Bitcoin, the leading digital asset, is poised for a significant price movement, according to veteran traders and market analysts. Insights from experts like Peter Brandt suggest that Bitcoin’s market behavior follows distinct patterns, indicating a potential bullish trajectory.

Peter Brandt Analyzing Bitcoin’s Behavior

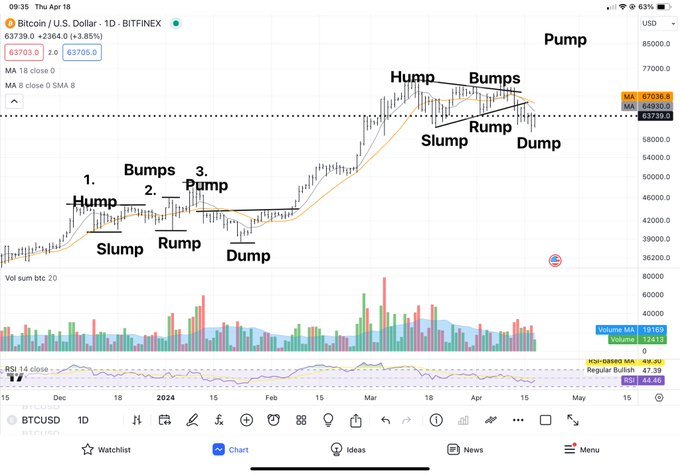

Peter Brandt, an experienced trader, identifies three phases in Bitcoin’s market behavior: Hump-Slump, Bump-Rump, and Pump-Dump. Brandt suggests that Bitcoin is currently in the third phase, with the “pump” part yet to materialize. Bitcoin’s price briefly fell to $59K amid Israel-Iran tensions but quickly rebounded to $65K, signaling resilience. This uptick also buoyed other digital assets, hinting at a potential rally behind Bitcoin.

Brandt seems to be targeting the $85,000 mark for the completion of the 3rd phase.

Other analysts echo this sentiment, as many expect the digital asset to have tested its bottom at $60,000. Tuur Demeester, another analyst, stated that he believes bitcoin has had the correction it needed, as it fell 20% from its all-time high.

Bitcoin: I think its likely that $60k ends up being the bottom of this correction. 20% drawdown from the high. pic.twitter.com/UueSUnfImy

— Tuur Demeester (@TuurDemeester) April 18, 2024

He also pointed out Morgan Stanley’s new report on Bitcoin mining, highlighting electricity’s significance to that of petroleum and Bitcoin’s similarity to the combustion engine. He emphasized that, like petroleum before engines, much of electricity’s potential was untapped until Bitcoin emerged. Demeester referred to the Morgan Stanley report, highlighting Bitcoin miners as the quickest means to establish data centers due to their access to substantial power. The report suggests Bitcoin miners are undervalued based on the intrinsic value of their secured power.

Electricity is the new petroleum—bitcoin the new combustion engine.

— Tuur Demeester (@TuurDemeester) April 20, 2024

Before the engine, most of petroleum’s potential was locked away. Similarly before bitcoin, most potentially electrifiable energy was impossible to economize. That’s all changing now.⚡️ https://t.co/IHxzF885UI

The Impact of Bitcoin Halving

The 4th Bitcoin halving event, designed to reduce mining rewards and slow down the creation rate of new bitcoin, is expected to influence bitcoin’s price dynamics. Historically, halving events have driven up demand for bitcoin, potentially leading to price surges. Brandt predicts BTC will surge due to the Bitcoin halving, reinforcing his forecast of significant price movement.

Despite the anticipation surrounding the halving event, analysts from institutions like JPMorgan Chase and Deutsche Bank suggest that the event’s impact may already be priced into bitcoin’s valuation. However, Peter Brandt believes otherwise. The outcome of Brandt’s clue is eagerly awaited, but uncertainty looms over when and how significant the expected shift will be.

Accumulation and Resilience

Recent data reveals that significant bitcoin holders have taken advantage of price dips to accumulate more bitcoin. This accumulation activity hints at underlying confidence in Bitcoin’s long-term prospects. Despite market turbulence, Bitcoin has exhibited resilience, with prices rebounding after intraday lows.

Conclusion

In conclusion, Bitcoin’s market is brimming with anticipation as experts like Peter Brandt predict a major price movement ahead. The recently executed halving event, coupled with market dynamics and accumulation activity, adds to the intrigue surrounding bitcoin’s future trajectory. While analysts debate the impact of the halving, traders and investors closely monitor the market for further indicators of bitcoin’s next move.

By analyzing patterns, considering expert insights, and observing market behavior, stakeholders aim to navigate the Bitcoin landscape with anticipation and vigilance.