Guest article contributed by Meyrick Dabreo. Follow Meyrick on Twitter and check his podcast on Fountain.

In this article, we will explore seven economics principles that I found to be very helpful or even essential on my journey to understand bitcoin. Let’s dive in.

Lindy Effect

The Lindy effect, also known as Lindy’s law, can be traced back to a 1964 New York Times article. The concept is named after Lindy’s delicatessen in New York City and was more recently popularized by author Nassim Nicholas Taleb in his famous book “Antifragile: Things That Gain From Disorder.”

At its core, the Lindy effect is a theorized phenomenon by which the future life expectancy of some nonperishable things, like a technology or an idea, is proportional to their current age. Therefore, the concept conveys that the longer an idea or technology survives, the longer its remaining life expectancy becomes.

The Lindy effect applies to nonperishable items or items that do not have an expiration date. Simply put, the longer something has survived, the longer it is likely to exist into the future.

To further explore the Lindy effect in action, let’s look at books. Each year over 100,000 books are published and less than 500 make the New York Times Best Seller list, but most of these books are forgotten the following year. However, classics like Paulo Coelho’s “The Alchemist” released in 1988 are still printed every year; the Lindy effect is our unconscious assumption that these books will therefore very likely continue to be printed for the next 20-30 years because they have been continuously for so long already.

Similarly, in 1976 John C. Bogle introduced the Vanguard 500 Index Fund with a target of $250 million but managed to raise only $11.3 million. This didn’t deter him from continuing with the fund. Fast-forward to our current timeline (46 years later) the firm now manages over $7 trillion and would continue to scale for the next 46 years.

Through our “Bitcoin Glasses” we can see that Bitcoin has survived for over 13 years. Moreover, Bitcoin has survived through all of these major downfalls:

So I have no doubt that Bitcoin is here to stay for a very very long time. And as Nassim Taleb would put it, “the only effective judge of things is time.”

This concept was covered in depth in this Bitcoin Magazine article “Examining The Lindy Effect And Bitcoin.”

Stock to Flow Ratio (S2F)

The stock to flow model is seen as controversial among Bitcoiners, as some criticize the original S2F promoter “Plan-B” for using the model only to spread false hopes, gain followers and monetize reach.

Put simply the stock-to-flow ratio or the stock-to-flow model is calculated by dividing the amount of a resource held in reserves by the amount that is produced annually. Most commonly the stock-to-flow is used in the commodity market. The higher the stock-to-flow ratio the scarcer the item.

Can you guess historically which metal had a high stock-to-flow ratio and at the same time had minimal industrial application? Yup, that’s right gold. Hence for centuries (and even longer), gold has been regarded as the best store of value. As of 2019, gold has an S2F ratio of 62. Uranium on the other hand has an even higher S2F ratio as compared to gold, however most of the mined uranium is gobbled up by industry.

Now putting on our Bitcoin glasses, bitcoin is the world’s first scarce digital asset. Scarce how? Only 21 million bitcoin will ever exist. Additionally, the underlying technology that Bitcoin is built upon assures that the quantity of new supply decreases over time at a predictable rate, increasing its scarcity.

Just as in mining gold (where the reward for miners is newly-found gold) in the Bitcoin protocol Bitcoin miners are rewarded with newly-issued bitcoin. The “block reward” is given to the miner that is able to calculate the hash required to validate a block of transactions which happens approximately every ten minutes; this process is known as proof-of-work.

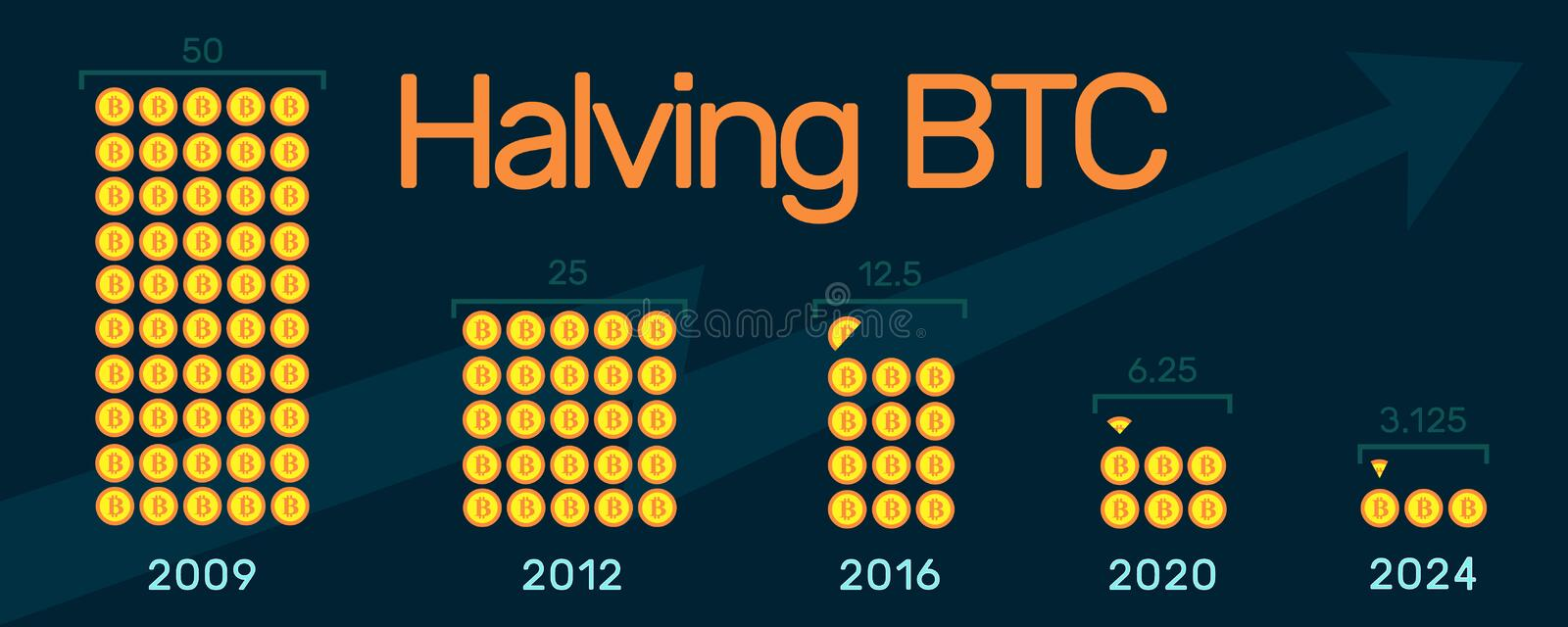

As per the Bitcoin whitepaper, for every 210,000 blocks mined, the block reward is halved — a phenomenon called the “Bitcoin halving.” In the early days (2009) Bitcoin miners were rewarded 50 BTC, which was halved to 25 BTC in 2012, then to 12.5 BTC in 2016, and then to 6.25 BTC in 2020. The next halving is predicted to take place in 2024 and the reward will drop to 3.125 BTC.

Due to this, in the long run, bitcoin will outperform gold and will eventually lead to having no new in flows as the last bit of bitcoin is expected to be mined in the year 2140.

“Scarcity creates ‘unforgeable costliness’ and assigns intrinsic value to an asset.” – Nick Szabo, cryptographer, and computer scientist.

Cantillon Effect

This economic effect was first described in the 18th century by Irish-French banker and philosopher Richard Cantillon in the book he wrote “An Essay on Economic Theory.” His basic theory was that those who benefit when a nation creates (prints) money are those who are closest to the money printer.

In the 18th century that meant the closer you were to the king, the wealthier you were. Fast-forward to 2020, the U.S. government passed a giant multi-trillion dollar bailout aimed at hospitals, banks, the unemployed, and small businesses.

However, what happened was large spikes in the stock market. In other words, money that was meant for everyone found its way only to the stock market. The reason behind this is that money travels through institutions and eventually, some money gets to the rest of us. So money gets to the rich first and having early access to this money they buy up harder (physical or financial) assets. Hence, it can be said that getting ahead in life results from getting closer to the money printer.

The Cantillon effect is nicely summarized by Nicolás Cachanosky from the American Institute For Economic Research (AIER): “The Cantillon effect refers to the change in relative prices resulting from a change in the money supply. The change in relative prices occurs because the change in money supply has a specific injection point and therefore a specific flow path through the economy. The first recipient of the new supply of money is in the convenient position of being able to spend extra dollars before prices have increased. But whoever is last in line receives his share of new dollars after prices have increased.”

Trivia – Richard Cantillon was murdered and his house was burned down. I guess that is what you get pointing out the biggest scam in history.

Again let’s view the Cantillon effect through our Bitcoin filter. Bitcoin was born on January 3, 2009, after the 2008 financial crisis and its very first block (aka “the genesis block”) is embedded with, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” the headline from The Times newspaper of London. Satoshi Nakomoto’s mission was to eliminate the Cantillon Effect and create truly neutral and fair money that is not dependent on any third party. Satoshi did not unfairly pre-mine any bitcoin to keep for himself.

So it is safe to say that the world was introduced to Cantillon effect 2.0 with the birth of Bitcoin. The Cantillon effect 2.0 is also known as the Nakamoto effect. The Nakamoto effect levels the playing field for all as anyone is free to join as a miner, validator, or a holder, and every 10 minutes all the miners have an equal chance of earning a reward of newly produced BTC (block reward).

Gini Coefficient

Gini coefficient (Gini index or Gini ratio) is a statistical measure of economic inequality in a population. The Gini coefficient was developed by the statistician and sociologist Corrado Gini. This coefficient can take any values between 0 to 1 (or 0% to 100%). In the instance, that wealth is perfectly distributed among the population the coefficient will be equal to zero.

Whereas a coefficient of one represents a perfect inequality where one person in a population receives all the income, while others earn nothing. When it comes to investing the Gini coefficient is similar to having a first-mover advantage, i.e., buying when the price is the lowest.

Here is The World Bank’s estimates for country wise global wealth distribution as of 2019.

<iframe src="https://data.worldbank.org/share/widget?end=2016&indicators=SI.POV.GINI&start=2016&view=map&year=2019" width='450' height='300' frameBorder='0' scrolling="no" ></iframe>

The Gini coefficient through our Bitcoin lens we often hear the same argument from no-coiners or shitcoiners alike, that the early adopters of Bitcoin have a first-mover advantage. But is this true? Let’s examine …

Calculating the Gini coefficient for Bitcoin is not straightforward as users have multiple addresses, custodial wallets represent multiple users and users purchase bitcoin at different price points. To get a clear picture of Bitcoin’s Gini coefficient, I will be drawing from Michael Weyman’s work on the same topic.

For this examination, Weyman excludes wallets that hold BTC less than USD 100. Looking at the data it is evident that since Bitcoin went online (03/01/2009) the Gini coefficient has been almost steadily declining. As I mentioned it is not a simple task to calculate Bitcoin’s Gini coefficient; various studies suggest it is 0.48, 0.65, 0.73, and even as high as 0.88, where the author claims Bitcoin’s Gini coefficient is worse than North Korea.

Additionally, Weyman uses another metric to measure inequality in wealth distribution, the Nakamoto index. The Nakamoto index takes into consideration 51% of the wealth in the ecosystem whereas the Gini coefficient considers the entire population. In 2012, the Nakamoto index comprised of only 1,840 accounts, i.e., only 1,840 accounts held 51% of the total supply of bitcoin. Currently, this number has risen to over 5,000 accounts.

Hence both metrics demonstrate that bitcoin is becoming more evenly distributed over time. In addition, examining the global adoption of Bitcoin, which current estimates state that only 1-3% of the population holds bitcoin. Last year’s Chainalysis reports suggest that global cryptocurrency adoption has surged a whopping 881%. Hence, it is safe to say that Bitcoin is being adopted more quickly than the internet.

The graph below demonstrates the adoption rate of various technologies throughout history:

The pace of technology adoption is pacing up. Source (https://hbr.org/2013/11/the-pace-of-technology-adoption-is-speeding-up).

Opportunity Cost

Opportunity cost is a simple concept to understand with the use of an example. Say for instance you purchased a house to rent out means you can not live in that house, or if you choose to live there you can not rent it out.

Opportunity Cost = (returns on best Forgone Option) – (returns on Chosen Option)

To further eplain the concept, here are two more examples: Say you have $100; you can choose to save the amount or you can spend it. Similarly, a business has $100,000 to invest in either project A or project B; project A generates annual returns of $5,000 from the first year of operation and has a lifecycle of 10 years. Whereas, project B generates a one-off payment of $50,000 after five years of operation. Hence, the business would have to decide between a lump sum payment of $50,000 after five years or a steady flow of annual income over 10 years.

Moreover, from a business perspective, every dollar spent on marketing is not spent on R&D and every dollar held back as reserves are not paid out to shareholders.Nonetheless, in a broad sense, it can be said that in our world with limited resources and scarce time, everything we say and do has an opportunity cost.

Back to looking at opportunity cost through our Bitcoin filter. In the past, a significant amount of energy, time, and resources were consumed to mine gold, forge them into coins and bars, and then build storage facilities to store them (bank vaults). Instead, all of that (energy, time, and resources) could be used for more productive purposes like constructing roads, hospitals, and schools.

Similarly, today, significant energy and computational power are used to mine bitcoin which could otherwise be used to model weather and the climate or for protein synthesis (finding the cure for cancer). Nonetheless, just as it was critical to mine gold to have a good source of hardest money, it is now equally important to mine bitcoin (our current equivalent of the hardest money).

Another angle of viewing opportunity cost through our Bitcoin filter is choosing to save in either fiat or bitcoin. Where fiat is constantly inflating (governments print/create more money) on the other hand bitcoin is inflating at a predictable and diminishing rate and will eventually hit its max supply limit of 21 million bitcoin, thus in the long run increasing its store of value.

Inflation and Deflation

Inflation and deflation both have been touched on in the above concepts. Let’s briefly discuss them again. price inflation is when the purchasing power of money declines; for example, a year ago you could purchase a head of lettuce for $5 whereas today it costs $10.

The term inflation itself comes from the latin inflare, which could be translated to ‘blowing up’.

The loss of purchasing power stems from an increased money supply. We differentiate between “price inflation” and “inflation.” Inflation is all about the money supply, but politicians don’t want people to know that.

In a nutshell, we can say that inflation as well as price inflation is the direct outcome of increasing the money supply.

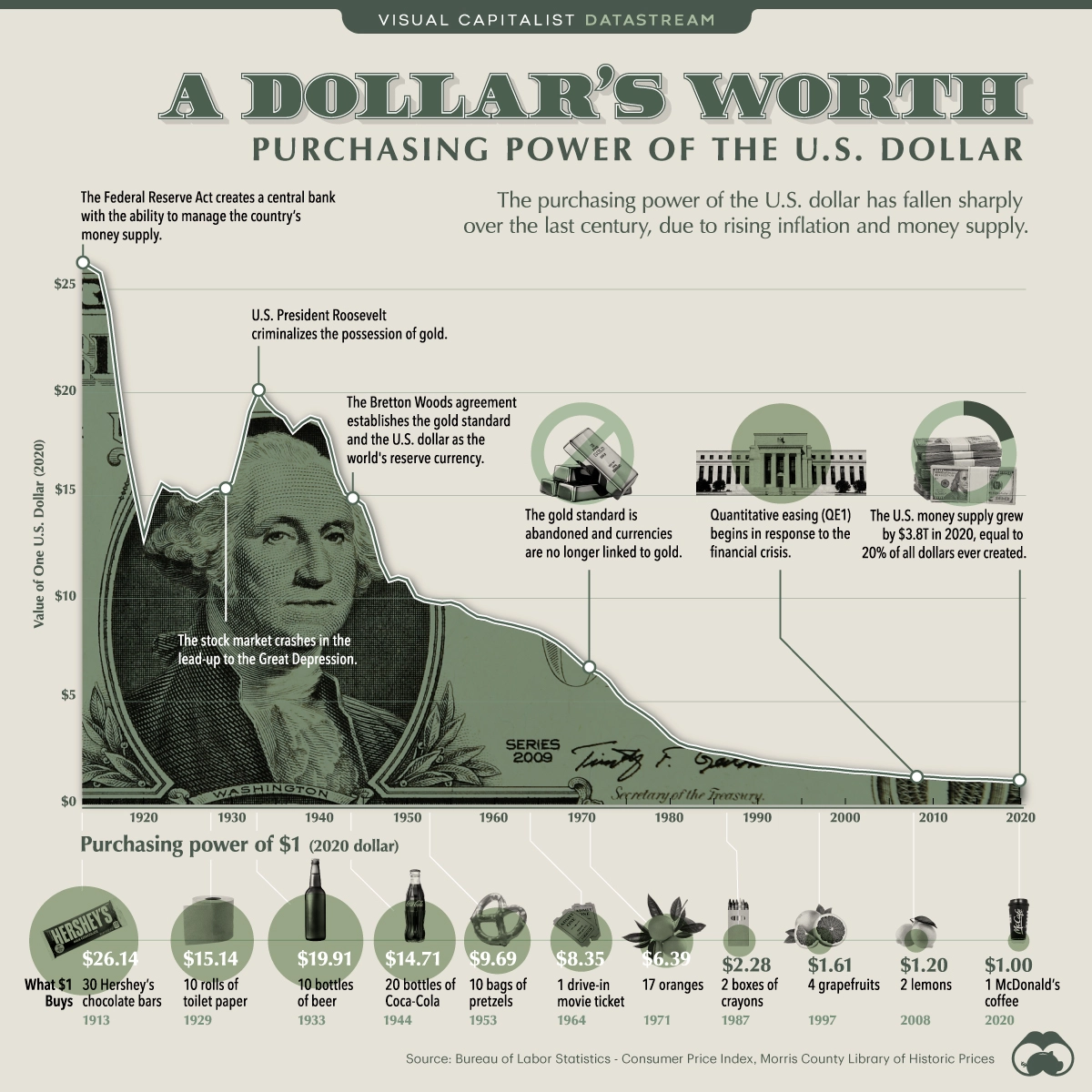

The chart below shows how inflations reduces purchasing power:

Source – Purchasing Power of the U.S. Dollar Over Time

Deflation on the other hand is the mirror image of inflation where purchasing power increases and prices decrease over time. Mainstream economists want you to believe deflation is bad. However, you can see why the average person would be at an advantage in a deflationary system.

Now let us assume we are in a hypothetical world where governments can not artificially inflate the money supply. In this world, we are more likely to see price deflation. That means prices of goods and services get lower over time. This also means your purchasing power increases as you can buy more goods with the same wage. In such a system all one would have to do to retire is to save money.

To further demonstrate deflation let us look at a technological example. We know that technology gets better and cheaper over time. If I need to buy an iPhone and hold off my purchase for the next five years, I know that five years later I will have a far superior iPhone with better graphics, performance, and camera system.

Deflation incentives savings. Moreover, looking back at history we can see that, prior to going off the gold standard, the low time preference people could attain from a stable store of value lead to great achievements in art, science, culture and technology for the benefit of everyone.

Furthermore, the deflationary system would be especially helpful for the poor and low-income segments where people cannot easily earn more. It is also advantageous to the older generation especially when their productivity is lowered. Hence with deflation, a simple wage still appreciates in value even if the individual is not able to improve their performance.

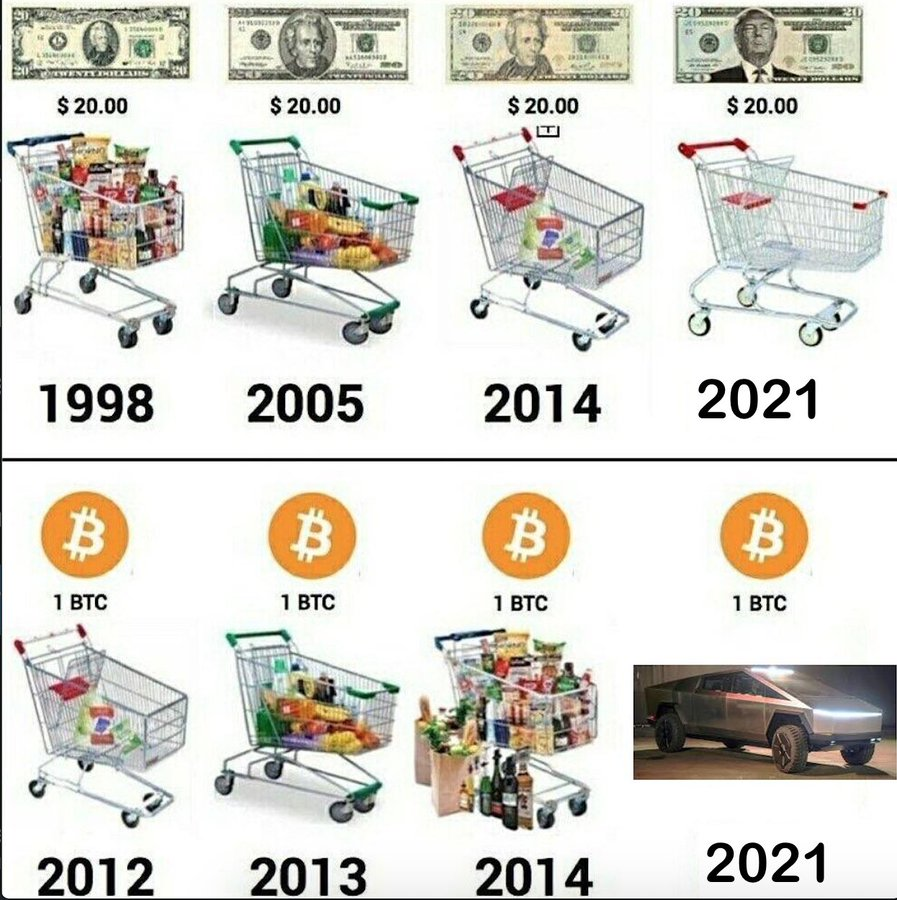

This is where Bitcoin truly shines. Bitcoin is the hardest money ever created. Bitcoin has a fixed supply of 21 million bitcoin, no more can be created. Thus, in the Bitcoin world hodling your Bitcoin leads to increasing your purchasing power. This is best demonstrated in the meme below:

Mercantilism

“Mercantilism is an economic policy that is designed to maximize exports and minimize imports for an economy” (Wikipedia). Mercantilism was based on the assumption that the world’s wealth was static, therefore for nations to stay wealthy they would have to export more than their imports. Between the 16th and 18th centuries most European nations maximized their exports and limited their imports (via tariffs) in order to accumulate more wealth.

Now let us assume in the future, bitcoin is adopted as the world’s reserve currency. Could this lead to a new form of Mercantilism in the modern age, given that bitcoin has a fixed supply?

This is just a theory, and I would love to hear your thoughts in the comments below.

Bonus: Matthew Principle

The Matthew principle or the Matthew effect, straight from the Bible, Matthew 13:12: “For to everyone who has, more will be given, and he will have abundance; but from him who does not have, even what he has will be taken away.” (New King James translation). This is very similar to the Gini coefficient, however, this is also a reminder to be grateful for what you have and more shall be given unto you.

Stay humble and stack sats.

P.S. – Don’t trust, verify :)