The Federal Reserve Bank of Minneapolis has sparked debate with a recently published research paper, suggesting that the U.S. government may need to tax or even ban Bitcoin to help manage the country’s growing deficits.

Released on October 17, the paper warns that Bitcoin, a decentralized digital asset with a fixed supply, poses challenges to governments that rely on running permanent deficits.

In a world where government spending often outpaces revenue, Bitcoin has emerged as an economic disruptor, according to the Fed’s researchers.

The main issue highlighted in the report is what the paper calls a “balanced budget trap.” This trap occurs when the presence of assets like Bitcoin forces governments to make tough financial choices, including balancing their budgets.

The researchers argue that Bitcoin, with its limited supply and decentralized nature, disrupts the traditional methods governments use to finance their spending. The paper states:

“A legal prohibition against Bitcoin can restore unique implementation of permanent primary deficits, and so can a tax on Bitcoin.”

The Fed suggests that taxing or banning Bitcoin would allow governments to continue spending more than they earn without the need to make immediate budget cuts.

A primary deficit happens when a government’s spending exceeds its revenue, excluding interest payments on debt. When this overspending becomes “permanent,” it means that the government intends to keep spending more than it collects, for an indefinite period.

The U.S. national debt currently stands at $35.7 trillion, with an annual primary deficit of $1.8 trillion. According to Reuters, this year’s deficit is the largest outside of the COVID-19 pandemic period, largely due to a 29% increase in interest payments on Treasury debt.

Related: US National Debt Hits $35 Trillion | Could Bitcoin Be the Solution?

The paper from the Minneapolis Fed is not the first time central banks have raised concerns about Bitcoin’s impact on government finances. Just a few days ago, on October 12, the European Central Bank (ECB) also issued a report criticizing Bitcoin.

The ECB’s paper went a step further, suggesting that bitcoin’s price growth benefits older investors at the expense of newer ones, a phenomenon they believe should be regulated or even stopped.

Jürgen Schaaf, a senior adviser at the ECB, echoed these concerns on social media, calling for policies to curb Bitcoin’s growth or eliminate it entirely. He noted:

“Non-holders should recognize that Bitcoin’s rise is fueled by wealth redistribution at their expense, there are compelling reasons to advocate for policies that curb Bitcoin’s growth or even eliminate it.”

Unsurprisingly, these reports have not gone unnoticed in the Bitcoin community.

Matthew Sigel, head of digital asset research at VanEck, commented on the Minneapolis Fed’s report, saying it joins a growing list of central banks targeting Bitcoin.

“The Fed fantasizes about ‘legal prohibition’ and extra taxes on BTC to ensure government debt remains the ‘only risk-free security,’” he said.

Sigel also referenced a post by Bitcoin analyst Tuur Demeester, who criticized the October 12 research paper from the European Central Bank.

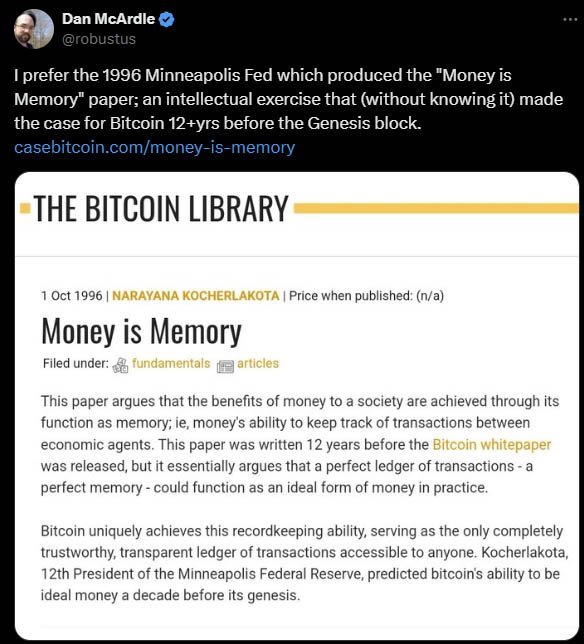

The paper has also caught the attention of Dan McArdle, co-founder of Messari, a digital-assets analytics firm. He pointed out a curious contradiction in the Fed’s stance on Bitcoin by referencing a 1996 paper from the Minneapolis Fed titled “Money is Memory.”

This older report outlined concepts that closely align with Bitcoin’s characteristics, including the idea of money as an asset with a fixed supply that doesn’t enter production—an idea that Bitcoin was built upon years later.

The concerns raised by the Federal Reserve and the European Central Bank reflect larger, long-standing worries about how Bitcoin could disrupt traditional financial systems.

The fundamental issue for central banks is that Bitcoin provides an alternative to government-backed currencies, which have historically relied on central banks and government policy for stability.

Bitcoin stands in sharp contrast to those traditional banking practices. With its limited supply of 21 million coins, Bitcoin offers an independent store of value that isn’t tied to inflation or national monetary policy.

This independence poses a problem for governments that rely on borrowing through nominal debt. The Fed’s paper suggests that Bitcoin undermines governments’ ability to issue debt and run deficits without worrying about balancing the budget.

By serving as an alternative financial asset, Bitcoin creates competition for government debt, reducing demand for bonds and increasing borrowing costs.

The Minneapolis Fed’s paper made this point clear, stating that Bitcoin complicates efforts to maintain permanent government deficits. The report goes on to propose that taxing or banning Bitcoin could help governments regain control of their fiscal policies.

It seems like another concern for the Federal Reserve is that Bitcoin presents an alternative to the centralized, debt-based financial system—a path many Bitcoin enthusiasts refer to as an ‘opt-out’ option.

The proposals from the Federal Reserve and the European Central Bank may raise important questions about the future of Bitcoin.

Could governments take more aggressive action against it? The answer remains unclear, but as national debts continue to climb, central banks may seek new ways to exert control over financial systems.

Critics argue that banning or heavily taxing bitcoin ignores the very reasons the digital currency was created. Bitcoin was designed to counter inflationary monetary policies, offering a fixed-supply alternative to traditional currencies that are often devalued through printing more money.

As Sigel from VanEck noted, the Fed’s focus on Bitcoin as a problem reflects a broader strategy to protect traditional financial assets. By framing government debt as the “only risk-free security,” the Fed may be aiming to preserve the status quo at the expense of innovation.

Both the Minneapolis Fed and the ECB are pushing for stronger regulatory measures against Bitcoin, but whether such proposals will become reality remains to be seen.

For now, Bitcoin continues to operate outside the influence of central banks, maintaining its appeal as a decentralized, inflation-resistant asset. However, the ongoing debates around Bitcoin’s role in government deficits and fiscal policy suggest that this issue is far from settled.