As the world of Bitcoin continues to evolve, a significant tightening in bitcoin’s available supply on exchanges has emerged, raising arguments about a potential shortage in the near future. Reports from Bybit, a prominent digital asset exchange, suggest that exchanges could run out of bitcoin within the next nine months if current trends persist.

Bitcoin Exchange Reserves: Supply Squeeze

Bybit’s latest analysis highlights an interesting trend: a rapid depletion of bitcoin reserves on centralized exchanges. This depletion is attributed to increased investor retention and a reduction in mining outputs in anticipation of the upcoming halving event. With only 2 million BTC remaining in exchange reserves, the supply crunch is becoming more apparent.

Alex Greene, who serves as a senior analyst at Blockchain Insights, said:

“The rapid depletion of Bitcoin reserves is preparing the market for a possible liquidity crisis. As reserves dwindle, the market’s ability to absorb large sell orders without impacting the price weakens.”

Interestingly, Bybit’s report highlighted the same effect, noting:

“Bitcoin reserves in all centralized exchanges have been depleting faster. With only 2 million bitcoins left, if we assume a daily inflow of $500 million to spot Bitcoin ETFs, the equivalent of around 7,142 bitcoins will leave exchange reserves daily, suggesting that it will only take nine months to consume all of the remaining reserves.

The upcoming halving will slash mining rewards, reducing new bitcoin supply. Mimicking scarcity like precious metals, it aims to curb inflation and boost bitcoin’s worth. This could decrease miner sales, increasing scarcity and prices.

It seems like miners are adapting to increased expenses and lower rewards. Some might sell some of their reserves before the halving to keep their operations going, which could lead to a temporary increase in supply before a more sustained decrease after the halving.

Institutional Interest Fuels Demand

Institutional interest in Bitcoin has been steadily increasing, particularly with the introduction of spot Bitcoin Exchange-Traded Funds (ETFs) in the United States. Bybit’s findings suggest that institutions view bitcoin as a safe haven asset, leading to a surge in allocations from both Bitcoin-native and traditional finance entities. This influx of institutional investment is not only driving up demand but also reducing the active supply available on exchanges.

Greene expressed:

“The surge in institutional interest has stabilized and drastically increased demand for Bitcoin. This increase is likely to exacerbate the shortage and push prices higher after the halving.”

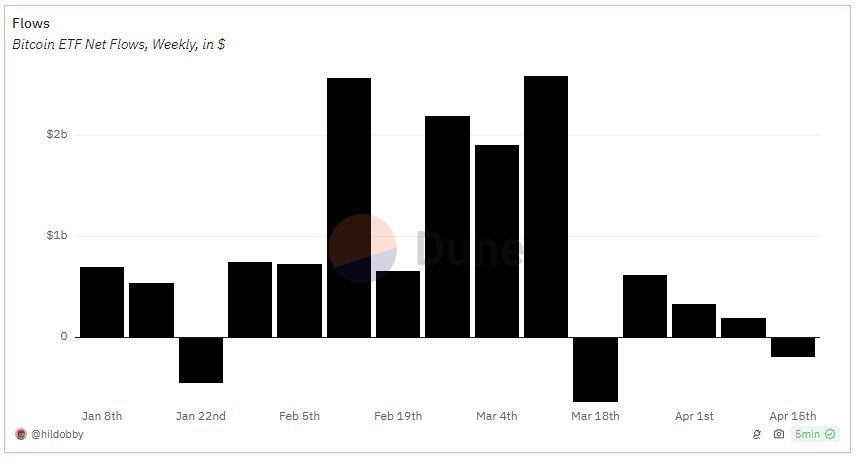

Since March, weekly inflows into spot Bitcoin ETFs have slowed. Last week, these ETFs received around $199 million in net inflows, a decrease from the $2.58 billion seen in the week starting March 11, per Dune Analytics. However, spot Bitcoin ETFs have amassed 841,000 BTC ($52.9 billion) with $12.7 billion in net flows since launch. Bitcoin investor allocation has risen, with institutions allocating 40% and retail investors 24% of total assets to BTC, according to Bybit’s Feb. 24 report. Bybit anticipates more institutions will join the trend via ETFs or proxy stocks such as MicroStrategy.

Bybit mentioned:

“We believe that not all institutions have been able to gain exposure since the approval of Bitcoin Spot ETFs in January 2024, as their investment mandates restrict them from investing in new products that have been in the market for only a few months.”

Halving Event and Scarcity

The upcoming Bitcoin halving event is poised to exacerbate the supply shortage. Scheduled to cut the reward for mining new bitcoin by 50%, the halving will further limit the rate at which new bitcoin are introduced into the market. This reduction in supply, coupled with growing investor inclination to hold onto their assets longer, paints a picture of increasing scarcity.

Ben Joe, co-Founder and CEO of Bybit said:

“Each Bitcoin halving sharpens the narrative of Bitcoin as not just a currency, but a scarce digital asset, akin to digital gold. This upcoming halving in 2024 will thrust Bitcoin into an era of unprecedented scarcity, making it twice as rare as gold.”

Conclusion: Implications for Investors

The tightening of bitcoin supply on exchanges has significant implications for investors and the broader market. With supply dwindling and demand continuing to outpace it, prices are expected to climb further. Bybit’s analysis suggests that bitcoin’s price may continue to rise both before and after the halving event, fueled by the supply squeeze.

Bybit’s report added:

“With this in mind, it’s unsurprising that Bitcoin’s price may continue to climb before the halving, or even afterward, as the supply squeeze propels the price to another new record.”

The forecasted depletion of bitcoin reserves on exchanges within the next nine months presents a critical challenge for the Bitcoin market. As institutional interest grows and the halving event approaches, the scarcity of bitcoin is becoming increasingly evident. Investors should monitor these developments closely as they navigate the dynamic landscape of bitcoin investing.