Amid the recent Bitcoin market’s bullish trend, the top question on everyone’s mind seems to be “When is BlackRock Bitcoin ETF approval date?” The latest developments suggest that the firm is making waves in the financial market, and the launch may be drawing near.

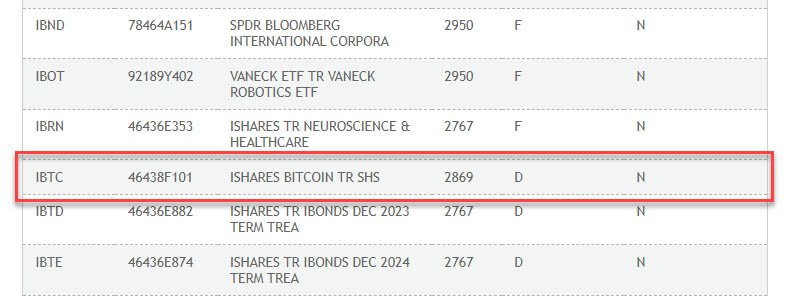

A significant clue comes as the ticker from the iShares Bitcoin Trust, IBTC, was recently listed by the Depository Trust & Clearing Corporation (DTCC). Notably, DTCC is a colossal infrastructure player in U.S. financial markets, handling a staggering $2.3 quadrillion in stock sales annually.

Adding to the anticipation, BlackRock, which manages $9.5 trillion in assets, recently filed an amendment application that disclosed a seed fund investor for its proposed Bitcoin ETF. A seed fund investor is instrumental in kickstarting an ETF’s journey, providing the initial funding required to launch and commence trading on an exchange.

The filing of an amendment to the United States Securities and Exchange Commission (SEC) by BlackRock is a customary step in the ETF approval process. Applications undergo multiple drafts, often amended and refiled following feedback from the commission, before final approval or rejection.

While the exact date remains concealed within the amendment, these steps signal the world’s largest asset manager’s active involvement in the Bitcoin ETF space and suggest that they are advancing their efforts toward gaining regulatory approval.

It is important to note that the SEC has approved several Bitcoin Futures ETFs in the past. However, it has been cautious in granting approval for Spot Bitcoin ETFs, citing concerns about market manipulation and investor protection.

When is BlackRock Bitcoin ETF Approval Date? — Analysts Predict

BlackRock’s iShares Bitcoin Trust is one of 12 Spot bitcoin ETFs in the SEC’s pending approval queue. Other asset management firms like Grayscale Investments, Fidelity, VanEck, and WisdomTree have also submitted applications. The SEC recently extended the review process by at least a month, delaying all pending fund applications.

Notably, the securities regulator faces a final deadline to respond to 21Shares and ARK Invest’s Bitcoin ETF application by January 10 and that of BlackRock by March 15 next year. Analysts are closely observing these developments and speculating on potential timelines. Senior Bloomberg Intelligence analyst James Seyffart acknowledged the significance of the update. He stated:

“We believe there’s a 90% chance of approval by Ark’s January 10 deadline.”

Other industry experts, such as Scott Johnsson of Van Buren Capital, have hinted that BlackRock may be preparing to infuse cash into the ETF sooner rather than later.

BlackRock initially applied for a Bitcoin ETF in June. CEO Larry Fink has voiced his perspective, referring to Bitcoin as an “international asset” and highlighting the digital transformation of gold through Bitcoin.

Also, Fidelity has recently shared a similar comment on the matter, with its the Director of Global Macro Jurrien Timmer calling Bitcoin “exponential gold.”

As the digital asset and financial communities eagerly await further updates, the trajectory of BlackRock’s Bitcoin ETF approval remains a topic of great interest and anticipation.