Michael Saylor, the former chief executive and the Executive Chairman of MicroStrategy, made a bold statement regarding the approval of a Spot Bitcoin Exchange-Traded Fund (ETF) in the United States. The Bitcoin enthusiast claims that the BTC ETF is the biggest development on Wall Street since the introduction of the S&P 500 index fund.

“It’s not unreasonable to suggest that this may be the biggest development on Wall Street in 30 years,” Saylor said in an interview with Bloomberg on December 19, while adding:

“The last thing that was this consequential was the creation of the S&P index and the ability to invest in all 500 S&P companies via one trade at the same time.”

Spot BTC ETF is a Door for Investors

Saylor, who has remained bullish on Bitcoin even during the 2022 crash, said that a Spot Bitcoin ETF will act as a door for retail and institutional investors who have not been able to access a “high bandwidth compliant channel” to invest in Bitcoin.

The MicroStrategy executive believes that the approval of an ETF by the United States Securities and Exchange Commission (SEC), coupled with the “supply shock” following the upcoming Bitcoin halving, will drive demand for the digital asset higher.

He noted:

“I don’t think we’ve ever seen a 2 to 10x increase in demand combined with a halving in supply in a scarce, desirable asset that people want to hold for a long period of time.”

MicroStrategy to Remain Bullish on Bitcoin in 2024

Saylor predicted that “2024 is going to be a major bull run for the asset class,” while adding that his company will remain bullish on Bitcoin and invest in the digital asset throughout the year.

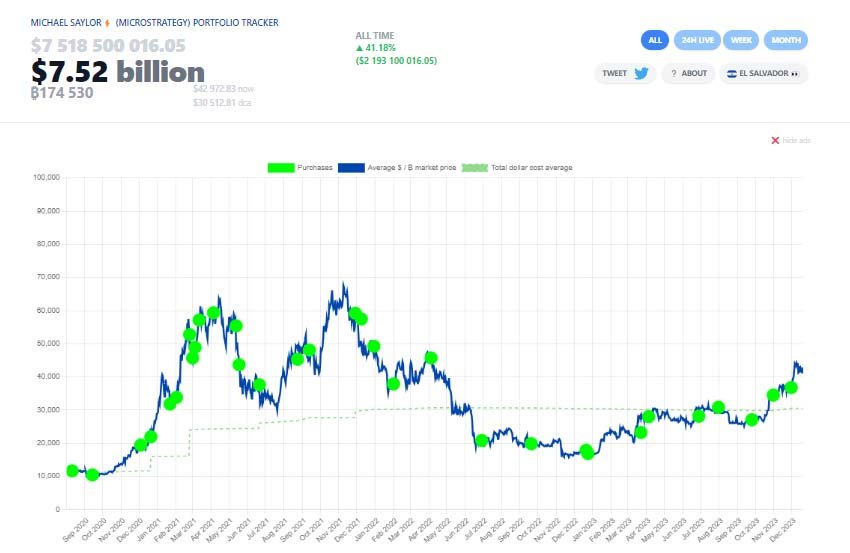

Notably, MicroStrategy is the biggest corporate holder of Bitcoin and currently holds 174,530 BTC after the latest disclosure on November 30. The average purchase price of each BTC is $30,252.

“Our goal is always to find a way to pursue more Bitcoin per share for our shareholders via debt, equity, or cash flows from the business,” Saylor said while noting:

“We provide [investors with] leverage, and we don’t charge a fee. [So] we offer sort of a high-performance vehicle for people that are Bitcoin long-term investors.”

As reported earlier, the Bitcoin price surge in late October put MicroStrategy’s BTC bag back in profit. According to the SaylorTracker chart, MicroStrategy is currently making $2.193 billion in profit by simply dollar cost averaging its investment in BTC.

It is also important to note that in November, Saylor predicted at the 2023 Australia Crypto Convention that Bitcoin’s price could potentially grow by up to 10 times by the end of 2024.