This article was originally published on The Bitcoin Layer.

The global dash-to-cash has found its way into the crypto ecosystem

Yet another victim of the global liquidity contraction is upon us, only this time it’s not a central bank, it’s a shadow bank.

The second largest crypto exchange in the world—FTX—is facing liquidity issues as the native token that represents most of its balance sheet, FTT, sells off in an end-of-days fashion.

The impetus for this sell pressure? The largest crypto exchange—Binance— publicly announced its planned liquidation of all its holdings of FTT, a $2.1 billion sum.

After less than 48 hours of stop-hunting for FTX’s liquidation target, Binance successfully depressed the assets of its largest competitor—so it can purchase them.

Binance draws first blood, FTX contends with selling pressure and a bank run simultaneously

Off the heels of a CoinDesk piece that leaked Alameda’s balance sheet conditions, it was discovered that large portions of their holdings are little more than vaporware.

The FTT token was invented by Alameda’s sister company, FTX, and represents a large part of Alameda’s reported $14.6 billion balance sheet in one form or another:

- $3.66 billion | Unlocked FTT

- $2.16 billion | FTT Collateral

- $292 million | Locked FTT

The trading desk’s net equity consists mostly of an internally-created-out-of-nowhere token rather than a more liquid and sought-after base money like dollar deposits or Treasuries. This revelation sparked concern among those with exposure. One of which was Binance, whose CEO took to Twitter to announce plans to eliminate these now-unwanted risky holdings:

“As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete.”

Just like the Fed can move the $20 trillion+ US Treasury market with its choice of words, the CEO of the largest crypto exchange is tanking a ~$3b market by explicitly badmouthing it on Twitter. Language moves markets—the less liquid they are, the more devastating the impact can be.

In response, the CEO of Alameda offered to buy all of Binance’s holdings over the counter at an agreed-upon price to minimize the downside of market selling:

“@cz_binance if you’re looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!”

CZ had no response. He denied an OTC deal which would have the least impact on market liquidity, and therefore the least impact on Alameda and FTX-by-extension’s solvency. In other words, by announcing his plan in advance and slowly dumping FTT onto the open market, he chose the path of maximum pain for FTX.

Make no mistake, this is a cunning and deliberate move by CZ. By publicly announcing its intention to spot sell more than half of FTT’s market capitalization, it leveraged its competitor’s precarious capital position to further its own market dominance. In other words, this is a Speculative Attack. A wounded gazelle is running for its life while a ravenous cheetah is nipping at its ankles—why let it limp away?

In the words of Dylan LeClair from our friends over at Bitcoin Magazine Pro:

CZ chose blood.

The demarcation of “FTT Collateral” on its leaked balance sheet implies that Alameda is borrowing against its FTT holdings. You wouldn’t be phased by a temporary price decline of this specific token, not unless it’s being used as collateral. $22 is perhaps a liquidation point for FTX/Alameda, which is why this level was so staunchly defended to try and prevent spillage.

It was a bad idea to explicitly name $22 as a key level, it implies your liquidation target rests close to this area. Once Binance decided to stop-hunt this level—create enough sell pressure to force a margin call—the writing was on the wall.

When Binance announced its intention to dump $2.1b of it onto the open market, it created such extreme downward pressure on FTX/Alameda’s collateral that they were put in the unfortunate position of buying all of the FTT that the market had to sell to stave off these margin calls.

If you’re wondering how this “liquidation cascade” of collateral works, Joe wrote a brief thread on it.

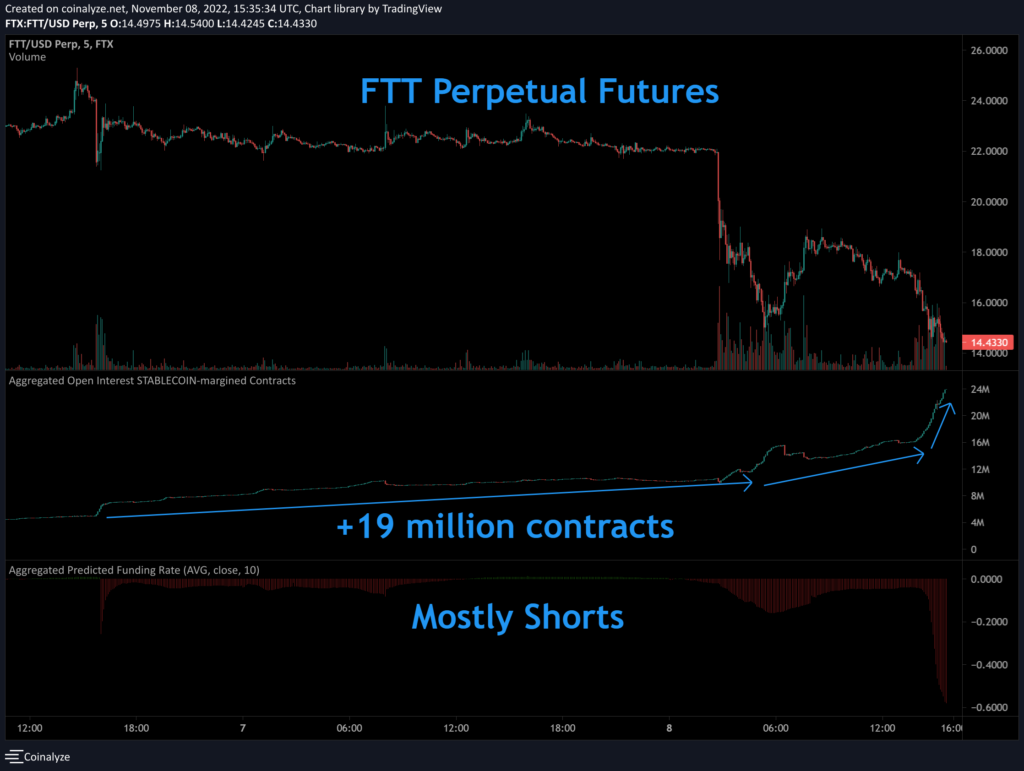

CZ’s public declaration of sale sparked capital flight from retail that wanted short exposure to FTT—now FTX has to contend with spot sellers and highly-leveraged short sellers in the futures market. The total amount of open futures contracts has skyrocketed past 19 million as shorts continue piling in over the last 48 hours:

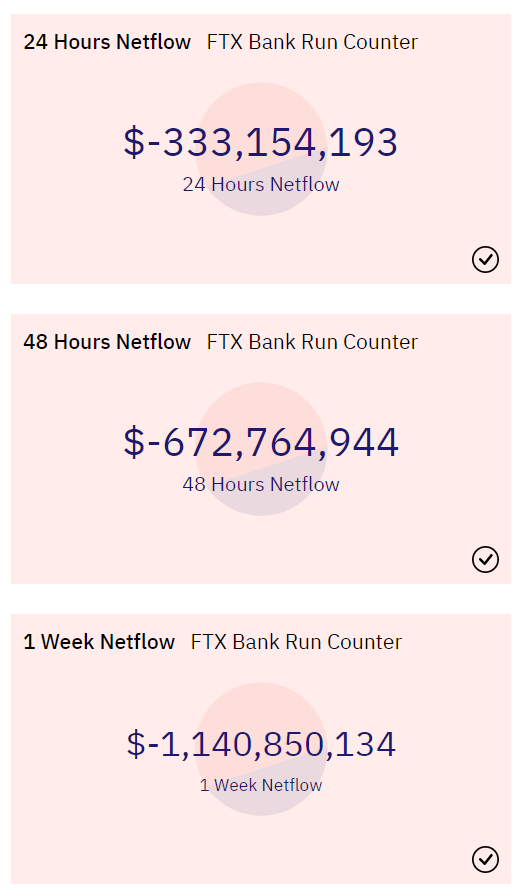

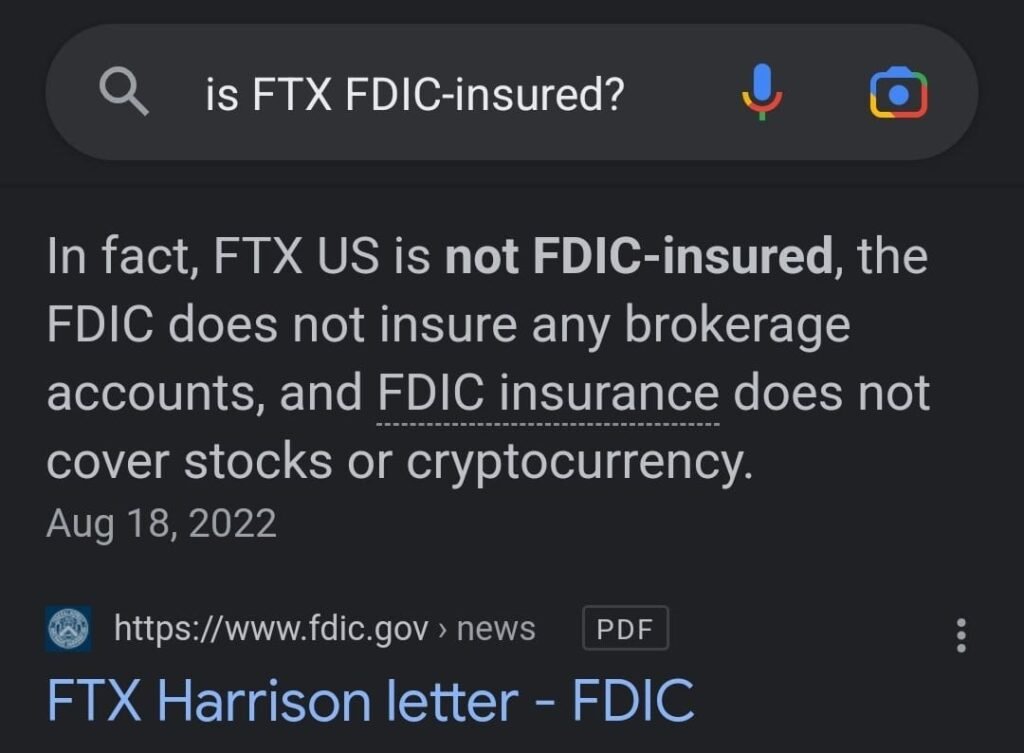

The primary risk for someone like FTX is being drained of dollar reserves as a result of “run-on-the-bank” dynamics following this upshot in public fear. You see, FTX falls into the category of a shadow bank—a bank that does not deal with the Federal Reserve directly and therefore does not have the ability to create bank reserves at whim. It pays deposit interest, makes loans, and arbs a profit like a normal bank, but it cannot lend money into existence like one, it has to lend actual deposited money. Without access to the Fed’s discount window for a liquidity backstop, FTX is fully exposed to liquidity issues as withdrawals exceed deposits. Over the last week, over $1.14 billion has left the FTX exchange, observable in known on-chain wallets:

FTX liquidating on-chain holdings, becoming the FTT buyer of last resort

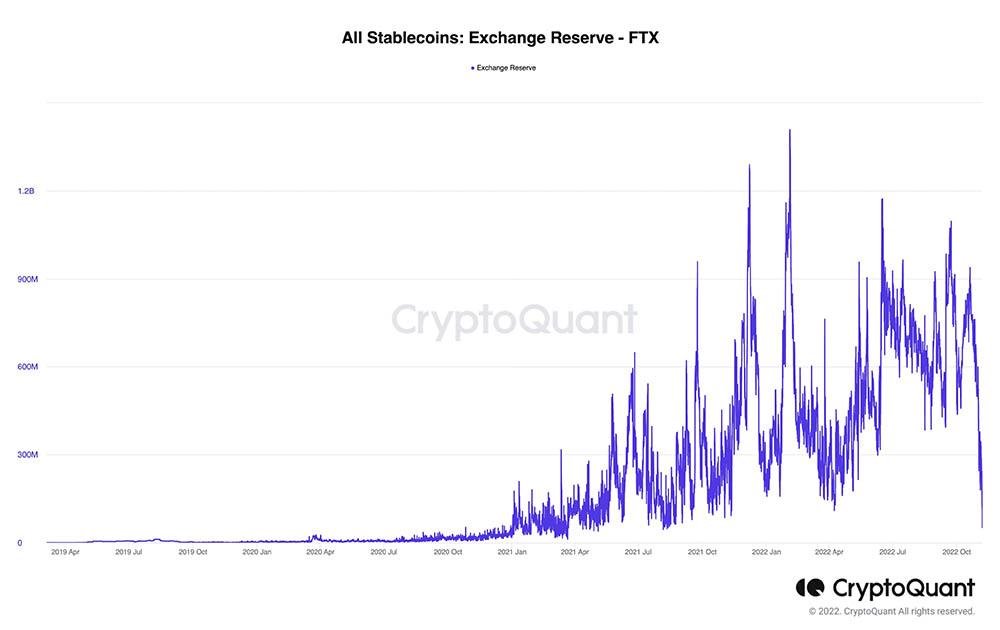

FTX has drained its dollar reserves from over $1 billion to less than $50 million in less than a month:

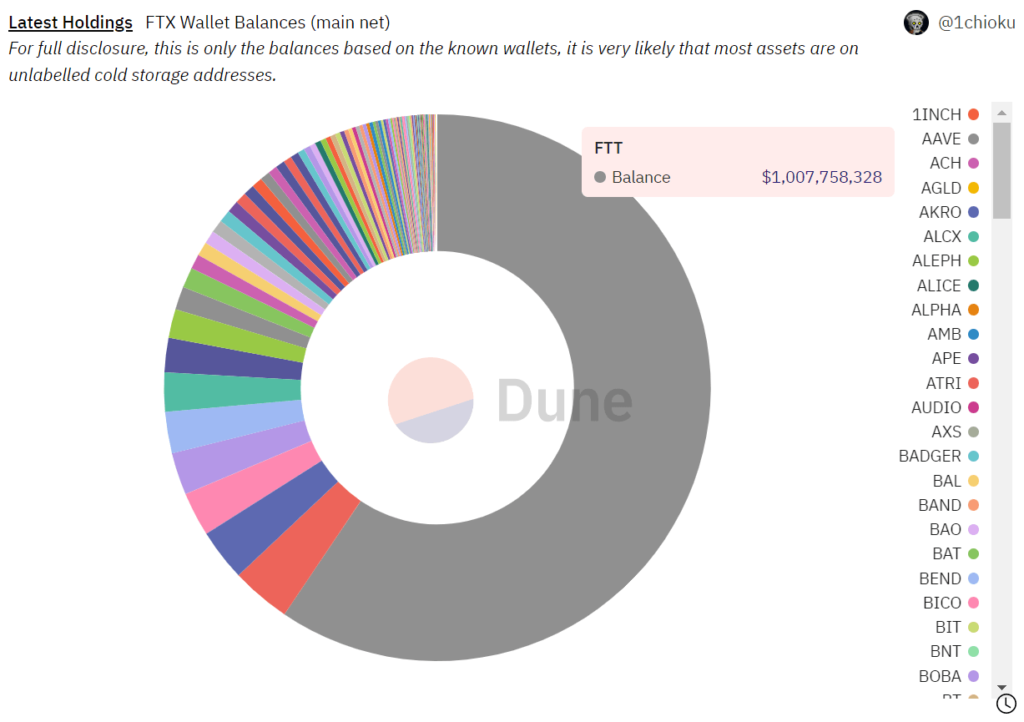

These reserves are being used to purchase all of the FTT that the market and Alameda are selling—on-chain, we observe that FTX now owns over $1 billion in FTT and climbing:

This intervention is not even remotely sustainable. FTX cannot simultaneously be the sole buyer against billions of short and spot sellers and meet customer withdrawals. This is a Bank-of-Japan-level currency intervention. Whereas Japan can defend the yen with an infinite balance sheet, FTX has to defend FTT with a limited amount of dollar-denominated reserves. Without the ability to print the difference, FTX has shored up dollars by rapidly selling every illiquid token that it owns, and it’s all but run out of available liquidity to do so—something has got to give.

FTT’s low liquidity characteristics and desperate last-resort buying by FTX give it the profile of junk-quality collateral. Financial institutions normally have a liquidity backstop from the Fed to buy their collateral ad infinitum, this mechanism does not exist for FTX. As the dam doors opened and the liquidity rushed out, FTX has been forced to stand in front of the dam to stem the flow of water.

Sam Bankman-Fried, the CEO of FTX and founder of Alameda Research, remarked yesterday that there are no liquidity issues across either entity. At the same time, they have halted on-chain withdrawals from their exchange, pointing to serious solvency concerns from this bank run. It seems that FTX/Alameda’s exposure to Celsius during its deleveraging event is finally coming home to roost:

In the words of Sam Bankman-Fried last summer prior to the Celsius bankruptcy:

There are some… exchanges that are already secretly insolvent.

Months later, this quote has adopted an entirely new paradigm; reading more like an ominous warning about FTX than a matter-of-fact statement about other exchanges.

After stepping in as the de facto lender of last resort for overextended crypto institutions this summer, FTX & Alameda have found themselves scrounging for a lifeline. Their own poorly-collateralized lending has left them facing mass liquidation and exodus from their platform—an ironic twist of fate.

In times like these where everyone is dashing to cash, it pays to be fully reserved—pausing withdrawals and pleading with clients suggests that FTX is not. With a run on your fractionally-reserved institution that doesn’t have a Federal Reserve hotline, you’ll need to find an altruistic institution willing to extend a liquidity lifeline.

The Buyer of Last Resort

In their final hours, FTX slammed the circuit breakers by pausing withdrawals while they decided what to do next. With limited options, they reached out to the institution that started this domino effect toward imminent insolvency in the first place, Binance:

Binance has now signed into a non-binding letter of intent to purchase FTX’s distressed assets and ameliorate the liquidity crunch. If made official, Binance will have succeeded with the largest speculative attack on a competitor in the history of this industry.

It stalked its prey, drove its assets to trade to extreme discounts, and then stepped in with the liquidity injection at the point of maximum distress—its prize is the ownership over its closest competitor, strengthening Binance’s domineering industry foothold. CZ recognized FTX’s embattled state, identified its liquidation levels, leveraged his audience and his firm’s assets to place downward pressure on those levels, and then swooped in with an acquisition during FTX’s darkest hour.

A multi-billion dollar speculative attack from a prescient competitor, where every available move leads to one incontrovertible outcome: checkmate.