Thailand financial regulator, the Securities and Exchange Commission (SEC), has recently amended regulations to facilitate investments in highly-successful U.S. spot bitcoin Exchange-Traded Funds (ETFs) for special investors. This development underscores the evolving investment preferences in Thailand and positions the country as a thriving hub for diverse investment opportunities.

As per a recent report by the Bangkok Post, the local regulator has granted approval for asset management firms to launch private funds specifically designed for investing in spot Bitcoin ETFs, with eligibility limited to institutional investors and “ultra-high-net-worth” individuals.

Thailand Financial Regulator Shifts Stance

In January, Thai SEC said that it was monitoring the development of overseas spot Bitcoin ETFs to “formulate supervisory policy responses.” Moreover, it added at the time that it had no plans to allow any such products in the nation.

However, the regulator’s latest shift in stance happened during a recent board meeting, where it agreed that asset management firms could manage private funds exclusively dedicated to investing in spot Bitcoin ETFs on U.S. exchanges.

According to SEC Secretary-General Pornanong Budsaratragoon, this move is the response to multiple requests it received from asset management firms to invest in Bitcoin ETFs. He noted that the U.S. SEC’s classification of these funds as securities rather than digital assets solidified the agency’s decision.

Investing in Spot ETFs: A Privilege

However, the privilege of investing in spot Bitcoin ETFs is reserved for institutional investors and ultra-high-net-worth individuals, a precautionary measure taken due to the inherent risks associated with digital assets. Ms. Pornanong emphasized the need for careful consideration before allowing asset management firms direct exposure to digital assets.

She added:

“We need to consider carefully whether to allow asset management firms to invest in digital assets directly due to the high risk.”

Favorable Market Amid Bitcoin-Friendly Regulations

This regulatory development coincides with a period of heightened bitcoin prices, hovering around an all-time high, currently trading at over $70,000. Ms. Pornanong highlighted the strategic timing, indicating that the SEC’s approval aligns with the potential benefits of unlocking investments for Thai investors amid favorable market conditions.

This regulatory shift follows last month’s move by Thailand’s Ministry of Finance, which relaxed tax rules on digital asset trading by suspending the 7% value-added tax on trading profits. Effective from January 1, 2024, with no specified expiration date, this tax exemption aligns with the broader trend of Thailand positioning itself as a welcoming environment for the digital asset industry.

The Success Story of Spot ETFs

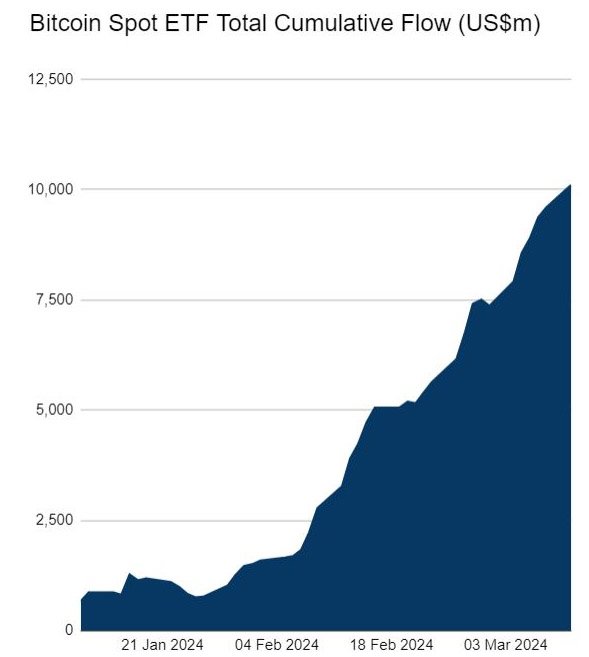

Amidst a robust market performance, spot ETFs collectively recorded a substantial net inflow of $505.5 million on March 11. BlackRock’s IBIT remains a leader with an impressive $562.9 million inflow. Traditional investors’ keen interest in the newly-launched ETF products is notable, with the total net inflow soaring past an impressive $10.1 billion.

The amended Thai regulations have paved the way for the local investors to enjoy a seamless entry into this lucrative market, aligning with the escalating demand and positive performance.