Table of Contents

Author Foreword

This report is the second in a three part series looking at the nature of Bitcoin and Lightning on the Isle of Man. Me and the many people that have grown up and are living here are all aware of the benefits our little Island has to offer. The aim now is to share that with others and bring about the change needed to inspire the diffusion of Bitcoin and Lightning for the Islands economic growth.

1- Introduction

Embracing the exciting era of groundbreaking financial technologies like Bitcoin requires a harmony between innovation and regulatory frameworks. The political landscape of an economy must pave the way, outlining how these innovations align with existing regulations, notably emphasizing property rights and contractual obligations.

A stellar example is El Salvador. Their successful launch of bitcoin-backed ‘volcano bonds‘ is a testament to their forward-thinking digital securities issuance law. Embracing this fact, the time has now come for a more proactive, competitive, and understanding regulatory system in the Isle of Man.

As suggested in the first report, the power to drive the mass adoption of new payment options often rests in the hands of the consumers themselves. This brings us to a pivotal moment, as the global market braces for a surge in bitcoin’s market value, likely coupled with heightened usage post-halving.

In anticipation of these shifts, the following comprehensive report will delve into the Isle of Man’s regulatory environment for both Bitcoin and Lightning.

To offer a well-rounded and credible perspective, the report and its accompanying article will incorporate insights from industry members on the Island, shedding light on the Isle of Man’s journey towards becoming a regulatory trailblazer in the world of digital finance.

2- Overview of Bitcoin and Lightning Regulation In the Isle of Man

Quick facts about Bitcoin/Lightning Regulation for Companies (Source – and verified)

| Business license needed | No (Designated Business Registration with the IOMFSA) |

| Regulated | AML/CFT oversight only |

| Cryptocurrency license needed | not yet |

| Additional requirements | AML/CFT |

| Residency required | no |

| Minimum capital | non |

| Min number of shareholders | 1 |

| Minimum directors | 2 Isle of Man resident directors or 1 director in combination with registered agent |

| Company taxation | 0% |

| Capital gains Tax | 0% |

| Government Support | See section 3.3: regulatory sandbox, grants |

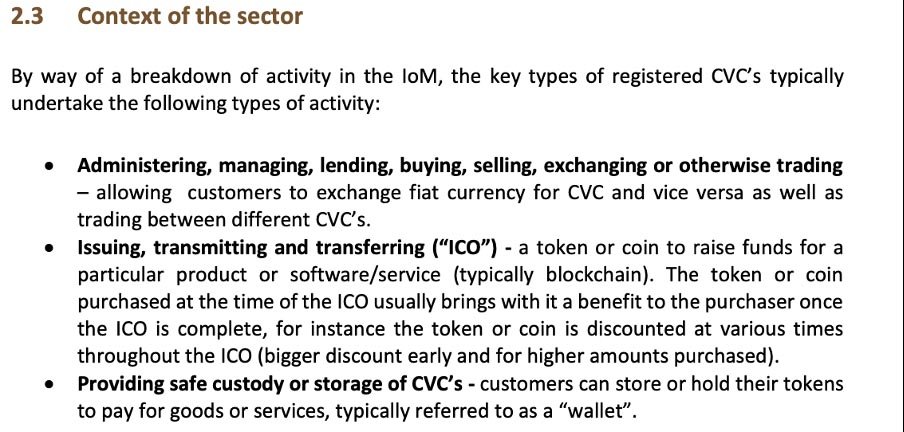

Concerning Lightning, there are currently no regulations that specifically address the network itself. Instead, Lightning activities are categorized under Convertible Virtual Currency (CVC) activities.

This classification aligns with the Islands blockchain agnostic approach to regulation, which seeks to regulate the use cases of blockchain technology, as opposed to the technology itself.

Context of the Sector on the Isle of Man

Turning to Bitcoin, the Isle of Man Financial Services Authority (IOMFSA) has explicitly stated that it does not consider bitcoin as a security. However, if bitcoin were to offer the right to an income, it would be considered a security and regulated as a result.

Consequently, bitcoin falls outside certain aspects of the regulatory environment. This has significant implications for both consumers and businesses, which is discussed in the corresponding sections business implications and consumer implications.

Bitcoin and Lightning focused companies can expect to not have to apply for a financial services license, however, they must comply with strong Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) legislation. Further, companies must register as a Designated Business with the IOMFSA.

In terms of specific acts that govern this, Tynwald first amended the Proceeds of Crime Act 2008 to include coverage over Bitcoin companies.

This was further strengthened by changes to the Terrorism and Other Crime (Financial Restrictions) Act of 2014, and the Designated Business (Registration and Oversight) Act of 2015.

2.1- Insights from the IOMFSA 2023 Annual Report

Published on November 7, 2023, the report further cements the Authority’s existing stance on Bitcoin and other digital assets. This stance is one of cautiousness, under-commitment, and a strong reversal when compared to the Bitcoin Island narrative that developed in 2014/15.

The listed activities devoted to Bitcoin and other digital assets in 2024 include an inspection of operational CVC firms, and working with the industry to develop legislation on the travel rule for such businesses. This travel rule is also discussed later in the article.

Lastly, the authority disclosed that 21 new Designated Business registrations had been undertaken in the period of April 2022 – March 2023, although there was no indication as to how many were Bitcoin or CVC based and/or accepted.

2.2- Insights from the George Johnson Law Prize 2020

The George Johnson Law Prize is an essay based competition for members of the Isle of Man Law Society. Notably, The Isle of Man Law Society declined to assist with the project.

The competition is held in memory of George Sayle Johnson Esquire, a past president of the society. Adam Killip won the prize in 2020 by discussing three possible reforms that would make the Island more competitive as an offshore financial center. They include:

- The extension of the concept of ‘permission to appeal’ in court proceedings

- Clear and specific regulation of persons involved with digital assets (especially so-called ‘security tokens’)

- An amendment to the Proceeds of Crime Act 2008 (“POCA”) to provide more permissive regulation of medical cannabis and funds derived from it.

Mr. Killip justified his second reform in part with:

“The Isle of Man is falling behind in this area and risks ceding further competitive advantage to other jurisdictions such as Gibraltar, Bermuda, the Cayman Islands, and Malta.”

Adam Killip, Associate Director at DQ Advocates, for the George Johnson Law Prize 2021 (Source)

The author’s perspective on the government’s approach in 2020 adds an intriguing layer to the discussion. According to Mr. A. Killip, the Island’s strategy at that time involved assessing the legal and regulatory landscape to establish the most suitable environment for the Island.

Examining the insights presented in the section titled ‘Bitcoin and Lightning Regulation in the Isle of Man – Government, Industry, and Consumer Perspectives,’ it becomes evident that the Island’s current approach in terms of regulation and legal frameworks still hasn’t changed since Mr. Killip’s description of their position back in 2020.

2.3 – Taxation of Bitcoin and Lightning Activities on the Isle of Man

2.3.1 – Personal Income Tax

As previously mentioned in the first article and corresponding report, the Isle of Man has a favorable tax environment for companies and high-net-worth individuals.

The current rates and allowances for the next tax year are listed below, whilst a copy of the deductions available to personal income tax can be found in the embedded source link for the figure.

Personal Income Tax Rates 2023/24

| Standard Rate: | 10% |

| Higher Rate: | 20% |

| Non-Resident Rate: | 20% |

High-net-worth individuals are subject to a flat tax rate of £200,000, while jointly assessed couples face a rate of £400,000. Currently, around forty individuals or jointly assessed couples are believed to be leveraging this ‘election cap’.

Further still, there is 0% inheritance tax and 0% capital gains tax. For those seeking more information on the potential tax benefits new residents moving to the Island can leverage, please see here and the paragraph looking at government schemes.

For more information on the government’s recent budget update, please see here.

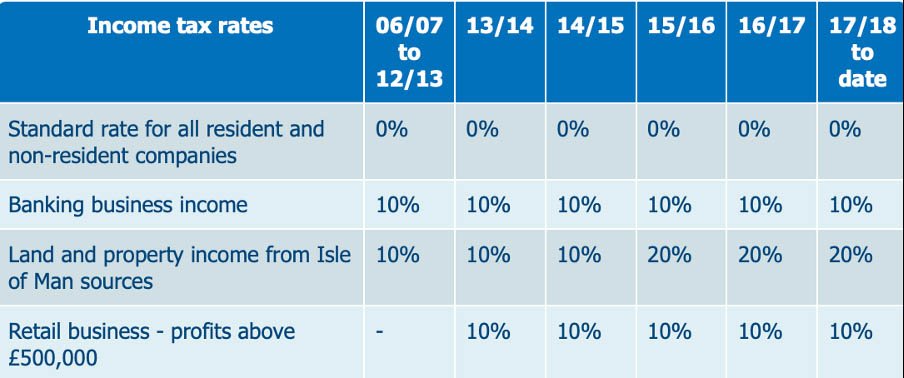

2.3.2- Corporation Tax

There are currently 24,938 companies registered under the 1931 Act (15,200), and the 2006 Act (9,738) as of Q4 2023 in the Isle of Man. Interestingly, the total number of companies being registered overall has been steadily decreasing from an all-time high of 36,126 in Q1 2003.

These companies are able to leverage a competitive 0% corporation tax on most business activities. For activities that do not fall under the 0% tax rate, the below numbers apply.

Income Tax Rates for 2023/24 for Companies Registered in the Isle of Man

Furthermore, the number of company documents received by the IOMFSA has hit an all-time high of 45,720 as of the last quarter for 2023. For 2023 overall, the number of company documents received hit well above 35,000 in every quarter.

This reflects the IOMFSA’s strong efforts towards ‘challenging and correcting data’ during 2022/23, under the obligations of the Beneficial Ownership Act of 2017. This act requires by law for those who own 25% and above of a company, directly or indirectly, to register in the Isle of Man beneficial ownership database.

Notably, total civil penalties worth £307,292 were borne by companies under the same reporting period.

2.3.3- Bitcoin and Digital Asset Tax Reporting in the Isle of Man

The Isle of Man is committed to adopting the Crypto-Asset Reporting Framework (CARF), an international standard developed by the Organization for Economic Cooperation and Development (OECD). The Isle of Man, along with 47 other jurisdictions, plans to implement CARF into domestic law by 2027.

The joint statement by the 48 jurisdictions, including the Crown Dependencies and Overseas Territories, underscores their dedication to combating tax evasion and ensuring global tax transparency.

Developed in collaboration with G20 countries, CARF establishes a standardized framework for the automatic exchange of tax information on Bitcoin and other digital asset transactions, covering aspects such as asset scope, reporting entities, transaction details, and due diligence procedures.

3- Bitcoin and Lightning Regulation in the Isle of Man – Government, Industry, and Consumer Perspectives

The Isle of Man Civil and State Flag

On the November 3, 2022, the IOMFSA issued its feedback on a consolation about Bitcoin and other digital assets with 9 industry members.

Providing a concise summary of the direction to be taken from this consultation, Dan Johnson stated:

“There are a number of substantially different regulatory regimes under development around the world and all are facing practical hurdles for which there are not yet clear solutions. This means that the time is not right for the Authority to make firm decisions on the introduction of crypto-related regulation in the Island”

– Dan Johnson, Senior Manager, Policy and Authorisations was quoted on the statement release — Source

However, the consolation also revealed that as of the February 21, 2022, there were twenty ‘CVC’ businesses registered with the IOMFSA as Designated Businesses.

When discussing the implications of expanding the existing regulation for the twenty or so businesses, it was noted that:

“To provide appropriate regulation is a cost and it is unclear what the benefit of that regulation would be for the Island, in terms of economic growth, to balance that expenditure”

Dan Johnson, Senior Manager, Policy and Authorisations was quoted on the statement release — Source

Based on this, it is expected that the Isle of Man will shed its fast follower approach, and wait to regulate and expand its attractiveness for Bitcoin, Lightning, and other Digital Asset businesses.

Capturing this is the disclosure at Digital Isle of Man in November 2023, that public agencies had in fact been looking closely at all the MiCA elements for the last two years. However, the most productive thing to likely come from this will be a further consultation paper, among likely more calls to industry for information before any serious actions are taken.

3.1- Discussion from Self-Directed Research

Providing an overall analysis of the above, there exists a contradiction thus far in the IOMFSA’s approach among other public agencies.

Despite stating that all respondents in the consultation generally agreed on the need to regulate digital assets, the approach, steps, and resources taken by all public agencies remains far more cautious than the explicitly mentioned ‘moderate tolerance of the risks that technology and fintech advances may bring’.

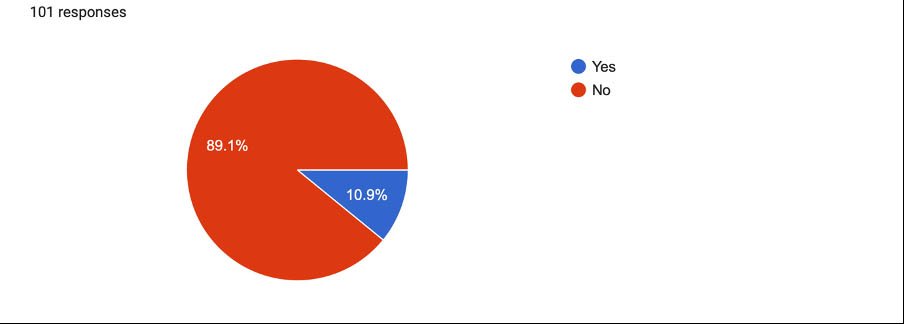

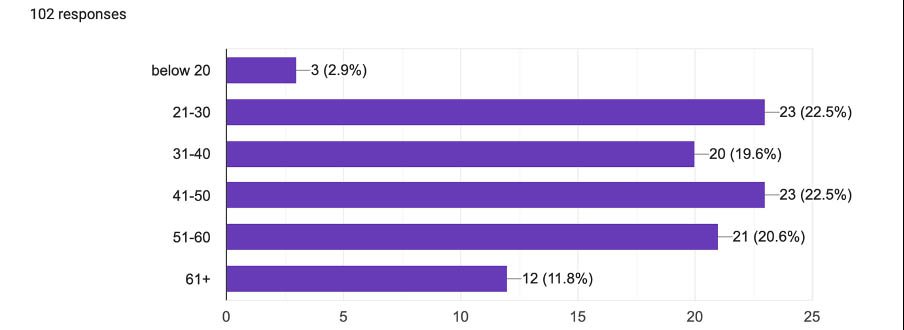

In addition, this self-directed research reveals two firm conclusions. Firstly, there still remains a lack of knowledge about current regulations on the Isle of Man among residents and business owners. The following contains over one-hundred responses from a 2022 self-collected survey, involving face-to-face conversations with all respondents.

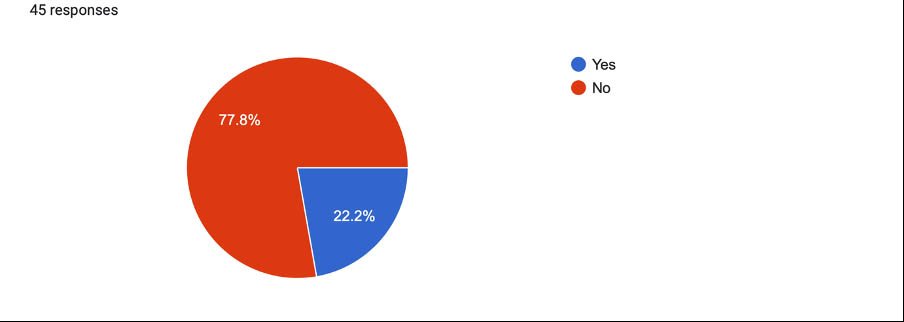

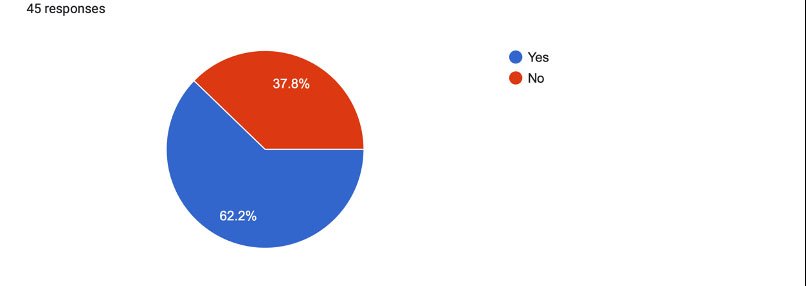

Are you aware of the Isle of Man’s Government stance towards Digital Assets? – 2022

Despite this being from 2022, the age range of respondents captures a representative view of the population, and to further support the statement, 2023 figures in another self-collected survey reveal similar conclusions.

How old are you? (2022 survey)

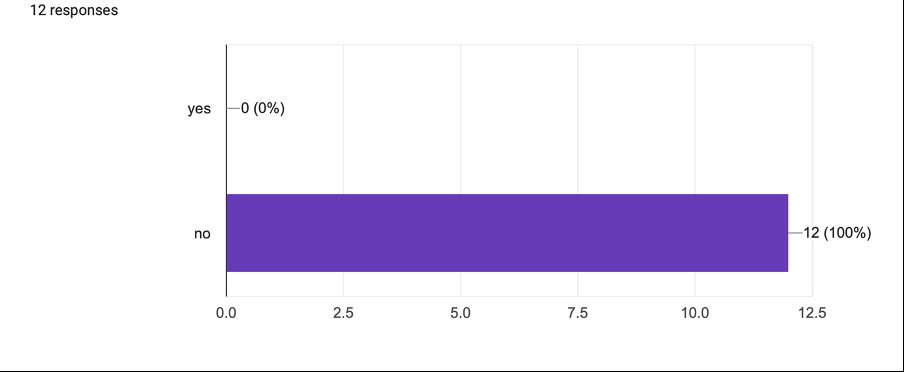

Do you know the Isle of Man’s legal stance towards digital assets? – 2023

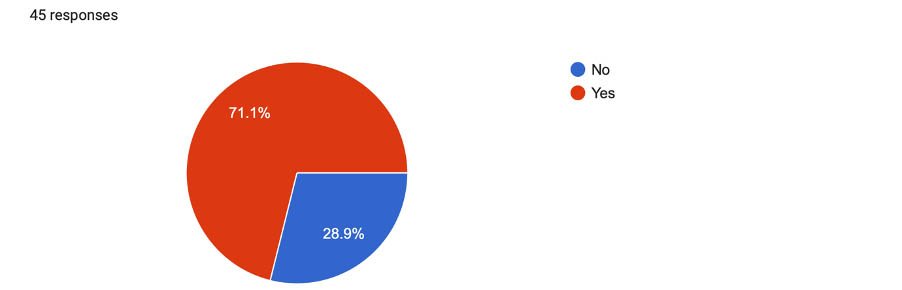

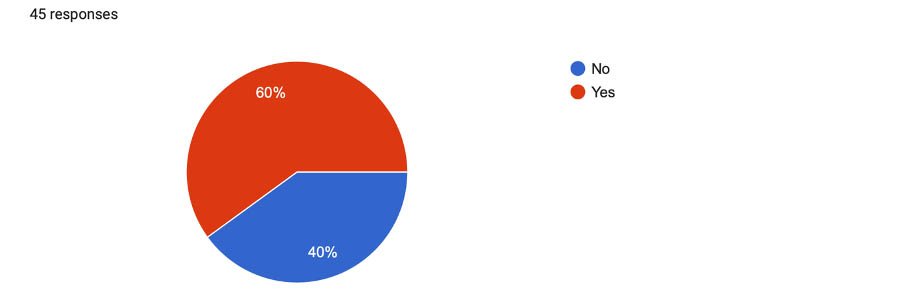

Secondly, as per the 2023 consumer orientated research, there remains clear enthusiasm from the population to have the chance in exploring what increased retail usage of Bitcoin and Lightning Network may look like.

Would you want bitcoin to be legal tender in the Isle of Man? – 2023

Do you trust Bitcoin? – 2023

Would you want your bank to start offering digital asset services? – 2023

It is important to state that some of these figures were also discussed in the first article.

However, despite 93.3% of the 2023 respondents being between 18-26, the observations fit in line with conclusions from the more representative 2022 survey, and the conclusions drawn from the aforementioned industry consolation by public agencies. Interestingly, in another self-collected survey focused on the attitudes of business managers on the Isle of Man, some mixed messages emerge in relation to the points discussed above.

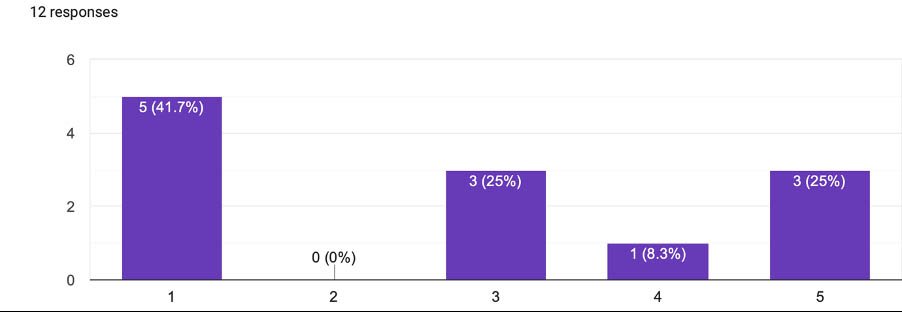

Firstly, as seen below, none of the business managers surveyed view the mass adoption of Bitcoin happening in 2024.

Do you see Consumer mass adoption of bitcoin happening in 2024?

Taking a look at some of the reasoning behind this, some respondents discussed matters reminiscent of an institutional perspective, providing an interesting dynamic to the consumer based survey conclusions.

3.2- Selection of Responses

3.2.1- Topic: Why Business Managers in the Isle of Man Do Not See Consumer Mass Adoption of Bitcoin Happening in 2024

“BTC is too volatile for use as a currency or as an investment. Add in the bad news stories around it (eg FTX) and I just cannot see it becoming mainstream unless it becomes regulated. Regulation goes completely against the whole decentralization ideal that adopted want but are unlikely to get.”

– Response from business manager questionnaire

“2024 is still to early for mass adoption, we need retail giants and more EU countries to adopt it so consumers can use it and access it. Education on bitcoin is complex, try asking your grandad to store his private keys and make transfers.”

– Response from business manager questionnaire

“Instead, I see the emergence and adoption of Central Bank Digital Currencies (CBDCs) gaining momentum over the next five years”

– Response from business manager questionnaire

Further still, there remains uncertainty in how Bitcoin will impact their businesses in 2023.

How far do you agree with the statement : ‘Bitcoin specifically will impact my business in 2024’

Those that did foresee an impact had this to say:

3.2.2- Topic: Business Managers Who Foresee Bitcoin Having an Impact on Their Activities

“This period presents an opportunity for us to assert our position as veteran developers in the industry, offering products and services that meet the evolving demands of a more regulated and compliance-focused market”

– Response from business manager questionnaire

“As more financial institutions are adopting bitcoin and banks are starting to work with it, businesses will adopt this method to make international payments and cut out the archaic swift system so they can pay people quicker. If we do not adopt this method we will lose customers who will chose a provider who can facilitate bitcoin payments”

– Response from business manager questionnaire

A more negative perspective towards Bitcoin’s potential impact is seen below:

“little. We will continue to work in the sector but I see the blockchain technology being used more by tech businesses in the future.”

– Response from business manager questionnaire

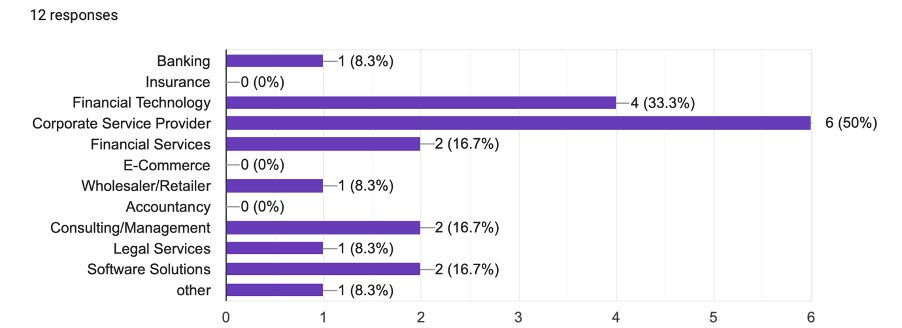

For additional transparency and debate over the integrity and representativeness of the results, a copy of the distribution between the industries of respondents for the survey is attached below. Please note more than one industry may apply to the same respondent.

What industry are you currently employed in? – 2023

3.2 – Implications for Businesses

As previously mentioned in the first section, Bitcoin is not currently fully regulated in the Isle of Man.

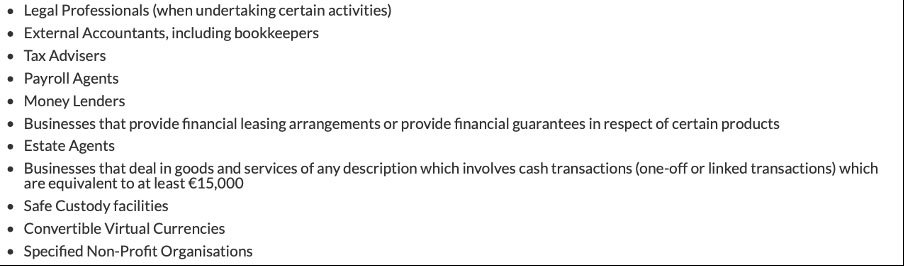

For businesses, this means that a financial services license is not needed to engage in such activities. However, registration is needed with the IOMFSA under the Designated Business (Registration and Oversight) Act of 2015. For examples of business activities that fall under the act, please see below.

Designated Business Activities

The act enables the IOMFSA to fulfill its monitoring and oversight obligations regarding AML and CFT.

Designated Businesses can also opt to have their compliance with AML and CFT obligations overseen by professional bodies, but registration and enforcement cannot be delegated to these bodies. This is of paramount importance due to the Financial Action Task Force’s (FATF) recommendations. These recommendations are integral to maintaining investor confidence in the Isle of Man as a secure, stable, and credible offshore financial base.

Currently the lsle of Man is in alignment with 39 of the 40 FATF recommendations. Businesses operating in the Island, as a result, have to appoint a Money Laundering Officer, collect and monitor customer due diligence, comply with anti-bribery laws, and international sanctions. Economies who fail to meet the FATF’s recommendations fall in danger of being placed on their gray list, which may translate into significantly reduced investor confidence in an economy.

One of the many criticisms that was levied against El Salvador through their adoption of bitcoin as legal tender, was in fact falling out of FATF’s recommendations. Reflecting this are the criminal or civil sanctions for non-compliant companies that provide or advertise such activities in the Isle of Man without first being registered. Further, monitoring is enhanced by periodic AML/CFT inspections by the IOMFSA. This can also be extended to search warrants should information not be provided.

In terms of registration, since October 5, 2018 the IOMFSA will not register a CVC business unless two conditions are met to ensure proper oversight.

Firstly, on top of the fit and proper test for the specified persons associated with the business, the CVC business must have two Isle of Man resident directors, or one director in combination with a registered agent. Secondly, management and control of the CVC business must be on the Island. For more detailed registration requirements, please see the link attached here.

On top of these two conditions, CVC businesses also have to submit full and detailed customer, technology, and business risk assessments.

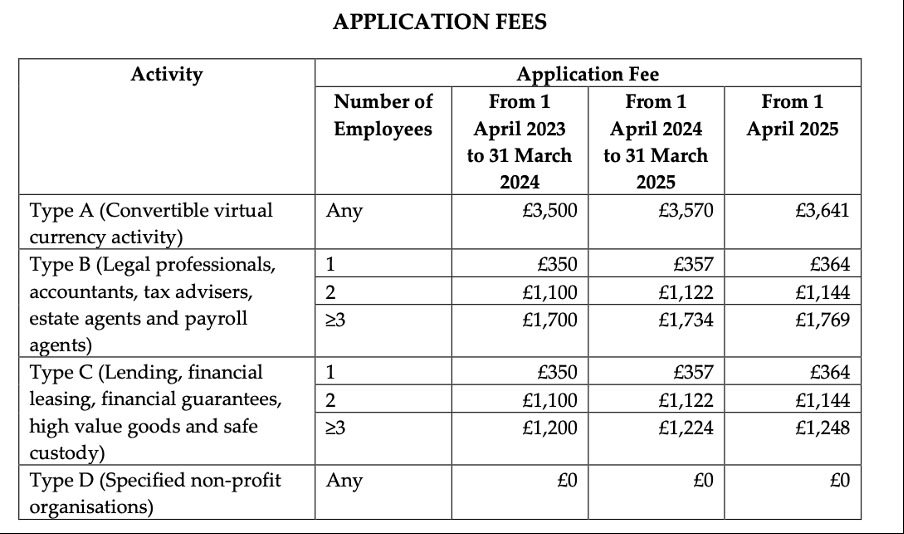

3.2.1- Designated Business License Costs

Regarding the total costs associated with a Designated Business Registration, companies should anticipate a base fee along with a corresponding volume fee based on the number of employees.

Currently (April 1, 2023 – March 31, 2024) the annual fees for CVC Designated Businesses CVC range anywhere from £2,450 to £5,600 (schedule 2) for those employing 1 to 25 people. Further, the base fee of £2,450 is being raised to £3,035 for the next tax year.

On top of this, application fees currently sit at a flat rate of £3,500 for CVC businesses in parallel to the tiered and much cheaper fees for Type B, C, and D businesses.

In the initial year of trading, considering the anticipated increased costs for the upcoming tax year (April 1, 2024 – March 31, 2025), a Lightning or Bitcoin-based business is expected to incur annual fees for a Designated Business license and registration ranging between £6,605 and £10,507 (as per schedule 3).

It’s worth noting that application fees alone for Bitcoin-based businesses currently stand at a disproportionate flat rate of £3,500 when compared to fees for other Designated Business activities.

Application Fees for a Designated Business License

However, despite the high costs at first glance, it is lower than fees in other jurisdictions.

- Lithuania – licenses and applications can cost around £17,000.

- El Salvador – licenses and applications come in at around £7,000, with $5,475 for an initial one-off fee and $3,650 annually

- Dubai – licenses and applications sit at around £7,450.

With this in mind, licensing costs in the Isle of Man appear to be competitively priced. Despite this, in a comments request from a Designated Business that prefers to remain anonymous, they stated:

“The general conditions seem broadly reasonable, but the new FSA yearly fees for cryptocurrency businesses disproportionately punish them relative to other Designated Businesses (lawyers, accountants) of a similar size and who carry an equal-to-superior risk of AML/CFT. This feedback has been provided to the FSA in the past.”

– Senior Manager at a Designated Business on the Isle of Man

3.3 – Implications for Consumers

The current regulatory approach in the Isle of Man diverges significantly between consumers and businesses. Feedback gathered for this article highlights a prevalent sentiment within the industry. Current regulations, while robust in AML and CFT compliance, are perceived to lack emphasis on safeguarding consumer interests.

When questioned about the existing Designated Business route, one professional from industry insiders expressed concerns:

“It meets AML/CFT regulations but lacks in offering the consumer protection typically expected from a registered business. With regions like the UK, EU, Dubai, and Singapore advancing in crypto legislation, the Isle of Man is at risk of falling behind. It would be beneficial for the Isle of Man to expand its legislation beyond AML/CFT, utilizing existing frameworks like ISO or SOCS, PCI, and implementing audit requirements for reserves and cold storage”

– Rick Landman, Chief Technology Officer Infinex Partners

Other legal-based members of the industry had this to say:

“Although the DBA has been sufficient in the past, I do believe there needs to be additional regulation to ensure that the Isle of Man’s integrity is upheld and to ensure we do not facilitate an incident such as FTX.”

– Jack Igglesden, Advocate specializing in bitcoin, cryptocurrency, and digital assets

The prevailing emphasis on AML and CFT obligations, rather than consumer protections, can be traced back to the central government’s stance on industry growth. Treasury Minister Dr. Allison’s recent statement on the adoption of a new international digital asset tax reporting standard reflects this approach:

“While I do not anticipate there being many businesses on the Island that will need to report under this new standard, it is vital that we play our part in ensuring the crypto-asset market does not facilitate tax evasion…”

– Dr. A. Allison, Treasury Minister

This, coupled with the apparent lack of interest from public agencies and the central government in Bitcoin, Lightning, and other digital assets, indicates why the current regulatory focus leans toward AML/CFT obligations rather than prioritizing consumer protections.

Isle of Man Quick Facts

| Top 10 percentile globally for internet speed (source) | Location: Middle of the Irish sea |

| High speed fiber now available to 75% of premises and increasing | Size: 33 miles long by 13 miles wide |

| Several Tier-3 data centers | Capital: Douglas |

| 6 undersea cables connecting to US and EU (source) | Population: 84,069 (2021 May) |

| 96% surveyed strongly agreed the Isle of Man was a safe place to do business (source) | Political system not based on party politics Led in a ministerial style of Government led by current Chief Minister, The Honourable Alfred Cannan MHK |

| Life expectancy: 81 (2021) | Tynwald, the Isle of Man’s parliament, is the oldest continuous parliament in the world at over 1,000 years old (source) |

| Gross Domestic Product: £5.27 billion (2020/21) | Gross Domestic Product Per Capita:£60,270 (2021) Isle of Man Jobs Page (here) |

| Nationality –Adjective: Manx | Credit Ratings:Moodys: Aa3 (2020) – Stable outlook |

3.4 – Government Schemes

In recent years the government has made an admirable effort to boost key economic targets for the Island through the provision of several grants and schemes. However, Andrew Stewart noted at this year’s Digital Isle of Man conference:

“…some of our assistance schemes are hidden away”

– Andrew Stewart, Director of Policy and Strategy for the Department of Enterprise Isle of Man

In terms of Bitcoin and digital asset based schemes, the blockchain office and regulatory sandbox launched in 2019 form the backbone of the government’s existing strategy. In addition, Digital Isle of Man also offers an Accelerator programme for Bitcoin, Blockchain, and FinTech based companies.

Currently, the programme has 20 firms scattered amongst the three levels of support available, and over 16 supporting partners comprising legal firms, corporate service providers, and more. The programme aims to provide a partnership with the government to develop further Bitcoin, Lightning, and digital focused companies.

In terms of more general schemes, individuals seeking to migrate to the Isle of Man can benefit from:

- Signing up to the Locate Talent Portal

- Contacting Locate Isle of Man for more information on immigration and work permits

- Applying for a Isle of Man Worker Migrant Visa for individuals who have been offered a skilled job in the Isle of Man, allowing family members a visa application that could last 3 years and an option to extended if accepted

- National Insurance Holidays up to £4,000 for Manx Students returning to the Island achieving an income of £23,000 or above

For companies seeking to establish operations on the Island, the Department of Enterprise also has specific provisions for funding support schemes and grants.

- Employee Relocation Incentive: Provides a 20% grant of up to £10,000 towards re-locating employees in their first year net salary.

- Financial Assistance Scheme: Can offer up to a generous 40% towards capital and operating expenses.

- Micro Businesses grant Scheme: Provides start-ups and early stage small businesses grants up to £6,000 with mentoring services.

- Business Improvement Scheme: Matched funding available up to £5,000 for help in engaging external consultants such as in sustainability, marketing, and business development.

- Business Energy Savings Scheme: Unsecured interest-free loans up to £20,000 for businesses seeking to improve energy efficiency.

3.5- Interesting Legal Cases and Rulings

3.5.1- Covid Travel Ruling [2021]

During the lockdowns in 2021, the Isle of Man introduced a travel rule specifically for Bitcoin and digital asset based companies. This travel rule allowed Bitcoin companies to register for a Designated Business license despite not having two Isle of Man resident directors, through a “subject to” agreement. This is only if all other criteria are met.

At the time, this led to a slight resurgence in the Bitcoin island narrative, with some media outlets reporting the Isle of Man as the ‘…world’s most attractive base for crypto companies’

3.5.2 – AAO Technologies V IOMFSA [2023]

In a ground-breaking case on January 16, 2023, AAO Technologies Limited faced the IOMFSA in a pivotal legal dispute concerning the rejection of its Designated Business application. This marked a historic moment, as it led to the tribunal imposing the first-ever reported costs order against the IOMFSA.

AAO Technologies, the parent company of FastBitcoins, a Bitcoin-only exchange founded by Danny Brewster, initially moved to the Isle of Man with aspirations of creating an operational base for their existing global operations. However, recent court rulings by the Isle of Man Financial Services Tribunal in part prompted AAO Technologies to relocate to another location.

AAO Technologies sought to challenge a separate decision by the Financial Services Authority for an expedited public statement, leading to the rejection of their application. However, following the receipt of AAO’s grounds of appeal, the IOMFSA unexpectedly withdrew and revoked all decisions subject to the appeals. The Financial Services Authority provided no reasons for this revocation but stated its intention to reconsider the application and resist any cost applications by AAO.

The tribunal, in the case of AAO Technologies vs The Isle of Man Financial Services Authority, ruled that the IOMFSA’s revocation exceeded its powers, granting a costs order against them for breaching powers and engaging in unreasonable conduct under Rule 27(3)(b).

3.5.3 – Tulip Trading vs Van Der Laan [2023]

Despite the interim judgment for the case being determined in the Court of Appeal of England and Wales, the precedent it may go on to forge for other fraud cases is notable, and is also discussed by an Isle of Man Advocate (Source).

The advocate, Chris Brooks of Simcock’s Isle of Man explains that in the UK and Isle of Man, under regulations, Bitcoin is currently considered property and can be legally owned.

Traditionally, efforts to recover stolen bitcoin were focused on identifying and pursuing the thieves. However, the court case of Tulip Trading Limited vs Van der Laan, may set precedent to hold the developers accountable.

The idea is that developers, who control and run the Bitcoin network, should be considered fiduciaries and have a duty to help recover stolen assets. The justification for this lies in the activities of developers. Developers that fix software bugs, actively contribute to the code’s update instead of being a passive provider.

Whilst only an interim judgment, the Court of Appeal determined the developers (Van Der Laan) had fiduciary responsibilities to the owners of the $4billion dollars’ worth of stolen bitcoin from Tulip Trading. If the duties of developers are aligned with fiduciaries, how does this impact governance, and the existing operations of every Bitcoin based firm in the world? What incentives does this change for developers, if this was to go further?

4- Conclusion

Several factors are currently influencing the regulatory landscape for Bitcoin and Lightning in the Isle of Man. For one, the harsh UK laws against Bitcoin and digital asset financial promotion threaten to alienate growth-focused start-ups in the UK and push them to consider other more favorable jurisdictions such as the Island.

One issue is that these financial promotion laws don’t just seem to apply to digital asset exchanges but to anyone making these promotions in any way, including social media. A member of the industry expressed their viewpoint on this issue:

“The UK has recently enforced harsh financial promotion regulations as well as confirmed that all crypto-asset business activity will now be fully regulated. I agree that regulation is required, however, it is finding the right balance to prevent regulation being a deterrent. I am hopeful that the Isle of Man does not follow the UK’s approach and takes the time to produce a more coherent and attractive set of regulations to encourage growth.”

– Senior Manager from a Designated Business on the Isle of Man

Despite the Isle of Man presenting itself as a preferable alternative to the UK in this context, and others discussed through the report, the Island appears to struggle to fully capitalize on this opportunity. This is attributed to the attitudes prevailing within both the regulatory system and public agencies.

Justifying this is the small amount of resources and productive action that has currently been taken towards actioning the several calls to industry. This viewpoint is not limited to the author alone. Another industry member, who chose to remain anonymous, also weighed in on the issue:

“True change can only be achieved at a political level. Sadly, there is little evidence that IOM politicians have the appetite to embrace and encourage cryptocurrency adoption.”

– Anonymous industry member