BlackRock’s iShares Exchange Traded Fund (IBIT) now reportedly has more bitcoin in Assets Under Management (AUM) than Michael Saylor’s MicroStrategy. Previously, the latter had cemented itself as a big holder of the digital asset but BlackRock Bitcoin ETF added a whopping 12,600 BTC ($845 million) on Friday to go past it.

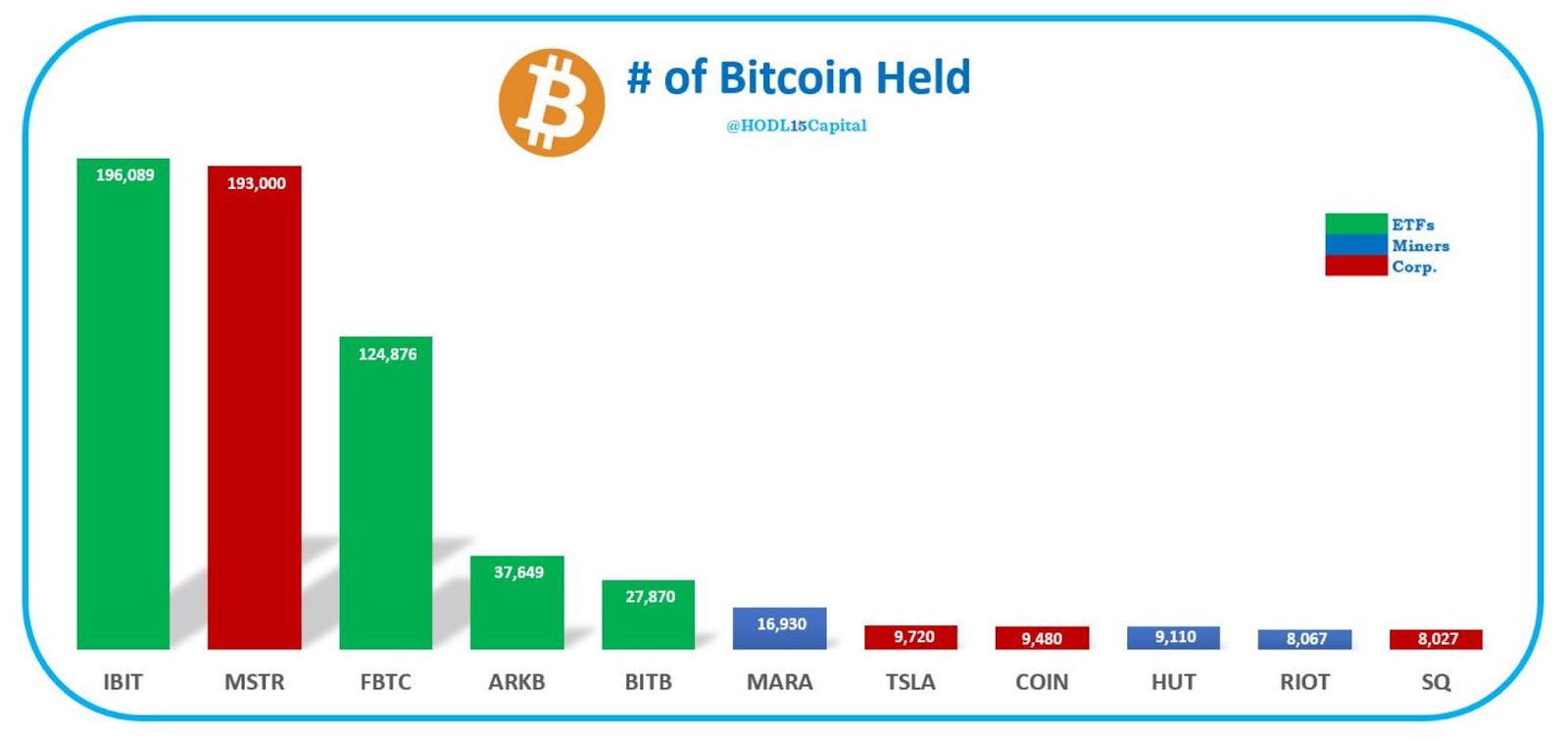

Here is the latest figure of bitcoin holdings across the board:

BlackRock Bitcoin ETF: Role in the Bitcoin Market

BlackRock is the largest asset manager on the face of the earth with a massive $9.1 trillion in Assets Under Management (AUM). The overall profile of the major fund manager is so big that the $13 billion or so in current bitcoin holdings pales in comparison to the overall magnitude of the fund.

This is why the news regarding BlackRock was seen as a massive event in the history of the digital currency revolution. It can unlock potentially hundreds of billions of dollars, if not trillions, for the digital asset market.

Latest Bitcoin Figures for MicroStrategy and BlackRock

According to BitcoinTreasuries, MicroStrategy currently holds 193,000 BTC ($13.2 billion) at an average buying price of $31,544 per BTC. Data from Apollo shows that BlackRock now has 196,089 BTC ($13.4 billion). So, at the moment, there is not a lot of difference among these two big holders of the top digital asset.

MicroStrategy is still the more aggressive purchaser of bitcoin but it is expected to fall behind due to the 9 trillion dollar might of BlackRock. Michael Saylor is betting the future of the company and his corporate profile on the premier digital currency.

The company added 3,000 more BTC at the end of last month at an average price of $51,813 but that pales in comparison to hundreds of millions of dollars worth of BTC entering BlackRock’s coffers on a daily basis. BlackRock has been able to surpass this level in less than 2 months of its existence. The IBIT ETF was launched only in the second week of January.

What Does the Current ETF Market Share Look Like?

The current ETF market is dominated by BlackRock’s IBIT and Fidelity’s FBTC Bitcoin ETFs. Together, they represent more than 80% of the overall spot ETF market. Other players include Bitwise (BITB), Franklin Bitcoin (EZBC), Valkyrie (BRRR), Invesco Galaxy (BTCO), Van Eck (HODL) and Grayscale Bitcoin Trust (GBTC).

BlackRock is Dominating the ETF Market

BlackRock is trying to up the ante by involving its own global allocation fund in the equation. In a recent filing with the SEC, the fund stated recently:

“The fund may acquire shares in ETPs that seek to reflect generally the performance of the price of Bitcoin by directly holding bitcoin — ‘Bitcoin ETPs’ — including shares of a Bitcoin ETP sponsored by an affiliate of BlackRock.”

This means that the largest investment fund in the world may start moving huge chunks of its own funds into IBIT. This can potentially result in further appreciation of the premier digital asset.