The following article represents the personal opinion of the author and is not financial or investment advice. The original report was done by Demelza Hays at the Crypto Research Report

- Dollar-Cost Average (DCA) is the most recommended investment strategy when it comes to an easy way to build up your bitcoin holding.

- However, what is mostly unknown is the fact that Value Averaging is an even smarter approach as data suggests.

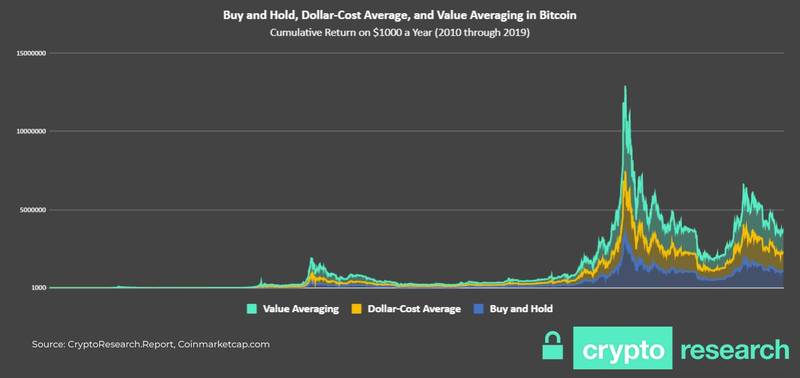

- Bitcoin researchers at the Crypto Research Report have discovered that Value Averaging (VA) beat DCA for the past 10 years for Bitcoin investors.

Figure 1: Value Averaging Beat Dollar-Cost Averaging for Bitcoin (2010-2019)

Source: Coinmarketcap.com, CryptoResearch.Report

Dollar Cost Average or Value Average which one is smarter?

When you start looking into Bitcoin as a long-term savings strategy, you have to decide if you want to begin with a one-off purchase or rather spread out your investment over a period of time, normally one year.

Usually DCA is the preferred choice as it gives the opportunity to purchase bitcoin at lower prices. Since you would split your investment over a period of time there is a chance bitcoin decreases slightly allowing you to stack more Satoshis for the same money.

Dollar-Cost Averaging does a great job to improve your accumulation strategy when you have sufficient cashflow and a long enough time horizon. However, Value Averaging can get you more bang for the buck as the report reveals.

But what is Dollar cost averaging and Value averaging? Let’s take a look at the dictionary:

Dollar cost averaging (DCA) is an investment strategy that is used to reduce the impact of volatility on large purchases of assets. Dollar cost averaging is also called the constant dollar plan (in the US), pound-cost averaging (in the UK), and, irrespective of currency, unit cost averaging, incremental trading, or the cost average effect.

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested in an effort to reduce the impact of volatility on the overall purchase.

The purchases occur regardless of the asset’s price and at regular intervals. In effect, this strategy removes much of the detailed work of attempting to time the market in order to make purchases of equities at the best prices.

How Does Value Averaging Work?

Now that we learned how Dollar cost averaging works, we can move forward and learn about value averaging.

For the ease of calculation let’s assume you would like to invest $1,000 in Bitcoin. Using dollar-cost-average, you would invest $1,000/12 = $83.33 per month.

Now with the value averaging method you will set the samt $83.33 as your monthly target. But the difference is that depending on the bitcoin price you adjust the amount.

That means some months you invest more (when the price of Bitcoin is going down) and other months you invest less (when the price of Bitcoin is going up).

This is how VA looked in 2019:

- On January 1, 2019, you would have invested $83.33 at $3,843.52 per Bitcoin and received 0.021681514 Bitcoin.

- On February 1, 2019, you should normally have to invest $83.33, so that means that your total investment at this point should be $83.33 (from January) + $83.33 (from February) equal to $166.66.

- Since the price on February 1, 2019 was $3,487.95 per Bitcoin, your original investment from January is now worth $75.62 (0.021681514 times $3,487.95).

- Since the price of Bitcoin went down, you need to invest more this month than the normal $83.33 goal. Specifically, you need to invest $166.66 (how much you should have in your portfolio by now) minus $75.62 (the value of your portfolio).

- This is equal to $91.04. So you should have invested $91.04 at the beginning of February 2019 instead of $83.33.

- Repeat this calculation every month to determine how much you need to invest.

As you can see in this example, you have invested more because the price of Bitcoin decreased, and the opposite would be true if the price had risen.

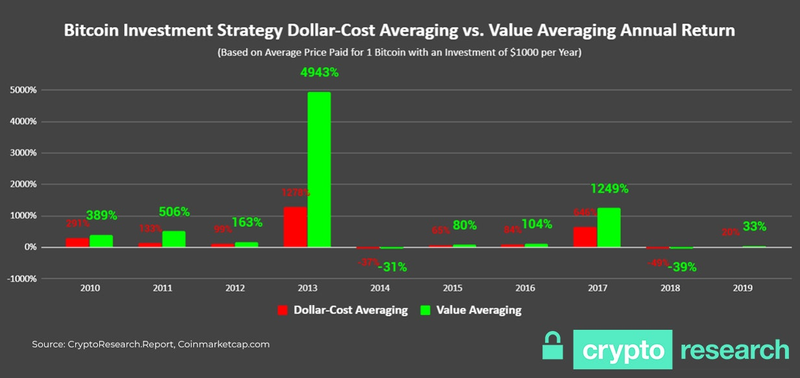

Figure 2: Value Averaging Increased Return Every Year for an Investor that Invested $1000 a Year

Source: Coinmarketcap.com, CryptoResearch.Report

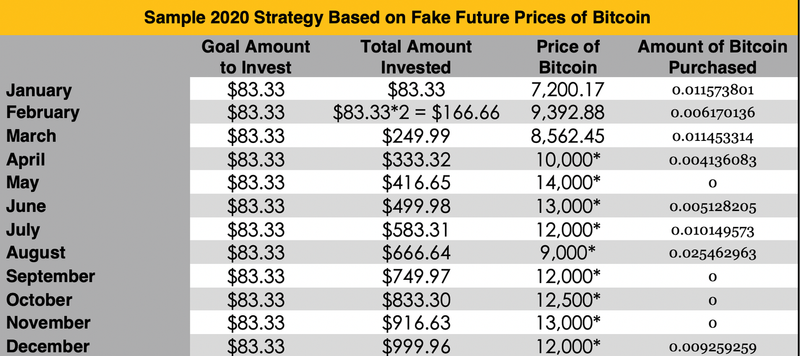

So what would a sample strategy look like for 2020? If the price of Bitcoin goes down, the Value Averaging strategy suggests to buy more.

Figure 3: Sample 2020 Value Averaging with Fake Bitcoin Prices *These values are fake values. Source: Coinmarketcap.com, CryptoResearch.Report

As you can see, some months you wouldn’t purchase any Bitcoin at all according to the strategy. The reason is that if the portfolio value grows enough in value, the target amount is reached without additional invest.

In this case, following the traditional dollar-cost-average strategy would mean a purchase of the normal target amount. With the value average strategy, you would save the money to invest a month later when the bitcoin price is potentially lower.

This of course implies the risk of missing out to “stack sats” in case a bull rally continues for a longer time period, say a couple of months. Considering historic movements (mind that past performance is no indication of future performance) the bitcoin price always falls after a spike.

Therefore value averaging would suggest to build up a significant dollar balance during a bull rally which is ready to be pushed in when the bitcoin price crashes.

Even the most experienced bitcoin veterans can face themselves being completely out of ‘dry powder’. If you are all-in you have nothing left to invest. If the bitcoin price tanks 20% you regret standing there on the sidelines with empty pockets while those who still got ‘dry powder’ are happy to stack cheaper sats.

On the other hand, if bitcoin happens to enter its final cycle, the Dollar Cost Averaging strategy could be seen as lower-risk compared to Value Averaging. With Dollar Cost Averaging, you at least purchase a little amount every month, which means more Satoshis in the end.

Based on the research, Value Averaging beat Dollar Cost Averaging every year of Bitcoin’s existence. As bitcoin has not crossed the $100.000 or $1.000.000 mark, its final cycle towards hyperbitcoinization is yet to come giving great opportunity to early investors.

Jesse Powell, CEO of the bitcoin exchange Kraken argues that Bitcoin will continue to stay volatility:

“I don’t think that we will see a lower volatility in bitcoin for a long time, maybe not until bitcoin replaces all of the world’s currencies… I think between $20.000 and $1.000.000 a Bitcoin you are going to have a lot of volatility.”

Lump Sum, DCA or VA – Do you still have dry powder?

Even the most experienced bitcoin veterans can face themselves being completely out of ‘dry powder’. If you are all-in you have nothing left to invest. If the bitcoin price tanks 30% you regret standing there on the sidelines with empty pockets while those who still got ‘dry powder’ are happy to stack cheaper Sats.

Only if bitcoin happens to enter its final cycle, the Dollar Cost Averaging strategy could be seen as lower-risk compared to Value Averaging. With Dollar Cost Averaging, you at least purchase a little amount every month, which means more Satoshis in case a final cycle (ultimate pump) appears.

Based on the research, Value Averaging beat Dollar Cost Averaging every year of Bitcoin’s existence. As bitcoin has not crossed the $100.000 or $1.000.000 mark, its final cycle towards hyperbitcoinization is yet to come giving great opportunity to early investors.

On its march towards becoming a global reserve money, bitcoin is volatile and the price is moving up and down. With the right strategy, you will be able to maximize your profits and minimize losses.

The majority of market participants are driven by short-term decisions. When prices are going down in the bitcoin market, some sellers panic sell. On the other hand, those investors who are convinced of the long-term potential of bitcoin are happy to buy the dip.

Value Average investing helps investors to buy more when price of Bitcoin is declining during a price correction. And similarly VA tames your investment hunger when the price is surging up too steep to be true.

Many investment advisors today are in favor of DCA, because DCA smoothens the portfolio’s volatility and maximum drawdown. DCA especially makes sense during a bear market, when the price is going lower and testing support levels and ‘lower lows’ after a fresh all-time-high (ATH).

Each time bitcoin hits a new ATH, some people are buying in at the top. There is nothing wrong with that as people who bought in at $20.000 in 2017 still are proud owners of bitcoin. And in fact are in the plus massively at the time of writing.

But imagine investors that went all-in during the December 2017 rally. These investors saw their portfolio value going down the drain in the months after. If they had used the DCA or VA method they would have much more bitcoin today.

Summary: DCA is easier, VA is more profitable

With the Value Averaging Strategy, investors can see better returns than with DCA. But it adds risks and also requires more math and time investment. DCA is very simple and straight forward and investors can lean back and relax.

One of the reasons to use DCA is to stay away from the markets. If you get emotional and stressed out when you see the bitcoin price surge or crash, a DCA plan keeps you from away from bad mistakes. Instead of following the market you are spending time with important things like your family or your hobbies.

If you want to get serious with your bitcoin accumulation strategy and also enjoy financial markets and trading, VA gets you more bang for the buck according to the comparison. But you also need to spend more time for research and execution.

It is also possible to combine both strategies. And even add a third strategy of lump sum investments: Assuming your income is based on a regular and stable monthly cashflow, you could split up that amount you want to invest into one part DCA and one part VA. Both strategies can complement and de-risk each other. If you are afraid to have too little dry powder when the bitcoin price declines, your AV strategy covers your ass. And if you think bitcoin is close to it’s final cycle because of an unforseen event, you are sure to not miss picking all the sats on the way up thanks to you DCA setup.

And if you suddenly receive a bonus payment from your boss or a client, you can just convert it into bitcoin instantly with a one off purchase.

Find out which strategy works best for you. We hope this article was of help and we appreciate your feedback and ideas.

Regardless whether you prefer DCA, VA or active bitcoin trading, you always want to educate yourself and gain more knowledge about bitcoin. In the video below Pierre Rochard, Bitcoin Strategist at Kraken explains why Bitcoin is savings technology. Enjoy.