Tesla, the renowned electric car manufacturer led by CEO Elon Musk, has announced that it did not sell any of its substantial bitcoin holdings during the first quarter of 2024. This decision marks a continuation of Tesla bitcoin investments, despite fluctuations in the market and the company’s own financial performance.

Tesla Bitcoin Reserves: Consistent Bitcoin Holdings

Throughout the first quarter of 2024, Tesla remained resolute in its stance regarding Bitcoin, refraining from either buying or selling the digital asset. This consistency reflects Tesla’s long-term “HODLing” strategy, as highlighted by the company’s seven consecutive quarters of no bitcoin sales.

Despite reporting a decline in revenue for the first quarter of 2024, with total revenue falling short of estimates at $12.3 billion compared to an expected $21.4 billion, Tesla’s stock experienced a 5% increase in after-hours trading following the release of its financial results. This market response underscores investor confidence in Tesla’s overall strategy, despite the revenue miss and negative free cash flow of $2.5 billion during the quarter.

The decision to maintain its bitcoin holdings proved fruitful for Tesla, as the value of its bitcoin assets surged significantly during the first quarter of 2024. This increase was largely attributed to bitcoin reaching a record high of $73,250 in March, driven by factors such as the approval of Bitcoin Spot ETFs by the United States Securities and Exchange Commission (SEC).

Comparison with MicroStrategy

Tesla’s approach to Bitcoin seems similar to that of MicroStrategy, a business intelligence and software firm led by CEO Michael Saylor, which also refrains from selling its bitcoin holdings while actively acquiring more. Although, there are distinct differences between the two.

Michael Saylor is a firm believer in Bitcoin, and has stated it multiple times that bitcoin is the best form of money. He adds bitcoin to the company’s balance sheet every chance he gets, and has stated he doesn’t have any plans to sell the company’s bitcoin stash.

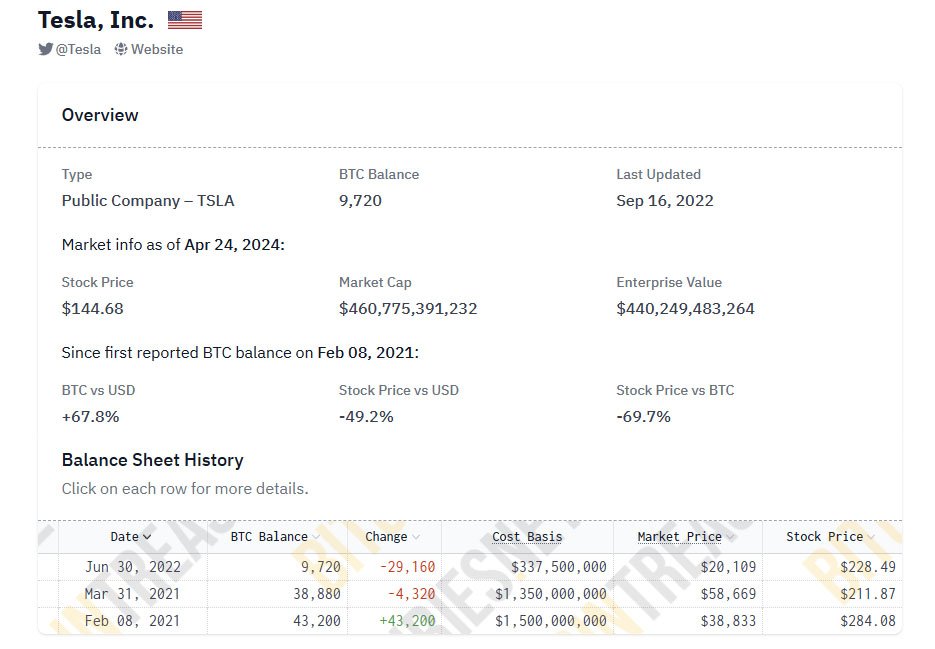

On the other hand, Elon Musk does not seem very serious about his investment. Tesla initially acquired 43,200 BTC in 2021, as the car manufacturer started selling its products for bitcoin. But after a while, Musk stated that he believes bitcoin mining is hurting the environment and he stopped selling products for bitcoin.

From that date, Tesla has sold 33,480 BTC.

MicroStrategy, contrary to Tesla, has never sold any of its bitcoin reserves, indicating a strong belief in the long-term potential of Bitcoin as a valuable asset.

Elon Musk and Dogecoin Speculation

Beyond Bitcoin, Musk’s affinity for “cryptocurrencies” has also sparked speculation about the company’s potential acceptance of Dogecoin as a payment method. While Musk has not provided a definitive answer, stating only that “At some point, Tesla should allow it,” his continued support for Dogecoin adds another layer of intrigue to Tesla’s digital assets strategy.

Related reading: The Economics of Dogecoin And Why It’s a Dangerous Bet

Conclusion

In summary, Tesla’s decision to maintain its $711 million bitcoin investment throughout the first quarter of 2024 reaffirms its commitment to bitcoin as a strategic asset. Despite challenges in revenue and cash flow, Tesla’s stock experienced a positive market response, reflecting investor confidence in the company’s long-term vision.

With bitcoin’s value on the rise and a shared strategy with MicroStrategy (although not as strong), Tesla remains poised to capitalize on potential future growth in the digital asset market.