Bitcoin (BTC) kicked off May with a notable sell-off, dropping below the crucial support level of $60,000 and hitting as low as around $56,000. This decline has left many investors on edge, with uncertainties looming over the direction of the digital asset market.

Plan B Bitcoin Prediction: Average Price of $500K

Amid these market movements, renowned analyst Plan B shared his insights into bitcoin’s price trajectory for the rest of the month in a YouTube video posted on May 1.

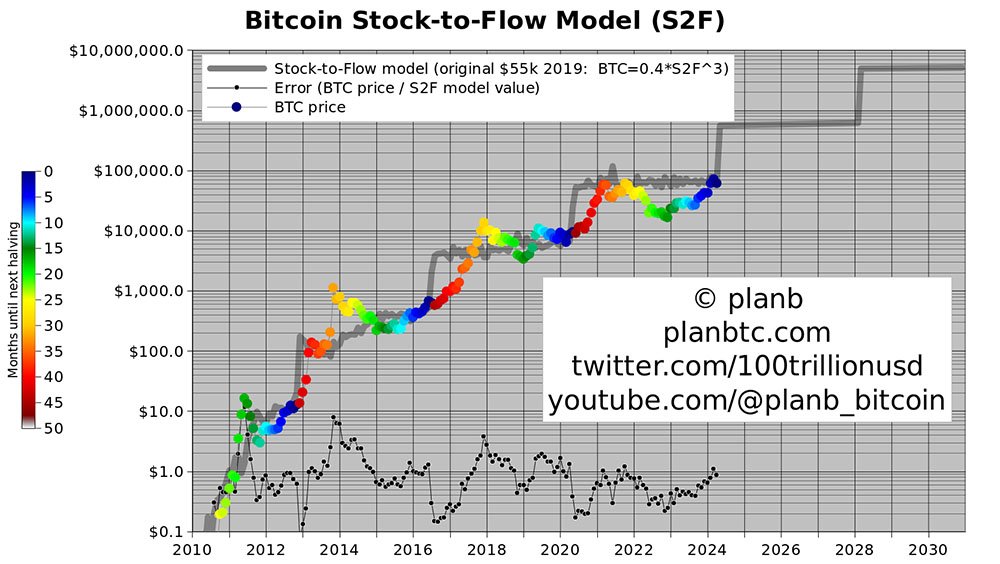

He emphasized the significance of Bitcoin’s stock-to-flow model, noting that despite the drop from March highs, bitcoin maintained a substantial year-to-date increase of 36%.

Plan B highlighted the historical accuracy of the stock-to-flow model, particularly in predicting bitcoin’s price around halving events.

He pointed out that the average bitcoin price of 2020-2024 halving cycle is around $34,000, which closely aligns with the $55,000 predicted by the original 2019 stock-to-flow model.

As May is the start of the new countdown to the next halving, Plan B notes the model’s forecast of a significant increase in bitcoin’s price over the coming years, projecting an average target price of around $500,000 between 2024 and 2028.

Short-Term Forecast

In the short-term, the expert is confident that bitcoin will reach $100,000 in the second half of 2024, driven by the recovery of mining revenue after the halving event. Based on historical trends, miner revenue typically has recovered within four to eight months post-halving. He stated:

“Usually, in the last three halvings, revenue did recover within four to eight months so that’s well within this year 2024 and the only way for mining revenue to recover is that price doubles so estimating from the current price of 60k we should be well above 100k.”

Moreover, Plan B anticipates that the market peak will happen in 2025, potentially pushing bitcoin’s price beyond $200,000. Bitcoin is currently trading at $58,200, down by 8.5% in the last seven days.

Peter Schiff’s Analysis

Notably, not all analysts share Plan B’s optimism. Peter Schiff, a well-known critic of Bitcoin and advocate for Gold, has expressed concerns about BTC’s valuation. Schiff predicts potential downside pressure in the near future, setting his target at the $54,000 price level.

This prediction from Schiff comes amid heightened volatility and uncertainty in the digital asset market, as Bitcoin has been on a downward trajectory in recent days.

According to his recent post on X, the Bitcoin critic has identified a negative pattern on the charts, suggesting a shift in market sentiment. He highlights a short-term head-and-shoulders pattern, explaining:

“Bitcoin is forming a short-term, head-and-shoulders top, with the head just under $60K, the shoulders around $58.5K and the neckline just below $57K. The downside objective is $54K.”

Schiff’s warnings about the short-term outlook for bitcoin have drawn considerable attention from the bitcoin community, given his history of skepticism towards BTC.

While Plan B remains optimistic about Bitcoin’s long-term prospects, Schiff’s cautionary stance underscores the divergent opinions within the community.