The foray of the south American country into Bitcoin as legal tender has stirred global attention, with recent reports revealing a positive trend in the El Salvador Bitcoin investment results. President Nayib Bukele proudly announced a profit of $3.6 million amid a surging Bitcoin market.

Initial Struggles and Bold Investment Moves

Since adopting Bitcoin as legal tender in 2021, El Salvador faced significant scrutiny due to unrealized losses stemming from the volatile Bitcoin market.

Critics both domestically and internationally had cast doubt on the country’s strategy, pointing to losses incurred during the digital-asset winter. President Nayib Bukele, however, defended his government’s approach, highlighting the long-term vision despite facing criticism.

Related reading: Bitcoin Adoption is Driving the Rebirth of El Salvador: Vice President

El Salvador Bitcoin Reserves: Profit Amidst Price Surges

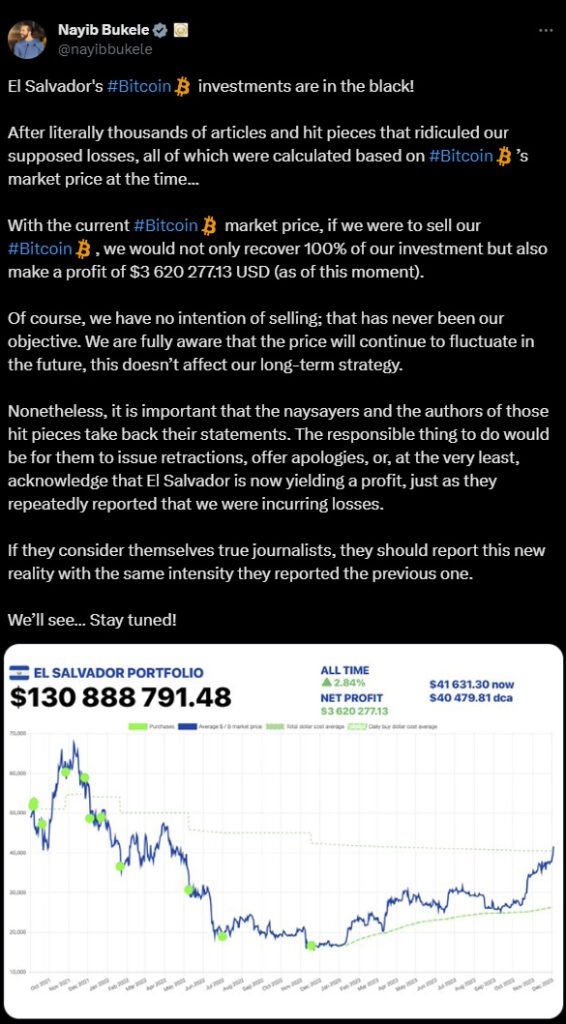

Recent reports indicate a shift in El Salvador’s Bitcoin fortunes. With holdings valued at around $131 million, the government reported a net profit of $3.6 million, signaling a remarkable turnaround from previous losses.

#Bitcoin | Estrategia de inversión del Presidente @nayibbukele en bitcoin genera más de $3.5 millones en ganancias. Detalles: https://t.co/ZzdyCOvIou #SecretaríaDePrensa pic.twitter.com/kvbH2C1PJj

— Secretaría de Prensa de la Presidencia (@SecPrensaSV) December 5, 2023

Bukele, in his statement, emphasized the government’s decision to refrain from selling despite the profitable position, citing a commitment to a steadfast long-term strategy.

He stated:

“Of course, we have no intention of selling; that has never been our objective. We are fully aware that the price will continue to fluctuate in the future, this doesn’t affect our long-term strategy.”

President’s Call for Recognition

President Nayib Bukele didn’t miss the chance to call out critics and urge them to acknowledge El Salvador’s current gains.

OK boomers…

— Nayib Bukele (@nayibbukele) February 16, 2022

You have 0 jurisdiction on a sovereign and independent nation.

We are not your colony, your back yard or your front yard.

Stay out of our internal affairs.

Don’t try to control something you can’t control 😉

https://t.co/pkejw6dtYn

He emphasized the importance of retractions or apologies from those who previously highlighted the country’s losses, now that the tables have turned. He added:

“Nonetheless, it is important that the naysayers and the authors of those hit pieces take back their statements. The responsible thing to do would be for them to issue retractions, offer apologies, or, at the very least, acknowledge that El Salvador is now yielding a profit, just as they repeatedly reported that we were incurring losses.”

Related reading: US Senators Worried About Bitcoin Adoption In El Salvador

El Salvador’s journey with Bitcoin drew international attention, with entities like the International Monetary Fund expressing concerns about the country’s adoption of Bitcoin. The President, however, remained resolute, deflecting external criticisms and reiterating the nation’s commitment to its unconventional monetary strategy.

Related reading: JPMorgan El Salvador Report: Growth Forecast Jumps to 3.9%

Bitcoin’s Recent Surge and Market Optimism

Bitcoin’s recent surge to around $44,000, marking its highest value since April 2022, sparked optimism and discussions among traders and analysts worldwide. The market rally has been attributed to various factors, including speculations about the potential approval of Bitcoin Spot ETFs by the United States Securities and Exchange Commission (SEC), and expectations of reduced U.S. interest rates.

On a related note, Ipek Ozkardeskaya, senior market analyst at Swissquote Bank, highlighted the positive impact that an ETF approval could bring to Bitcoin investments, considering the anticipated regulatory ease and increased attractiveness for investors.

She stated:

“The impact of an (ETF) approval is going to be big in terms of investment appetite because it’s going to be more easily regulated, more attractive and easier to invest […] What we have right now is a risk rally, and bitcoin is also benefiting big time by falling yields. There is also this positive bullish sentiment into next year because it is going to be the year of halving.”

Outlook and Ongoing Resilience

Despite the current profitable position, Bukele reiterated El Salvador’s stance on holding onto its Bitcoin reserves. The government remains committed to its long-term strategy, acknowledging the inherent volatility of the Bitcoin market and emphasizing resilience against fluctuations.

El Salvador’s Bitcoin saga continues to captivate the world, showcasing the unpredictability and potential rewards of embracing the digital money in a global economy.

El Salvador’s Bitcoin investments have turned a significant corner, propelling the nation into a profitable realm despite initial challenges. President Nayib Bukele stands firm in his defense of the country’s unconventional approach to monetary policy, signaling a strong resolve amidst ongoing global attention and market fluctuations.