Metaplanet Inc., a Tokyo Stock Exchange-listed company, has recently adopted bitcoin as its strategic treasury reserve asset.

Faced with Japan’s economic challenges, including soaring debt levels and a weakening yen, Metaplanet has changed tactics, aiming to protect investors against currency depreciation and leverage opportunities in capital markets.

The company, once a major player in the commercial real estate market across Asia, has undergone a remarkable transformation.

Originally founded in 1999, the company has a diverse history that includes hotel operations, investment services, and investor relations consultancy.

The COVID-19 pandemic dealt a severe blow to the hospitality industry, prompting Metaplanet to sell off most of its commercial real estate holdings and clean up its balance sheet.

Now, with a single hotel in Tokyo as its remaining physical asset, the firm has set its sights on a new frontier: Bitcoin accumulation through public capital markets.

Metaplanet’s journey towards Bitcoin was a winding one. Initially, the company explored the idea of a “Web3” or “crypto” pivot, but it soon became clear that a full-scale implementation of a public corporate Bitcoin standard was the best way forward.

This decision was driven by a belief that Bitcoin is superior to other forms of currency, and a desire to provide Japanese investors with a tax-efficient Bitcoin proxy in equity markets.

Like MicroStrategy’s Michael Saylor, Metaplanet’s CEO, Simon Gerovich, undertook an extensive process to educate the company’s board about Bitcoin. A long-time passive follower and investor in digital assets, Gerovich focused on the Bitcoin-only approach early in 2024.

The Japanese company also sought outside investment from within the Bitcoin ecosystem and appointed new board members who supported the corporate Bitcoin standard.

One key player in this Bitcoin journey is Dylan LeClair, an ardent proponent of corporate Bitcoin adoption.

Dylan joined the company through a connection with UTXO Management, bringing his expertise and passion for Bitcoin to help spearhead the implementation of Metaplanet’s corporate Bitcoin strategy.

Japan’s economic environment has played a crucial role in shaping Metaplanet’s financial strategy. With Japan’s high debt levels and weaker stimulus compared to other G7 nations, commercial real estate investors were left vulnerable during the COVID-19 pandemic.

After cleaning up its balance sheet in 2023, Metaplanet spent nearly a year exploring new strategic pivots before solidifying its Bitcoin-focused vision.

Retail and institutional investors in Japan have had a complex relationship with Bitcoin. The country’s association with the infamous Mt. Gox incident initially tarnished Bitcoin’s reputation.

However, in the face of global inflation and a weakening yen, both retail and institutional investors are becoming more open to considering Bitcoin a legit alternative investment option. Pain often serves as one of the best teachers.

Metaplanet’s goal is to educate these investors on Bitcoin’s unique attributes compared to other digital assets, positioning itself as a pioneering force in shaping the institutional investment landscape around Bitcoin in Japan.

Metaplanet is dedicated to expanding its bitcoin holdings over time. While the company has not disclosed specific details about its custody arrangements and acquisition strategies, it aims to set a high standard for corporate governance and transparency under a Bitcoin standard as a public company.

This commitment involves carefully balancing trade-offs between privacy, accountability, and transparency.

Metaplanet’s approach to volatility mirrors that of MicroStrategy. By embracing Bitcoin’s inherent volatility, Metaplanet remains focused on its long-term strategic goals, disregarding short-term price fluctuations to leverage Bitcoin’s huge benefits.

Metaplanet does not perceive direct competition in its Bitcoin-focused strategy, considering Bitcoin adoption a positive-sum game.

Unlike the zero-sum dynamics often seen on Wall Street, in hedge funds, and within the fiat currency system, Bitcoin offers a collaborative and mutually beneficial growth opportunity.

Metaplanet expects Bitcoin adoption to become increasingly common worldwide and actively encourages other corporations to follow this innovative path.

By shifting its focus to Bitcoin, Metaplanet anticipates several competitive advantages, including a more robust balance sheet, enhanced global recognition, and heightened interest from both Japanese and international investors seeking Bitcoin exposure in a tax-efficient public entity.

Metaplanet’s long-term goal is to increase both its aggregate bitcoin holdings and bitcoin per share for shareholders. While the company holds MicroStrategy in high regard, it remains laser-focused on its independent Bitcoin strategy, rather than comparing bitcoin holdings.

In the coming years, Metaplanet aims to continue pursuing its corporate strategy while educating Japanese and global audiences about Bitcoin’s unique attributes through the lens of a public corporate entity.

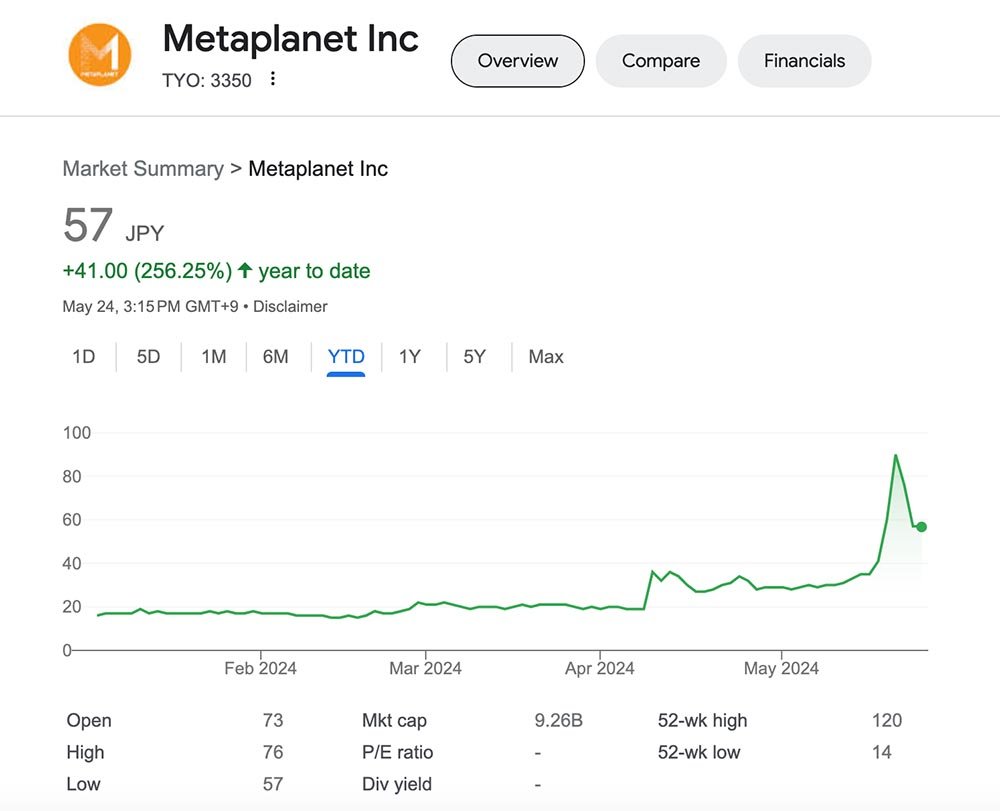

With its stock price performing well year-to-date and garnering substantial media attention, Metaplanet remains steadfast in its commitment to the long game.

In the land of the rising sun, a new financial force has emerged, one that is betting big on Bitcoin and the promise of a digital future.