As Microsoft’s annual shareholder meeting approaches in December, an intriguing proposal has captured widespread attention.

The National Center for Public Policy Research, a conservative think tank, has urged the tech giant to consider investing in bitcoin as a hedge against inflation and a way to diversify its corporate assets.

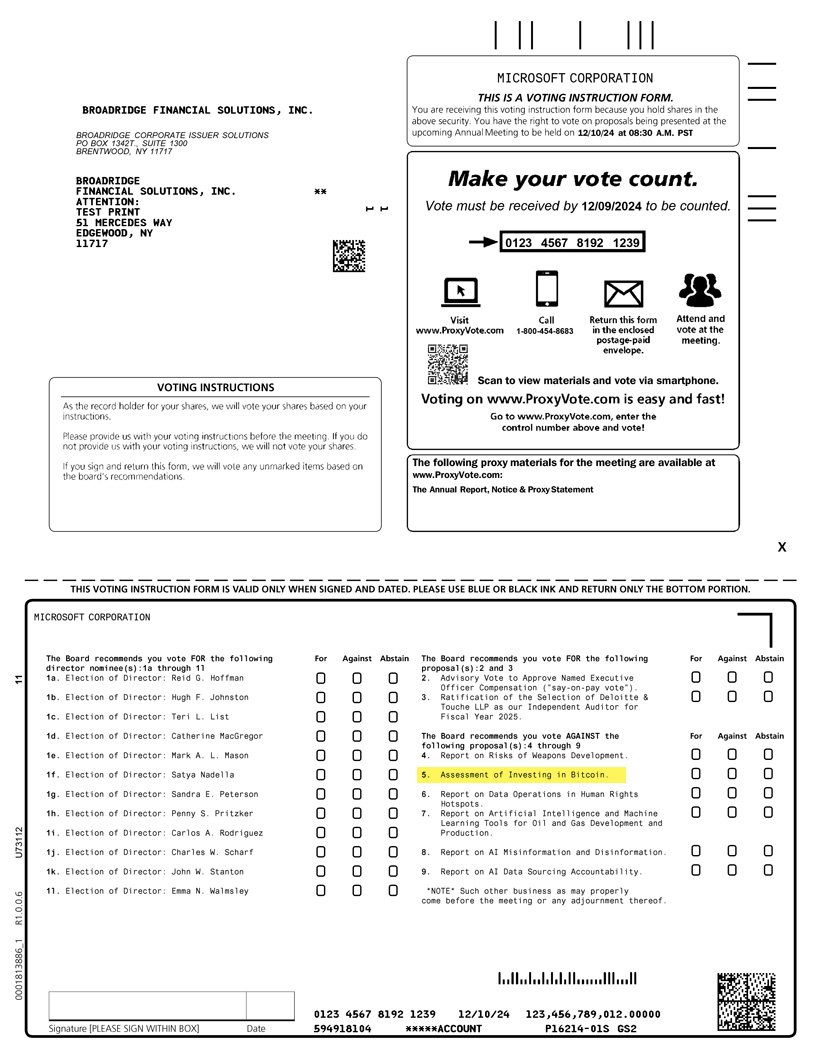

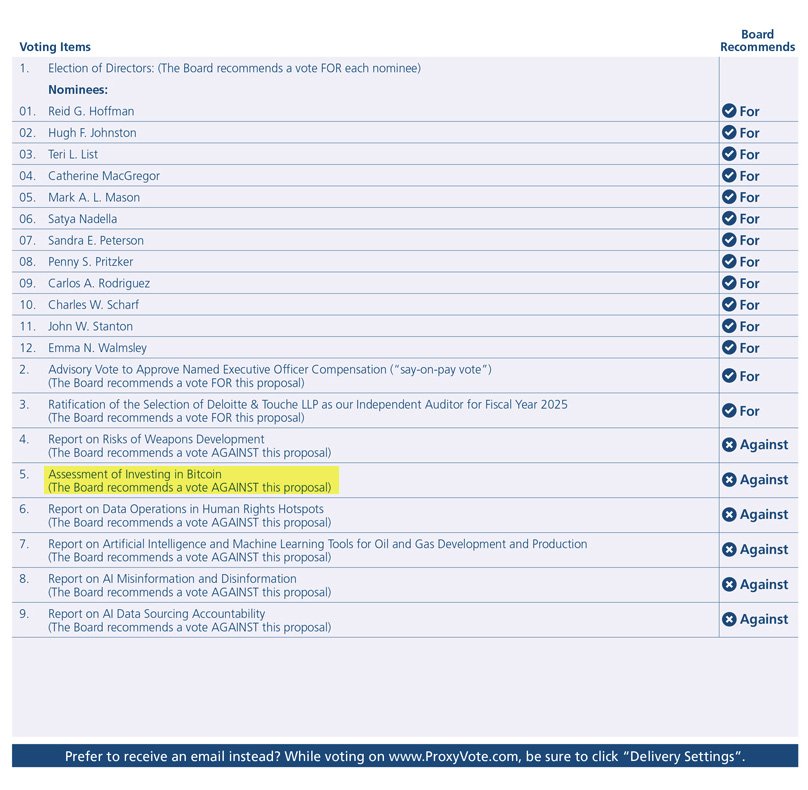

This proposal comes amid growing interest from corporations and investors in bitcoin, but Microsoft’s board has taken a firm stance against it, cautioning shareholders to vote “no.”

The proposal advocates for Microsoft to assess bitcoin’s potential as a “hedge against inflation,” citing that Microsoft, with a vast $484 billion in assets, should protect its balance sheet against inflationary pressures.

The proposal even goes as far as to argue that “a corporation has a fiduciary duty to maximize shareholder value,” which could include protecting profits from the effects of inflation.

According to the National Center for Public Policy Research, bitcoin could be a unique solution to this challenge, suggesting that Microsoft should consider allocating even just “1% of its total assets in Bitcoin.”

In its Q2 2024 financial report, Microsoft reported holding $76 billion in cash and cash equivalents. If shareholders encouraged the company to invest just 10% of that amount into bitcoin, it would amount to a substantial $7.6 billion investment.

Despite the think tank’s push, Microsoft’s board has recommended that shareholders reject the proposal, emphasizing that the company already has a “strong and appropriate process” in place to manage its assets.

In the SEC filing, the board assured shareholders that Microsoft’s Global Treasury and Investment Services team continually evaluates a broad spectrum of assets for the company’s balance sheet.

They’ve reportedly considered bitcoin and other digital currencies in the past, but Microsoft’s current portfolio, which prioritizes stability, comprises mainly of U.S. government securities and corporate bonds. The filing states:

“Microsoft has strong and appropriate processes in place to manage and diversify its corporate treasury for the long-term benefit of shareholders and this requested public assessment is unwarranted.”

Microsoft stated in the filing that a reliable and predictable investment strategy is essential to support the company’s daily operations and long-term goals. In other words, Microsoft doesn’t believe bitcoin’s potential high returns outweigh the risks posed by its extreme volatility.

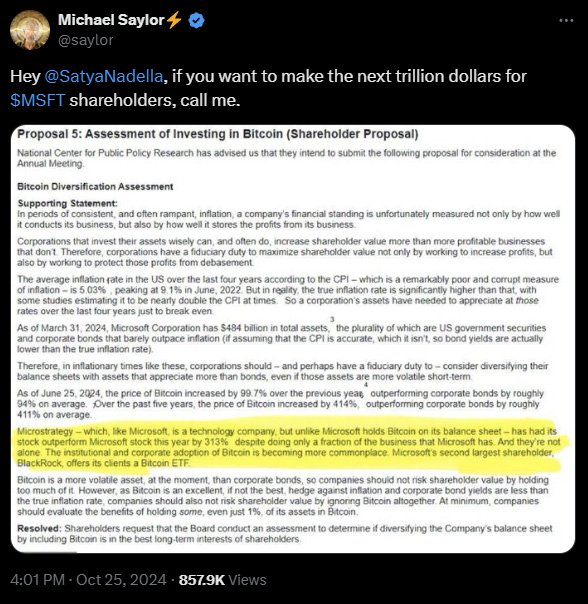

Not everyone agrees with Microsoft’s caution. MicroStrategy Executive Chairman Michael Saylor, a prominent advocate for corporate bitcoin investment, publicly encouraged Microsoft CEO Satya Nadella to consider bitcoin as an opportunity to add “another trillion dollars in value” to Microsoft.

Saylor’s own company has reaped considerable benefits from its large bitcoin holdings, which helped boost MicroStrategy’s stock by over 300% in the last year—far outpacing Microsoft’s stock growth of 16% in the same period.

Saylor believes that Bitcoin could do for Microsoft what it did for his company: significantly enhance its stock performance and overall value.

While Saylor and others push for direct bitcoin investment, analysts have pointed out a more conservative route that Microsoft could take: investing in Bitcoin via exchange-traded funds (ETFs) rather than buying the digital currency itself.

Financial analyst MacroScope noted that Microsoft’s management may choose to invest in Bitcoin ETFs over holding their own coins, which would still provide exposure to bitcoin’s performance without the complexities and risks of holding the asset directly.

If Microsoft did invest directly in bitcoin, it would be a landmark moment for the Bitcoin space. Microsoft is the world’s third-largest company by market capitalization, and any investment in bitcoin would signal a huge shift in the corporate world’s approach to digital assets.

The fact that the company is even considering the proposal, combined with the growing number of high-profile advocates, reflects how Bitcoin has moved from the fringes to the mainstream.

In a promising sign for Bitcoin proponents, Microsoft’s board did acknowledge in its statement that it has “evaluated Bitcoin and other cryptocurrencies in the past” and continues to “monitor trends and developments” related to Bitcoin.

This implies that while the board may not currently support an investment in bitcoin, it hasn’t entirely ruled out the idea for the future.

As inflation concerns and economic uncertainties mount, more corporations are grappling with how to protect their assets and shareholder value. Bitcoin’s supporters argue that the digital asset offers an alternative to traditional assets like bonds, which some say barely outpace inflation.

In the proposal, the think tank asserted:

“In inflationary times like these, corporations should—and perhaps have a fiduciary duty to—to diversify their balance sheets with assets that appreciate more than bonds, even if those assets are more volatile in the short-term.”

Still, bitcoin’s dramatic price swings make it a polarizing asset. Microsoft’s board is wary of bitcoin’s unpredictability, noting that such volatility might disrupt operational funding needs.

It’s this same volatility that has caused the board to urge shareholders to reject the proposal, asserting that the company’s current investment strategy already prioritizes long-term shareholder value.

The community’s feedback regarding this development has been mixed.

In a Yahoo Finance interview, Reid Hoffman, the founder of LinkedIn and a member of the Microsoft board, shared his positive perspective on Bitcoin.

He described it as a digital store of value and highlighted its potential to transform future financial systems. Hoffman is recognized as an early investor in Xapo, a prominent provider of bitcoin custody services.

Matthew Sigel, who leads Digital Assets Research at VanEck, provided a summary of the situation on X, “Microsoft Shareholders to Vote on Proposal to Invest in Bitcoin. MSFT Board Advises ‘Nay’. No-Coiner Vanguard owns ~9%.”

In the same vein, Nate Geraci, President of The ETF Store and Co-Founder of The ETF Institute, shared his outlook, “Gonna go out on a limb & predict Microsoft’s largest shareholder (Vanguard) will be voting ‘no’ on adding btc to the balance sheet…”

Di Lewis, CFO of BTC Inc., voiced significant doubt regarding Microsoft’s chances of adopting Bitcoin, saying, there is “0% chance Microsoft adds bitcoin to their balance sheet this decade.”

Adam Cochran, a partner at CEHV, rejected the proposal, calling it a “fringe” concept put forth by a shareholder of a think tank. He stated, “No. This is a fringe proposal by a think tank shareholder, and is not a serious consideration by Microsoft at large.”

Ultimately, Microsoft’s shareholders will have the final say on December 10. While the board’s recommendation to reject the proposal is clear, the outcome of the vote could reveal shifting sentiments among investors.

For Bitcoin enthusiasts, even getting a major corporation like Microsoft to consider a bitcoin investment proposal is a step forward in legitimizing Bitcoin as a mainstream asset.

Regardless of the vote’s outcome, the ongoing debate reflects a significant cultural shift in the business world. Bitcoin, once dismissed as a niche or risky venture, is now something even the most conservative corporate giants can’t ignore.

As Microsoft continues to evaluate its investment options, Bitcoin advocates like Saylor are waiting eagerly to see if the tech giant will one day join the ranks of companies holding the scarce digital asset.

Bitcoin, it seems, has become “too big to ignore”—even for Microsoft.