There has been a rapid increase in traditional finance firms in the United States embracing the digital asset revolution, allocating significant portions of their portfolios to bitcoin investment products, specifically to Fidelity Wise Origin Bitcoin Fund (FBTC).

According to an X post by Bloomberg ETF analyst Eric Balchunas, two U.S. investment advisors, Minnesota-based Legacy Wealth Asset Management and Kansas-based United Capital Management, have recently allocated 6% and 5% of their portfolios, respectively, to the Fidelity’s Bitcoin ETF.

FBTC Surpasses IBIT in Terms of Portfolio Allocation

The portfolio allocations by these asset management firms amount to more than $20 million each, surpassing the $17 million invested by a rival into BlackRock’s ETF, IBIT. Balchunas hailed these allocations as a “new high water mark” for investment into Bitcoin ETFs, indicating a significant shift in sentiment among traditional finance players.

He also noted that this trend is encouraging for those hoping for long-term bitcoin adoption, stating:

“This is as Boomer as it gets. We still have 5-6 weeks of more 13F reporting like this too. We could see 500-1000 firms like this reporting holdings once dust settles. And that’s just one 13F season. There are 4 in a year.”

A screenshot of United Capital Management’s website shared by Balchunas displayed the bold statement “WE’RE COMING FOR YOUR COINS DEGENS” on the homepage. However, the company had removed this statement from its website by the time of writing.

Bitwise CEO Shares Similar Scenario

Meanwhile, Bitwise CEO Hunter Horsley shared a similar scenario within his firm. He mentioned that in recent days, three Registered Investment Advisors (RIAs) managing between $100 million to $2 billion in assets under management (AUM) each, decided on various allocations to Bitcoin for their clients.

These allocations ranged from a proposed 2% to all clients, to discretionary allocations of 3-10% for all, and a 2.5% allocation to Bitcoin and digital asset equities for models.

Spot Bitcoin ETF Inflows

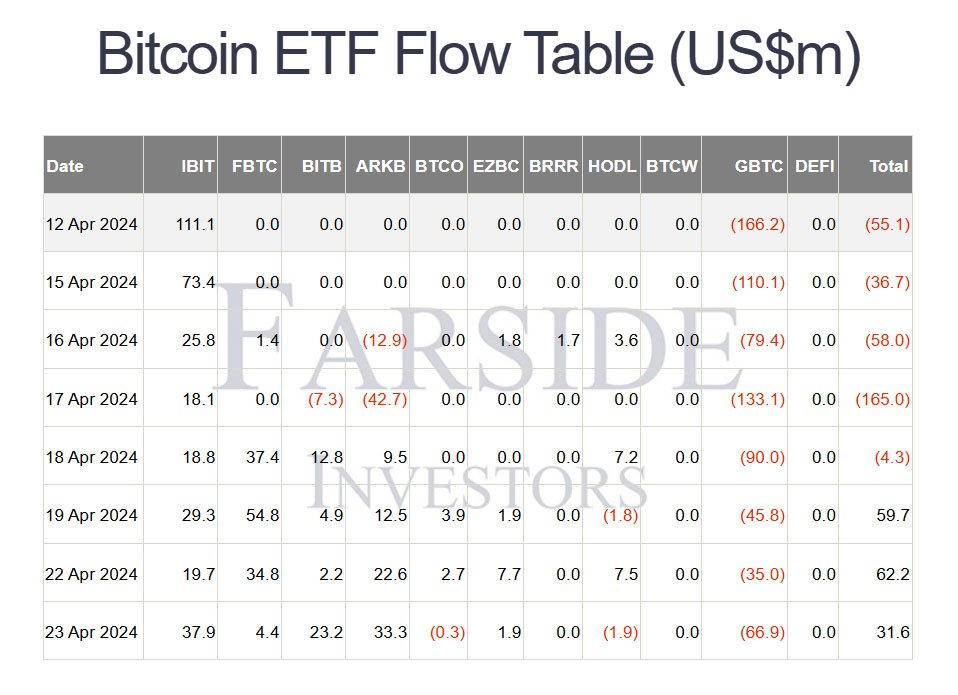

The allocation of $40.8 million into FBTC has significantly boosted spot Bitcoin ETF inflows, effectively reversing last week’s outflows. Data from Farside reveals that after experiencing four consecutive days of outflows, the funds recorded inflows on Monday, with FBTC seeing the highest at over $34.8 million.

IBIT, in particular, is nearing its 70th consecutive day of inflows since its launch, solidifying its position as one of the top ETFs with the longest daily streaks of inflows.

Joining the Trend

In a separate development, a student-run investment fund, the Stanford Blyth Fund, has also recently joined the trend by allocating 7% of its portfolio to Bitcoin following a recent purchase.

Similarly, Arthur Salzer, Founder & CEO of Canada-based family office Northland Wealth, disclosed that his firm had invested in Bitcoin for their families as early as the spring of 2019. Initially ranging between 2% to 10% of portfolios, today these allocations impressively vary between 5% to 20%.

These moves reflect a broader trend of traditional financial institutions increasingly embracing digital assets, signaling a maturation of the asset class and growing investor confidence in its long-term potential.