As true Bitcoiners, we are prone to view other cryptocurrencies with a mix of disdain and indifference; a condescending “well, that’s quite nice what you’re doing there…”, along with with a ruffle of the young scamps’ hair before turning again to The One True Altar of 21 million. This attitude, which has come to be known as “Maxi”, divides the world into Bitcoin and everything else. A valid point of view, if a little exclusionary.

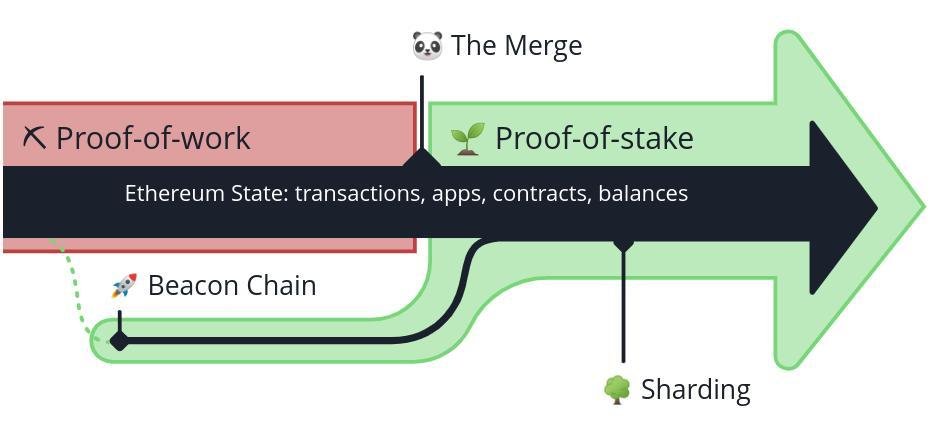

But anyway, on the 15th of September 2022, Ethereum, the second-largest cryptocurrency by market cap, successfully completed The Merge (Eth-maxis will insist on capitalization): a long-anticipated move from a Proof of Work consensus model to Proof of Stake. Doubtlessly the largest crypto event in recent years, what should we Bitcoiners make of this much discussed transition?

Although the Bitcoin network is not affected by The Merge , the narrative of wasteful, evil Proof of Work (PoW) consensus has been cranked up to eleven as a result. Which means that it’s time for Bitcoiners to clear our collective throats, raise our hands, and make a few salient points. Here we go:

Bitcoiners have consistently pointed out that Proof of Stake (PoS) is prone to censorship and centralized relative to the PoW model. But why? A quick study of PoS is instructive here. The original problem that both consensus models seek to solve is the double-spend conundrum: How decentralized network guardians (nodes) can clearly agree on which transactions are true and which are false. PoW elegantly deals with ambiguity by checking which transactions, grouped together in blocks, have the greater amount of computational work in its past blockchain. A double-spend block cannot be validated unless it has at least 51% of the global computational hashpower.

Alternatively, PoS requires validators to be financially invested by staking their Eth. Then checkpoint blocks are created, stating the validity of the network at a point in time. To create such a checkpoint requires a majority vote by stake, thus creating an incentive for validators to present a valid history of transactions. The second part of this is punitive: validators will have their stakes “slashed” if they attempt to create confusion over which blocks (transaction logs) are valid.

This is the first fundamental difference between PoS and PoW. Bitcoin miners who break the rules will just be ignored by the network. They will only have wasted their investment in hardware and electricity. They are also free to build on older blocks, but as these will have less Proof of computational Work in their blockchain history, they will again be ignored. The Bitcoin consensus mechanism is based on positive incentives: it is reward-based as opposed to punishment-based. This positive incentive model creates fundamental differences in the way Bitcoiners approach and think about their network.

For Ethereum validators there is no reward to be gained for their work. In fact, there is no work. As validators, they must sit tight and promise their node is a good boy; if they misbehave, they know they will be punished and be out of pocket. A negative incentive system is fundamentally fear-based–do as I say, or you will be slashed. In order for slashing of staked Ether to work correctly, an up-to-date list of Ethereum validators needs to be maintained. This list will also be needed for voting (if you recall, the majority vote is required to create checkpoint blocks). So how does one become a validator in Ethereum-land? This is the basis of the next fundamental difference (flaw?) between these two consensus models.

Ethereum is a permissioned system. Becoming a validator requires a staking of 32 Eth (at the time of writing, that’s about USD 50,000). There are also limitations on how many validators can leave in a particular period of time, along with significant barriers to entry and exit. Since all validators will also share all transaction revenues, there is a natural flow towards a small number of very large validators, as opposed to many small validators. In other words, PoS is not only more permissioned (more difficult to enter and exit), but is also more centralized than PoW.

So what’s wrong with being permissioned and centralized? Well, nothing really… If you’re Visa. Or Facebook. Or any number of centralized collectives that can create governing principles to accrue wealth and power. However, what if we weren’t talking about a Web 2.0 corporation or a protocol upon which apps can be built? What if we were talking about money? Money in its purest form is independent, incorruptible, and globally accessible. Then the attributes bestowed by a chosen consensus model become increasingly important. It is less about which is better, PoS or PoW–the issue is are we comparing like with like. And if we are discussing necessary attributes for sound money, it becomes hard to argue against PoW.

So amid the excitement, points-scoring, and energy-FUD around a successful merge, we Bitcoiners can carry on saying, with our mix of disdain and indifference, “yes, looks great… For what it is… But here’s what it isn’t: sound money.”