In a remarkable surge, Bitcoin (BTC) has shattered previous records, surpassing the $72,000 milestone, leaving its previous All-Time High (ATH) of $69,000 in the dust. This new bitcoin ATH comes amid a flurry of market activity and optimism, marking a significant moment for the world’s leading digital asset.

Breaking Records: BTC Surpasses $72,000

On March 11, bitcoin surged to new heights, reaching an all-time high of $72,000. This surge follows a steady increase in bitcoin’s price over recent weeks, with the digital asset rallying over 10% in the past week alone. The surge to $72,000 marks the first time bitcoin has reached such heights in its history, signifying a strong bullish momentum in the market.

New Bitcoin ATH: Contributing Factors

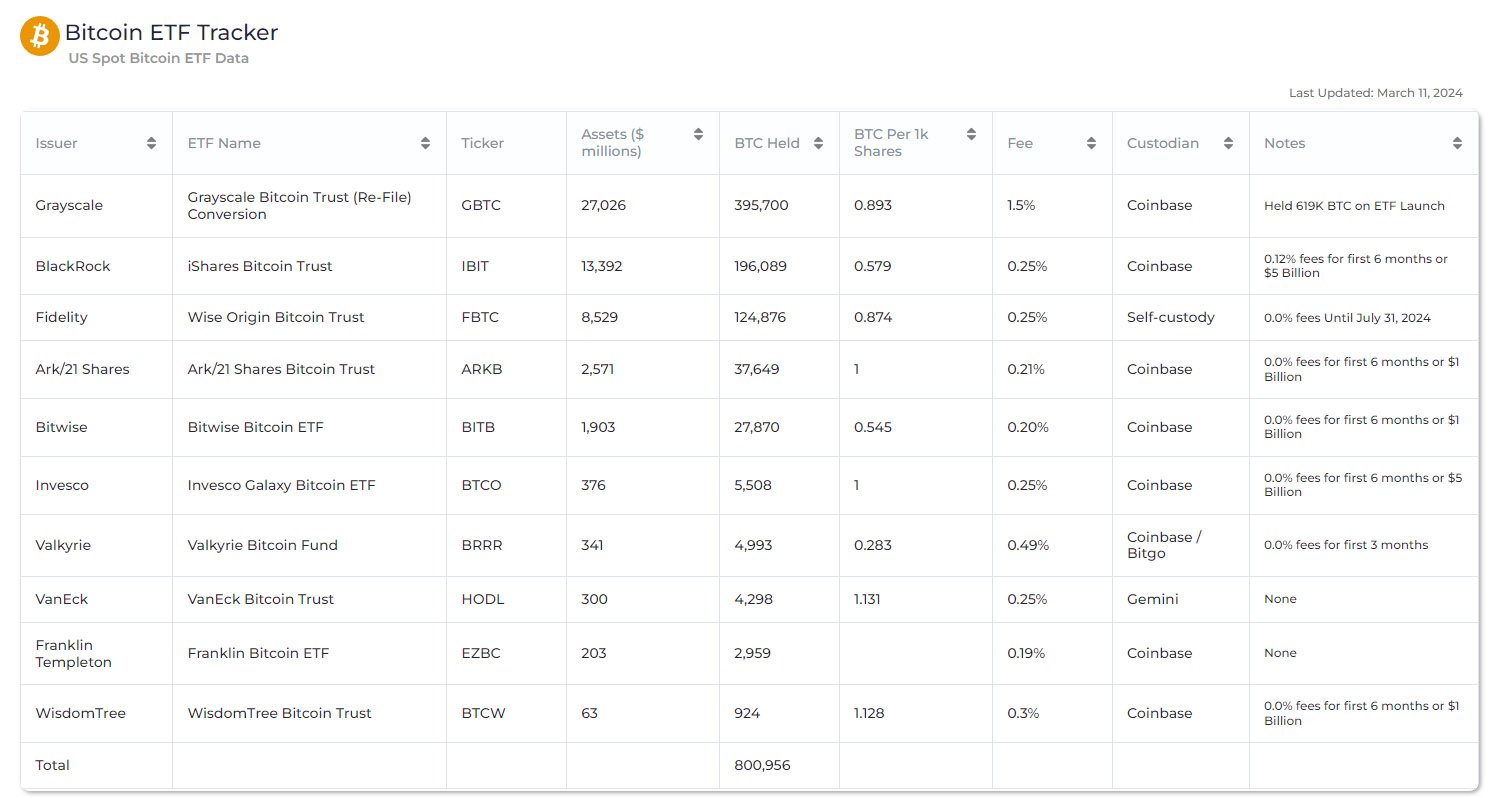

The surge in bitcoin’s price can be attributed to a multitude of factors, including increased institutional interest and market optimism. The recent approval of spot Bitcoin Exchange-Traded Funds (ETFs) in the United States has played a significant role in bolstering investor confidence and driving prices upward. Many believe this approval, has essentially mainstreamed Bitcoin adoption across the traditional financial sector.

The approval of these ETFs has provided both institutional and retail investors with easier access to bitcoin, fueling demand and subsequently driving up its price. This landmark decision has been met with enthusiasm from market participants, including old-fashioned investors.

The Institutional-Investment Factor

Large institutional players such as MicroStrategy and BlackRock have also contributed to bitcoin’s surge. MicroStrategy, a business intelligence firm, has expanded its digital asset portfolio to include a substantial amount of BTC, with its BTC stash now worth about $15 billion. Over the weekend, the firm purchased an additional 12,000 BTC, highlighting its confidence in Bitcoin as a store of value and investment asset.

Similarly, BlackRock, the world’s largest asset manager, has entered the Bitcoin space through its Bitcoin ETF, further solidifying Bitcoin’s acceptance among institutional investors. These investments underscore the growing interest in Bitcoin as a legitimate asset class among top financial institutions.

According to data from Apollo, BlackRock’s Bitcoin ETF (IBIT) now holds around 196,000 BTC, valued at over $14 billion at current market prices.

Market Sentiment and Regulatory Developments

Despite the overwhelmingly bullish sentiment surrounding Bitcoin, some uncertainties persist. Regulatory developments, particularly in regions like the United Kingdom and Japan, have contributed to market fluctuations. The Bank of Japan’s potential decision to raise interest rates has raised concerns among investors, highlighting the impact of regulatory decisions on the Bitcoin market.

However, analysts remain optimistic about Bitcoin’s future, citing strong demand fueled by institutional investments and growing interest in US-listed Bitcoin ETFs. The impending reward halving event, set to occur in April, is also expected to support bitcoin’s upward trajectory, further solidifying its position as a leading digital asset.

Notably, Tom Lee, head of research at Fundstrat, sees the halving event as a strong tailwind for bitcoin, forecasting a remarkable $150,000 price tag for the digital asset in the near future.

Looking Ahead: Continued Momentum

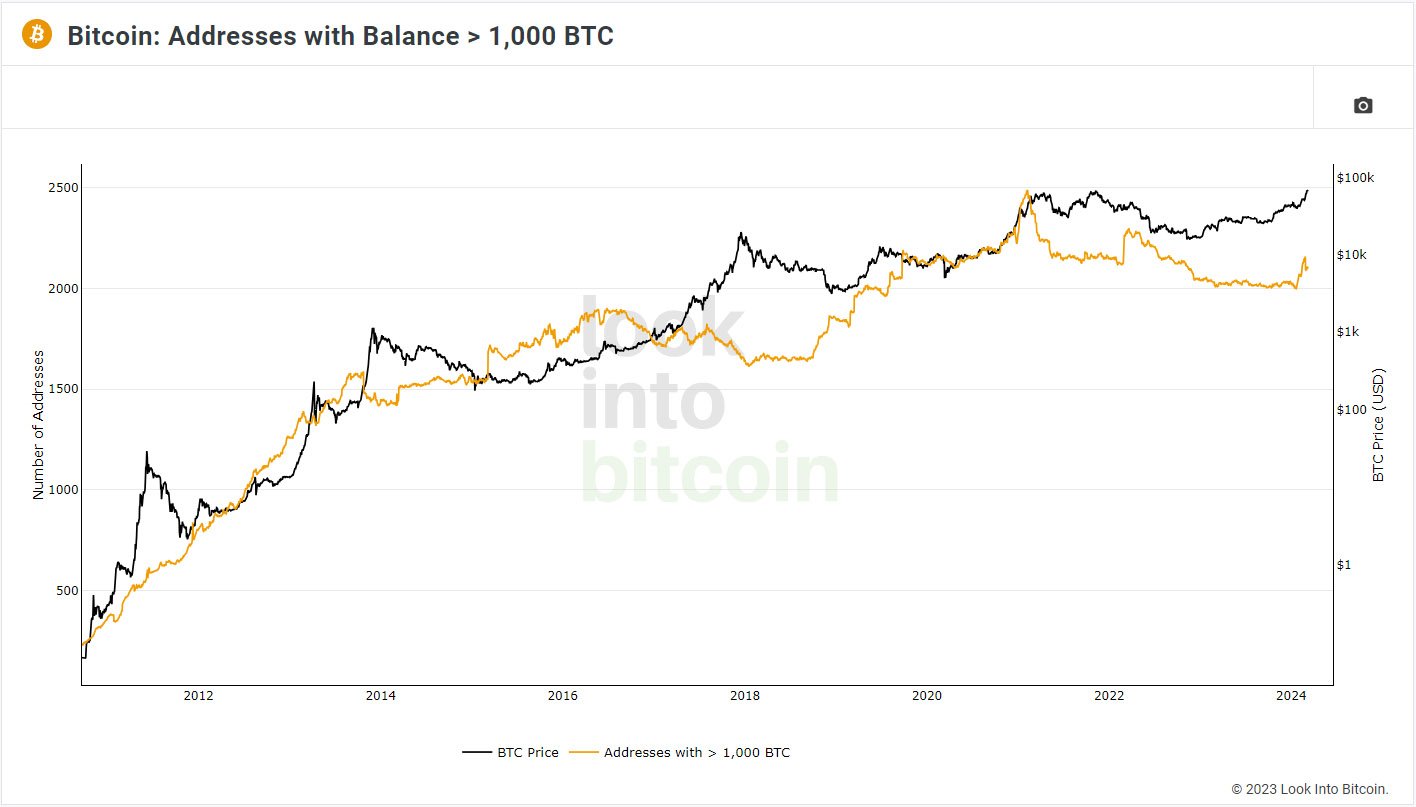

As bitcoin continues to break new records and attract institutional interest, all eyes are on its future performance. With market sentiment remaining largely bullish and institutional investments on the rise, bitcoin’s journey above $72,000 signifies a new chapter in its evolution as a mainstream asset class. Meanwhile, bitcoin whales persist in retaining their holdings, with 2,107 unique addresses possessing a minimum of 1,000 BTC as of March 9. This figure, however, falls short of the peak seen in February 2021.

Bitcoin’s surge to new all-time highs above $72,000 marks a significant milestone in its journey. With increased institutional interest, regulatory developments, and market optimism driving prices upward, bitcoin’s ascent reflects its growing acceptance and influence in the global financial landscape.