Table of Contents

Introduction

Before innovative new financial technologies such as Bitcoin can thrive within an economy, the political landscape of a society must first determine how these innovations can operate effectively.

This entails a clear definition within regulatory frameworks regarding property rights and contractual obligations. In light of this, the following article will provide a concise overview of the Isle of Man’s regulatory environment, whilst a supplementary report will cover the topic in greater depth.

To ensure a well-rounded and credible perspective, both the report and the article incorporate insights from various industry experts.

Overview of Bitcoin and Lightning Regulations in the Isle of Man

Concerning Lightning, there are currently no regulations that specifically address the network itself. Instead, Lightning activities are categorized under Convertible Virtual Currency (CVC) activities.

This classification aligns with the Islands ‘blockchain agnostic’ approach to regulation, which seeks to regulate the use cases of blockchain technology, as opposed to the technology.

Context of digital asset sector in the Isle of Man

Turning to BTC, the Isle of Man Financial Services Authority (IOMFSA) has explicitly stated that it does not consider it as a security. However, if BTC was to offer the right to an income, it would be considered a security and regulated as a result.

Related reading: Is Bitcoin a Commodity? Explaining its Superiority

Consequently, it falls outside certain aspects of the regulatory environment. This has significant implications for both consumers and businesses.

Implications for Businesses

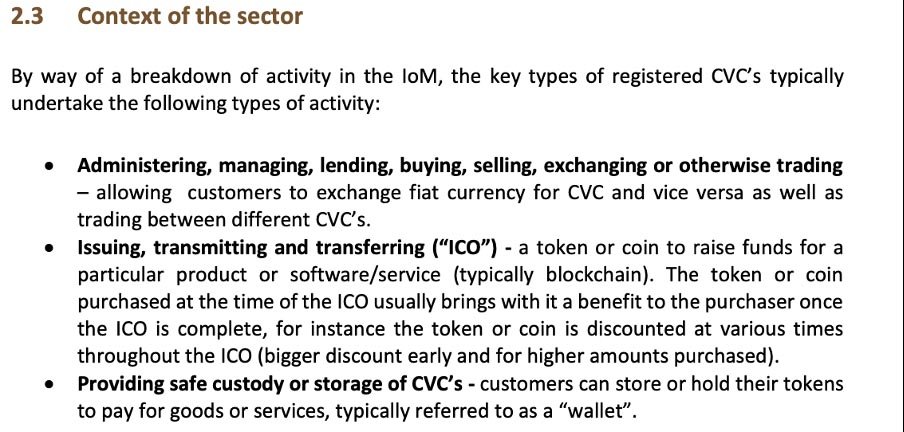

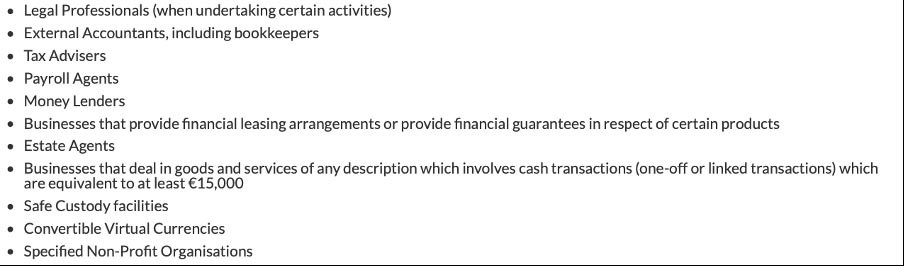

For businesses, this means that a financial services license is not needed to engage in such activities. However, registration is needed with the IOMFSA under the Designated Business (Registration and Oversight) Act 2015. Examples of business activities that fall under the act is displayed in the figure below.

The act enables the IOMFSA to fulfill its monitoring and oversight obligations regarding Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) provision[1].

This is of paramount importance due to the Financial Action Task Force’s (FATF) recommendations. These recommendations are integral to maintaining investor confidence in the Isle of Man as a secure, stable, and credible offshore financial base.

Consideration should be given to the legal consequences, whether criminal or civil, imposed on companies that fail to comply. This pertains specifically to those operating in the Isle of Man and engaged in activities such as providing or advertising without proper registration. Further, monitoring is enhanced via periodic AML/CFT inspections by the IOMFSA. This also can be extended to search warrants should information not be provided.

Designated Business Activities

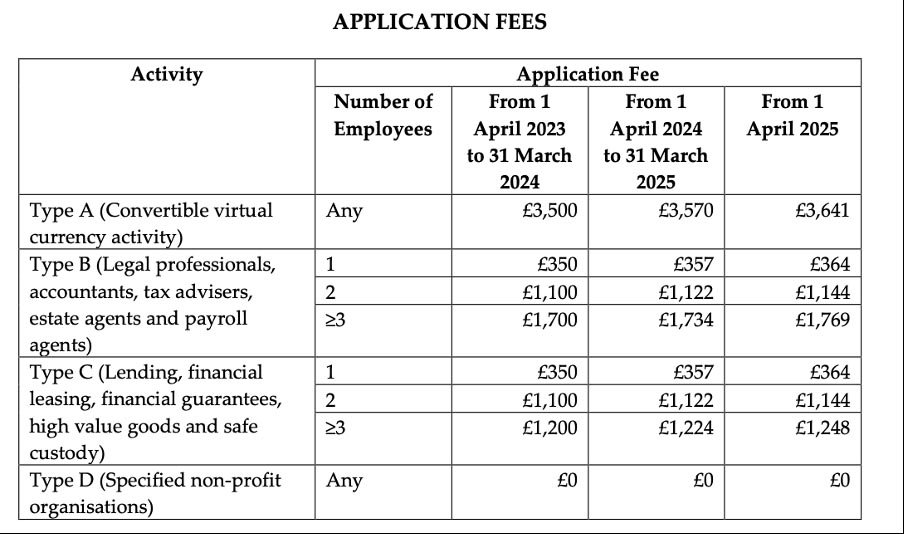

Regarding the total costs associated with a Designated Business Registration, companies should anticipate a base fee along with a corresponding volume fee, based on the number of employees.

In the initial year of trading, considering the anticipated increased costs for the upcoming tax year (1 April 2024 – 31st March 2025), a Lightning or Bitcoin-based business is expected to incur annual fees for a Designated Business license and registration ranging between £6,605 and £10,507 (as per schedule 3).

It’s worth noting that application fees alone for BTC-based businesses currently stand at a disproportionate flat rate of £3,500 when compared to fees for other Designated Business activities.

Application Fees for a Designated Business Licence

However, fees are different in other countries:

- Lithuania – licenses can cost around £17,000.

- El Salvador – comes in at around £7,000, with $5,475 for an initial one-off fee and $3,650 annually

- Dubai – sits at around £7,450.

Despite this, a Designated Business that preferred to remain anonymous stated:

“The general conditions seem broadly reasonable, but the new FSA yearly fees for cryptocurrency businesses disproportionately punish them relative to other Designated Businesses (lawyers, accountants) of a similar size and who carry an equal-to-superior risk of AML/CFT. This feedback has been provided to the FSA in the past.”

– Senior Manager at a Designated Business on the Isle of Man

Implications for Consumers

The current regulatory approach in the Isle of Man diverges significantly between consumers and businesses.

Feedback gathered for this article highlights a prevalent sentiment within the industry. Current regulations, while robust in AML and CFT compliance, are perceived to lack emphasis on safeguarding consumer interests.

When industry insiders were questioned about the existing Designated Business route, one professional expressed concerns:

“It meets AML/CFT regulations but lacks in offering the consumer protection typically expected from a registered business. With regions like the UK, EU, Dubai, and Singapore advancing in crypto legislation, the Isle of Man is at risk of falling behind. It would be beneficial for the Isle of Man to expand its legislation beyond AML/CFT, utilizing existing frameworks like ISO or SOCS, PCI, and implementing audit requirements for reserves and cold storage”

– Comments from an industry member in the Isle of Man

Other legal-based members of the industry added:

“Although the DBA has been sufficient in the past, I do believe there needs to be additional regulation to ensure that the Isle of Man’s integrity is upheld and to ensure we do not facilitate an incident such as FTX.”

– Jack Igglesden, Advocate specializing in BTC and digital assets

The prevailing emphasis on AML and CFT obligations can be traced back to the central government’s stance on industry growth, rather than consumer protections. Treasury Minister Dr. Allison’s recent statement on the adoption of a new international tax reporting standard reflects this approach:

“While I do not anticipate there being many businesses on the Island that will need to report under this new standard, it is vital that we play our part in ensuring the crypto-asset market does not facilitate tax evasion…”

– Treasury Minister Dr. A. Allison

This, coupled with the apparent lack of interest from public agencies and the central government in Bitcoin, Lightning, and other digital assets, indicates why the current regulatory focus leans toward AML/CFT obligations rather than prioritizing consumer protections.

Interesting Legal Cases in the Isle of Man

In a groundbreaking case on January 16th, 2023, AAO Technologies Limited faced the Isle of Man Financial Services Authority (IOMFSA) in a pivotal legal dispute concerning the rejection of its Designated Business application.

This marked a historic moment, as it led to the tribunal imposing of the first-ever reported costs order against the IOMFSA.

AAO Technologies, the parent company of FastBitcoins, a BTC-only exchange founded by Danny Brewster, initially moved to the Isle of Man with aspirations of establishing a global operation. However, recent court rulings by the Isle of Man Financial Services Tribunal prompted AAO Technologies to relocate to another jurisdiction.

The tribunal, in the case of AAO Technologies vs The Isle of Man Financial Services Authority, ruled that the IOMFSA’s revocation exceeded its powers, granting a costs order against them for breaching powers and engaging in unreasonable conduct under Rule 27(3)(b).

Conclusion

Several factors are currently influencing the regulatory landscape for BTC and Lightning Network in the Isle of Man.

For one, the harsh UK laws against digital asset financial promotion threaten to alienate growth-focused start-ups in the UK and push them to consider other more favorable jurisdictions such as the Island.

A member of the industry expressed their viewpoint on this issue, stating:

“The UK has recently enforced harsh financial promotion regulations as well as confirmed that all crypto-asset business activity will now be fully regulated. I agree that regulation is required, however, it is finding the right balance to prevent regulation being a deterrent. I am hopeful that the Isle of Man does not follow the UK’s approach and takes the time to produce a more coherent and attractive set of regulations to encourage growth.”

– Senior Manager from a Designated Business on the Isle of Man

Despite the Isle of Man presenting itself as a preferable alternative to the UK in this context, the Island appears to struggle to fully capitalize on this opportunity. This is attributed to the attitudes prevailing within both the regulatory system and public agencies.

This viewpoint is not limited to the author alone. Another industry member, who chose to remain anonymous, also weighed in on the issue:

“True change can only be achieved at a political level. Sadly, there is little evidence that IOM politicians have the appetite to embrace and encourage cryptocurrency adoption.”

– Anonymous industry member

Footnotes:

[1] – Designated Businesses can also elect to have their compliance with AML and CFT obligations overseen by professional bodies, but registration and enforcement cannot be delegated to these bodies.

FAQ

What is the Isle of Man’s regulatory approach to Bitcoin and Lightning Network?

The Isle of Man adopts a u0022blockchain agnosticu0022 approach, categorizing Lightning activities under Convertible Virtual Currency (CVC) and BTC as non-securities. Lightning Network is not specifically regulated.

Do Bitcoin businesses in the Isle of Man require a financial services license?

No, a financial services license is not required, but registration under the Designated Business (Registration and Oversight) Act 2015 is mandatory for Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) compliance.

What are the implications for businesses operating with Bitcoin and Lightning in the Isle of Man?

Businesses need to register under the Designated Business Act, incurring costs ranging between £6,605 and £10,507. Compliance with AML/CFT is crucial, and periodic inspections by IOMFSA are conducted.

How do fees for Bitcoin-based businesses in the Isle of Man compare to other countries?

Fees for Bitcoin-based businesses in the Isle of Man are relatively lower, ranging from £6,605 to £10,507, compared to countries like Lithuania (£17,000), El Salvador (£7,000), and Dubai (£7,450).

What concerns do businesses in the Isle of Man have about regulatory fees?

Some businesses express concerns about disproportionate fees, particularly for digital asset businesses, in comparison to other Designated Businesses of similar size and risk.

How does the regulatory focus differ between businesses and consumers in the Isle of Man?

While regulations emphasize AML and CFT compliance for businesses, there are concerns that consumer protection is not adequately addressed, potentially leaving consumers without expected safeguards.

Is there a push for additional regulations in the Isle of Man?

Industry members suggest the need for additional regulations beyond AML/CFT, incorporating frameworks like ISO or SOCS, PCI, and implementing audit requirements for reserves and cold storage.

How is the political sphere around digital assets adoption in the Isle of Man?

There is little evidence of political appetite among Isle of Man politicians to embrace and encourage cryptocurrency adoption, according to some industry members.