In a big win for the scarce digital asset, the US Department of the Treasury has officially referred to Bitcoin as “digital gold” in their fiscal year 2024 Q4 report. This is a major step in recognizing bitcoin as a store of value in the decentralized finance (DeFi) space.

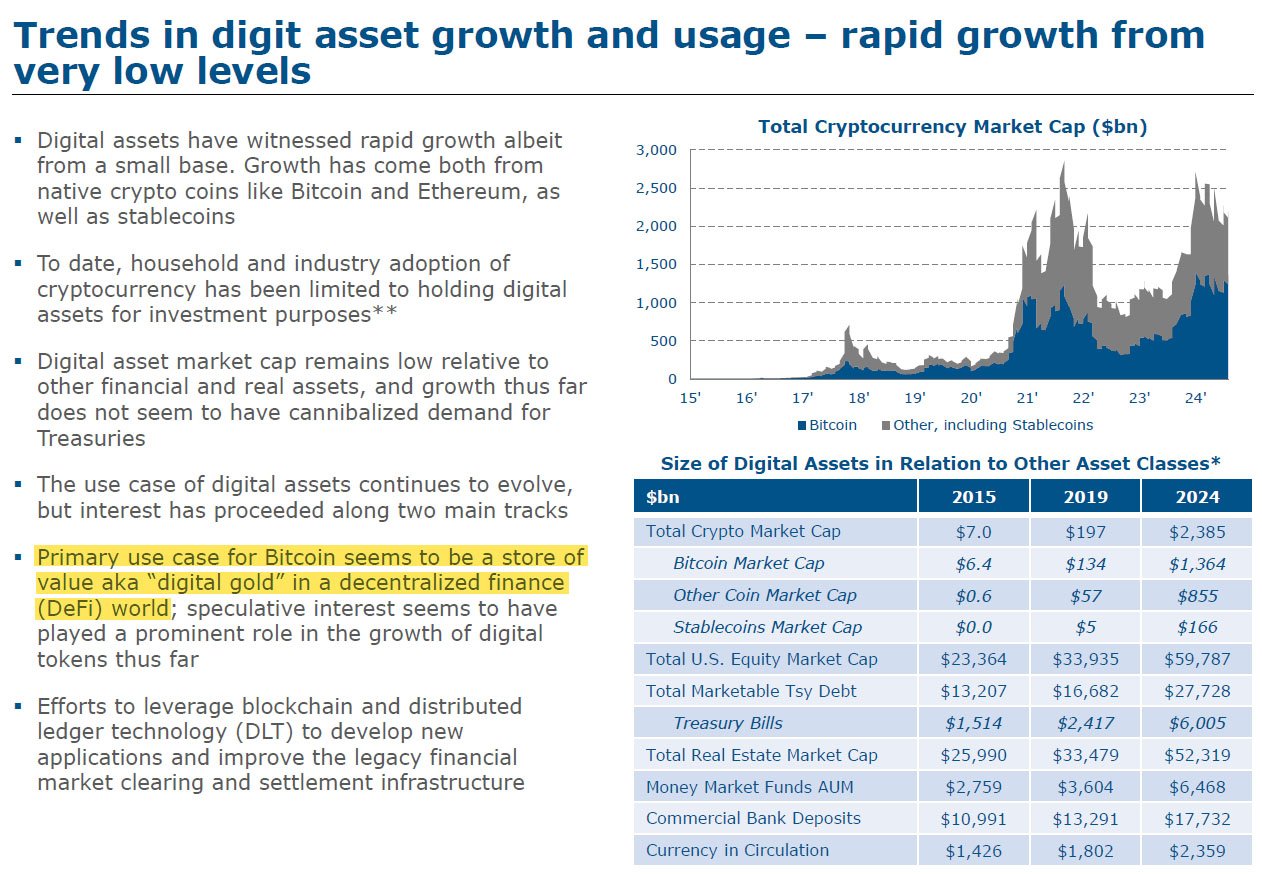

The report highlights Bitcoin’s rapid growth, citing its development from a niche investment with a market cap of $6.4 million in 2015 to about $2 trillion today, stating that bitcoin is disrupting traditional finance.

“Bitcoin has been compared to ‘digital gold’ in this report,” said a popular X commentator. This isn’t just a figure of speech; it puts Bitcoin in the same category as gold which has been a safe-haven asset for years.

The Treasury noted bitcoin’s use case as a store of value in the DeFi space. In the report they said:

“[The] primary use case for Bitcoin seems to be a store of value, aka ‘digital gold,’ in a decentralized finance (DeFi) world.”

This recent development has sparked speculation about the U.S. government’s commitment to establishing a strategic bitcoin reserve.

Federal Reserve Chairman Jerome Powell said in a recent speech, “Bitcoin is a speculative asset that has a closer correlation to gold than the U.S. dollar.” He dismissed the idea that bitcoin could replace the dollar but acknowledged it’s a digital financial asset like gold.

As Bitcoin gets more popular, institutional investors are taking notice. Companies like BlackRock — through its iShares Bitcoin Trust ETF (IBIT) — and MicroStrategy led by Michael Saylor are buying bitcoin.

Related: $1.5B Purchase Pushes MicroStrategy’s Bitcoin Holdings Past 400k BTC

IBIT now holds over 500,000 bitcoin worth nearly $50 billion, making it the largest Bitcoin ETF player. MicroStrategy has amassed over 402,000 bitcoin through a strategy that started during the pandemic and has continued uninterrupted.

The report also hints at what’s being called “corporate FOMO” (Fear of Missing Out), as more companies are looking to add bitcoin to their balance sheet.

Stablecoins were also mentioned in the Treasury’s report.

These digital assets, pegged to fiat currencies like the U.S. dollar, are stated to be a key part of the digital asset landscape. According to the report, stablecoins now make up over 80% of all digital asset transactions, with $120 billion of stablecoin collateral invested in US Treasuries.

The report says this has led to a small increase in demand for short term Treasuries, and links stablecoins to the traditional financial system. The dual role of stablecoins as a tool for DeFi and a driver of demand for Treasury backed assets shows how important they are becoming.

The Treasury’s report acknowledges Bitcoin and stablecoins potential but is cautious.

The authors believe speculative interest has been a big driver of bitcoin’s growth. The report says:

“Speculative interest seems to have played a prominent role in the growth of digital tokens thus far.”

At the same time, however, the report recognizes the transformative power of blockchain in modernizing old financial systems like clearing and settlement.

For fans, this dual acknowledgement of speculative risk and technological promise is a big step towards mainstream acceptance of digital assets.

As Bitcoin grows, the Treasury thinks its volatility will lead to increased hedging needs and demand for high quality assets like US Treasuries. The intertwining of DeFi and traditional finance suggests the future of finance is in the intersection of these two worlds.

The Treasury’s acknowledgement of Bitcoin as “digital gold” is a big change in institutional thinking around the scarce digital asset. What was once dismissed as a niche movement is now getting a toehold in the mainstream financial system.

For fans of Bitcoin, the future looks good.

The conversation between DeFi and traditional finance is far from over, but one thing is for sure: Bitcoin is no longer a speculation – it’s a financial asset.