature Bank, this year’s IRCI data demonstrates that Australians’ interest and investment in crypto remain high and continue to gain momentum.”

Bitcoin’s Domination

Bitcoin has solidified its position as the preferred digital asset for 36% of the population, reflecting a significant 12% surge since 2019. Out of this, a significant boost of 25% was experienced post the US approval of spot Bitcoin ETFs, signaling a renewed optimism and growth phase.

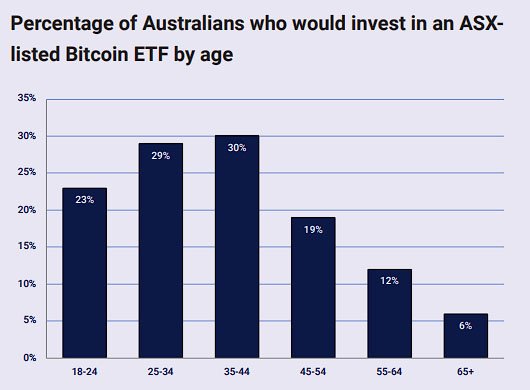

The major rise in positive sentiment was seen in people aged 55 and above, where liking Bitcoin went up by 100%. The survey found that 19% of people would invest in a spot Bitcoin ETF listed on the Australian Securities Exchange (ASX) if there was one.

“The Australian Securities Exchange (ASX) is predicted to approve an ETF linked to the price of Bitcoin in the first half of 2024 , and Australians have a strong appetite for it,” the report stated.

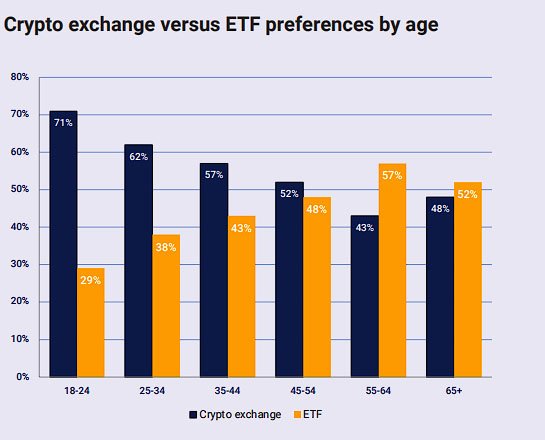

On the other hand, around one-third of respondents express a likelihood to invest in Bitcoin over the long term via a self-managed retirement fund. However, there is an equal divide among these respondents on whether they prefer accessing Bitcoin through an exchange or an ETF.

Interestingly, the percentage of Australians disapproving of any digital assets has dropped from 45% in 2019 to 22%.

Shifts in Digital Asset Ownership

The survey highlights a noteworthy shift in overall digital asset ownership, witnessing a 1.9% increase to 27.5% between 2022 and 2024. The most substantial changes are recorded among respondents aged 55 to 64 and 65 and above, demonstrating increases of 128% and 200%, respectively.

This shift underscores the growing appeal of digital asset, especially among older demographics, and suggests a broader diversification of investment portfolios.

Regulatory Developments and the Road Ahead

In October 2023, Australia’s Treasury Department proposed a digital asset regulatory framework and roadmap. The country is gearing up to release draft legislation covering licensing and custody rules for digital asset providers by 2024.

While this regulatory stride is anticipated to bring clarity and legitimacy to the digital asset space, the timeline suggests that Australian digital asset platforms may have to wait until 2025 to receive licenses under the proposed regime. IRCI states:

“The regulatory development promises to bring the industry greater confidence and certainty, paving the way for institutional investment and broader adoption.”

As retail investors navigate uncertainties, positive sentiments fueled by regulatory advancements and innovative investment products hint at a promising future for digital assets in the Australian financial system.