Wall Street CEO Howard Lutnick, head of Cantor Fitzgerald, has recently expressed strong support for Bitcoin and Tether, highlighting their unique features in the financial landscape.

Howard Lutnick Praises Bitcoin

In a series of interviews with CNBC, Lutnick initially expressed a broad support for digital assets. But later he pivoted to specifically praising Bitcoin. He emphasized Bitcoin’s distinct attributes, notably its halving cycles and its decentralized nature. He said these features position Bitcoin as an asset beyond centralized control, differentiating it with from other digital assets like Ethereum.

Related reading: Ethereum: the Centralized JPMorgan Protocol

According to Lutnick, Bitcoin represents a unique asset that cannot be seized or controlled by any entity; a quality that sets it apart in the financial world.

He added:

“The only asset people could have held where no one could take it? Bitcoin, it is uncontrollable. These other coins, they’re not a thing […] They’re kind of make-believe, Maybe Ethereum is OK. With Tether, you can call Tether and they’ll freeze it. With Ethereum, you can call Joe Lubin.”

Cantor Fitzgerald and Tether

Lutnick also showcased his admiration for Tether, indicating himself as a significant holder of the stablecoin’s treasuries.

Cantor Fitzgerald, a notable financial services firm, took on the responsibility of managing Tether’s substantial Treasury portfolio, exceeding a staggering $90 billion. This collaboration, which began in late 2021, marks an intriguing development in the otherwise cautious stance many Wall Street entities adopt towards engagement with digital assets.

Tether’s Standing and Criticisms

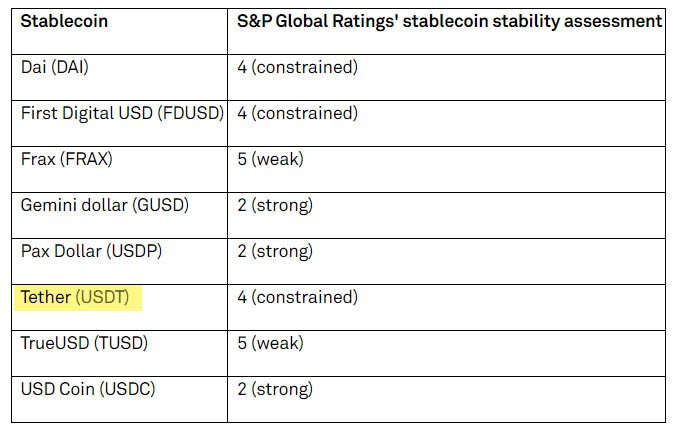

Despite Tether’s position as the largest stablecoin, it faces scrutiny for its lack of transparency regarding its reserves. An assessment by S&P Global rated Tether poorly among U.S. dollar-pegged stablecoins, indicating concerns about its ability to maintain its peg to the dollar and its overall stability.

Related reading: FED probes Stablecoin issuer Tether in 86-Page Denial Order

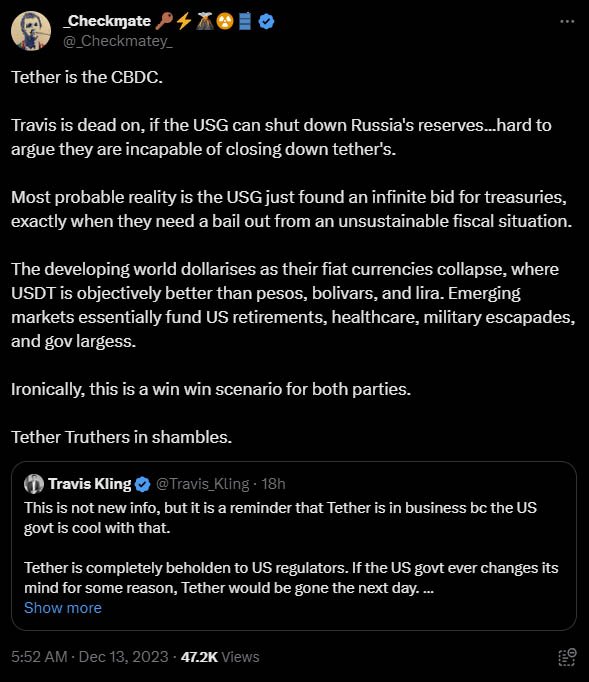

James Check of Glassnode likened Tether to a U.S.-controlled CBDC, potentially aiding dollarization in developing nations, echoing similar sentiments.

Lutnick also pointed out potential benefits of Tether for countries facing currency instability, suggesting it could offer a viable solution, citing examples like Argentina, where the new leadership has expressed interest in adopting alternative currencies.

This public backing of Bitcoin and Tether by a Wall Street figure like Lutnick underscores the evolving landscape of traditional finance intersecting with the growing world of digital assets. Cantor Fitzgerald’s involvement with Tether’s Treasury portfolio signifies a notable shift in the dynamics between established financial institutions and the digital-asset sphere.

Cantor Fitzgerald’s Unique Position in the Financial Landscape

Cantor Fitzgerald stands out among brokerage firms as one of the select few authorized to trade Treasury bonds, alongside names like Charles Schwab, Fidelity, and Vanguard. This status underlines the significance of their involvement with Tether, especially given the hesitancy of traditional financial institutions in dealing with digital asset businesses following certain industry setbacks.

As Tether continues to navigate concerns about transparency and stability, Lutnick’s endorsement signals a potential bridge between conventional finance and the digital-asset realm. His praise for Bitcoin’s unique qualities reflects a growing acknowledgment within traditional finance circles of the distinct value propositions offered by Bitcoin that is matched by no other.

Lutnick’s vocal support for Tether and Bitcoin highlights a notable evolution in the perception of digital assets within Wall Street’s corridors, indicating potential shifts in the financial landscape in the years to come.