Grayscale Investments, one of the leading asset management firms in the digital asset space, achieved its first day of net positive inflows for its Bitcoin Trust (GBTC) Exchange-Traded Fund (ETF) on May 3.

This marks a significant turnaround for Grayscale Bitcoin ETF, after nearly four months of continuous outflows since its conversion to a spot Bitcoin ETF in January.

Grayscale Bitcoin ETF Finally Records Inflow

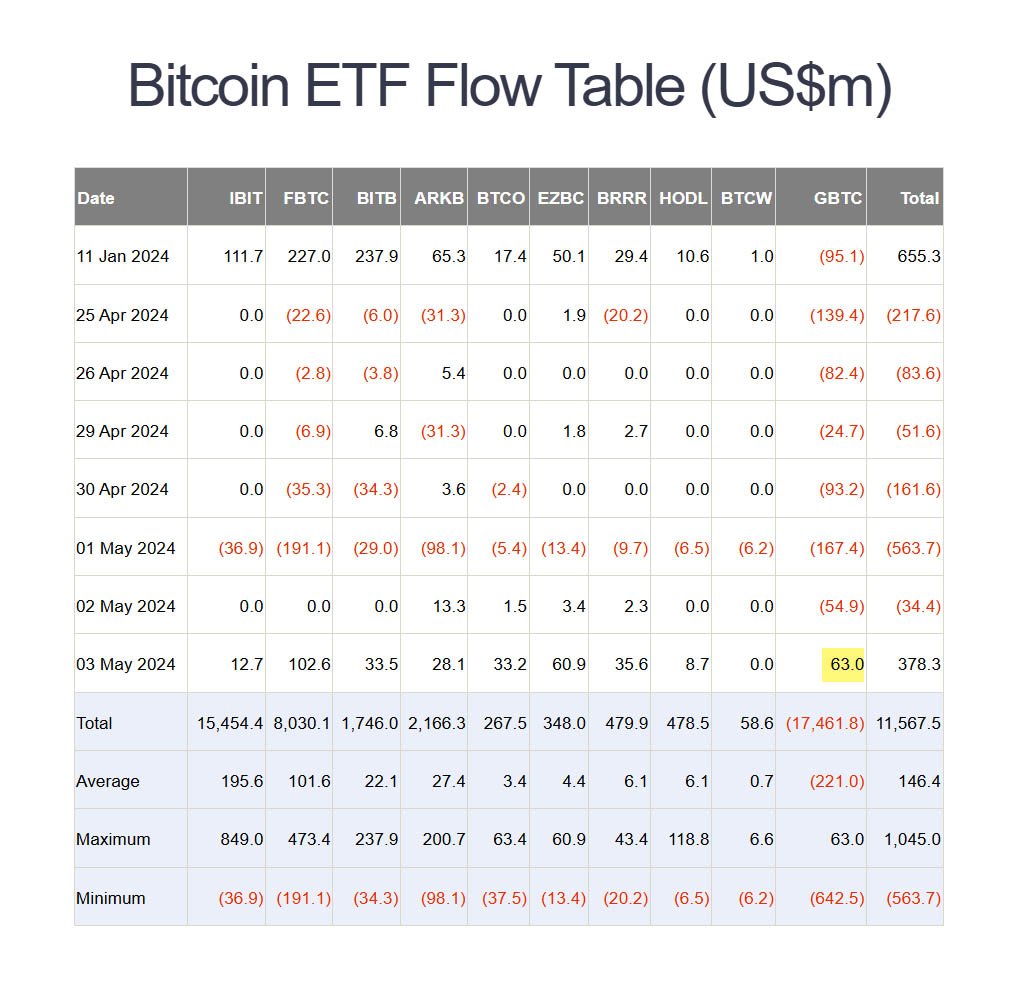

According to preliminary data from Farside, Grayscale’s Bitcoin Trust (GBTC) recorded $63 million of net inflows on May 3, following approximately $17.5 billion of outflows since 11 spot Bitcoin ETFs launched on January 11.

Among the other funds reported, Franklin Templeton’s Bitcoin ETF saw its highest-ever inflows of $60.9 million. Fidelity’s Wise Origin Bitcoin Fund led the day’s inflows with $102.6 million, followed by the Bitwise Bitcoin Fund with $33.5 million and the Invesco Galaxy Bitcoin ETF with $33.2 million.

The digital asset community has been closely observing these developments, speculating on how they might impact the price of bitcoin.

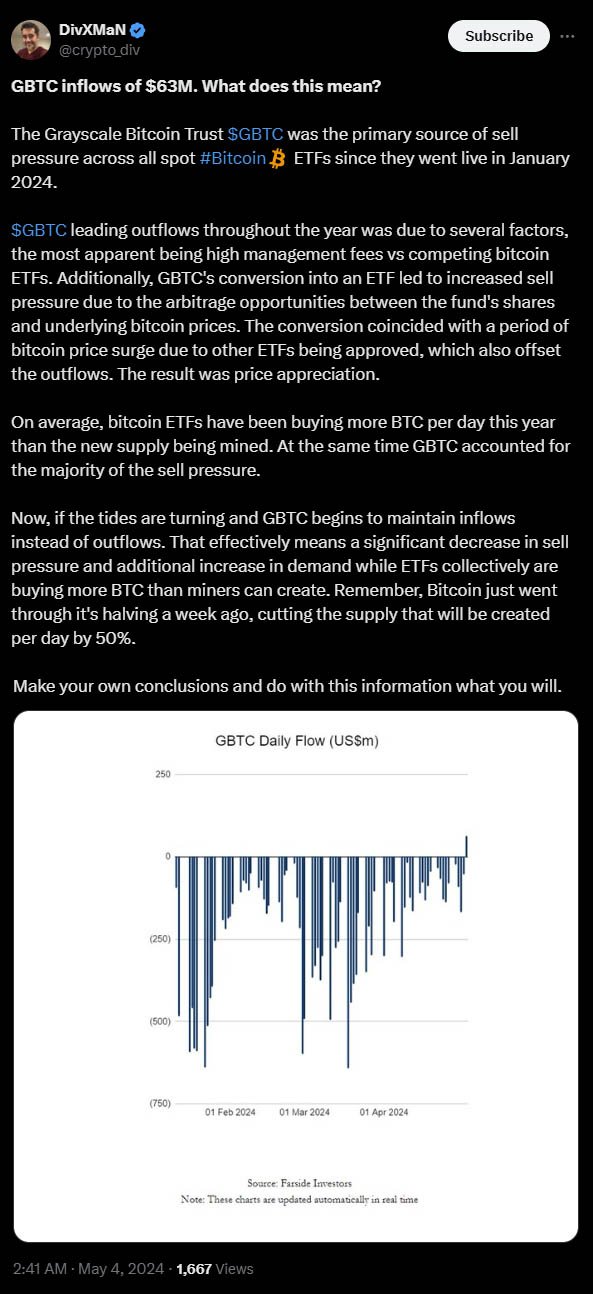

Pseudonymous Bitcoin investor DivXman suggested that the GBTC was the “primary source” of sell pressure across all spot Bitcoin ETFs, but noted that “the tides could be turning,” while adding:

“Now, if the tides are turning and GBTC begins to maintain inflows instead of outflows. That effectively means a significant decrease in sell pressure and additional increase in demand while ETFs collectively are buying more BTC than miners can create.

Remember, Bitcoin just went through it’s halving a week ago, cutting the supply that will be created per day by 50%.”

New ATH on the Horizon For Bitcoin

Digital asset trader Jelle predicted that Bitcoin’s new all-time high is on the horizon, citing the $60 million worth of inflows for Grayscale’s ETF. They stated that the current period of market volatility, known as the halving chop, will come to an end, with six-figure bitcoin prices following shortly after.

Bloomberg ETF analyst Eric Balchunas expressed his surprise at the GBTC inflows, emphasizing that the spot Bitcoin ETF finally ended its 80-day outflow streak.

Bitcoin also reacted positively to the event. At the time of publication, bitcoin’s price had increased by 4.5% over the course of 24 hours to $63,829.

As per an earlier report, Max Keiser, the advisor to El Salvador President Nayib Bukele, predicted a Bitcoin “god candle” that could push the price up by $100,000.

On the other hand, the chief executive of Blockstream, Adam Back, stated that BTC could go to $100,000 before the 2024 halving, which did not come to fruition.

Debut of 11 Spot Bitcoin ETFs

Several factors contributed to Grayscale’s ongoing outflows since the launch of 11 spot Bitcoin ETFs. One reason is GBTC’s comparatively high fees, which stand at 1.5% compared to below 1% for other available ETFs.

The cheapest among them is currently Franklin Templeton, with a 0.19% fee. Additionally, bankrupt virtual asset firms FTX and Genesis have been selling off large amounts of GBTC shares to repay creditors.

On April 6, Genesis liquidated approximately 36 million GBTC shares for $2.1 billion to purchase 32,041 bitcoin. With the recent positive inflows, the digital asset market is closely watching how this trend evolves in the coming days and its potential impact on bitcoin’s price trajectory.