This article was originally published by Joe Consorti, Mahek Acharya, and Nik Bhatia on Substack.com

Benjamin Franklin famously truncated this idiom into two certainties: death and taxes. 52 years to the day after detaching money from physical reality when we left the gold standard, it’s time to add another certainty: money devaluation.

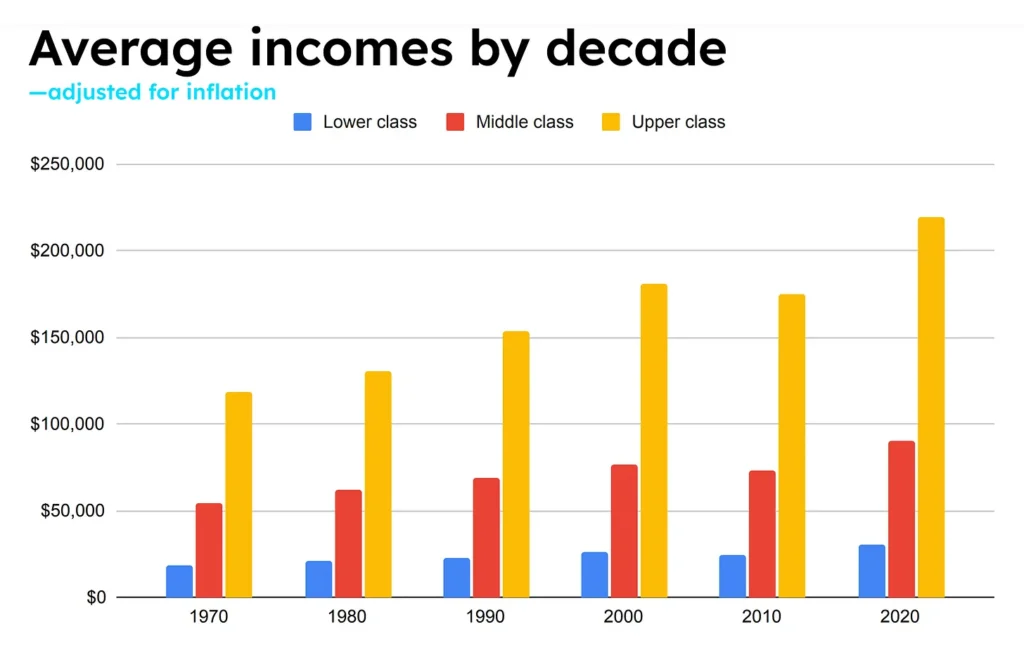

The Fed’s monetary policy tools of interest rate manipulation and large-scale asset purchases, paired with the US Treasury’s perpetual fiscal deficit, have had the impact of making assets more expensive, making the rich who own them richer and the poor exactly in the same place they were half a century ago.

To understand how immobilized lower- and middle-class America has been for 50 years, here are average incomes in the US by decade, adjusted for inflation. Incomes for the lower class have risen $11,000 over the last 50 years to $30,000, a 36% gain in wages—compared to the 40% increase in upper-class income from $120,000 to $219,000. At its current level, the average lower-class income in the United States is below the poverty line for a family of four:

Why are Americans slipping into poverty?

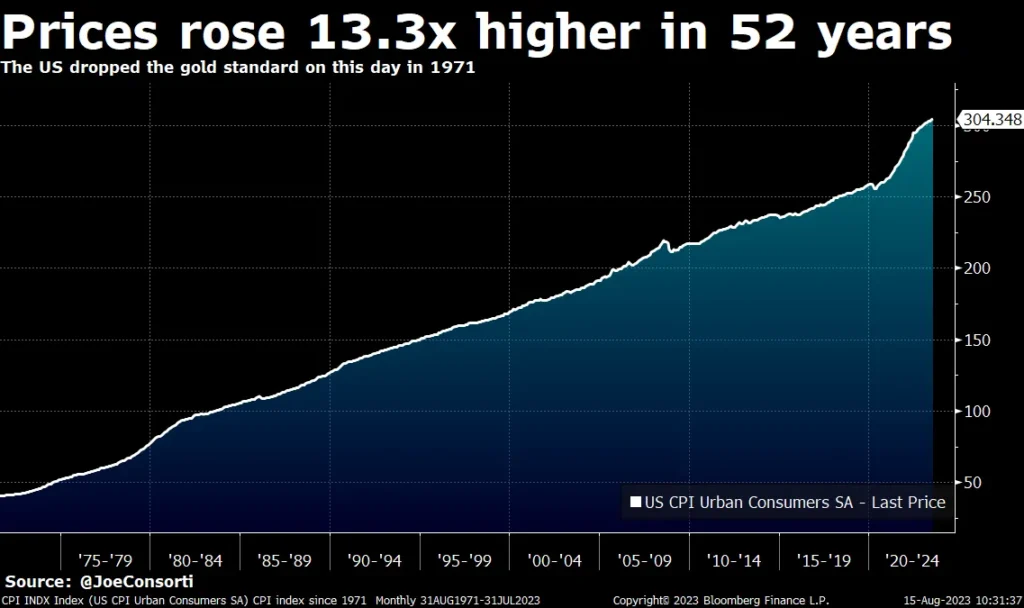

In the US, prices are 13.3x higher than they were 52 years ago. So despite living in an era of technological innovation, in which our lives grow evermore convenient thanks to the tools at our disposal, life is becoming infinitely more expensive.

Related reading : The “New Normal” Is Poverty, And Here’s Why

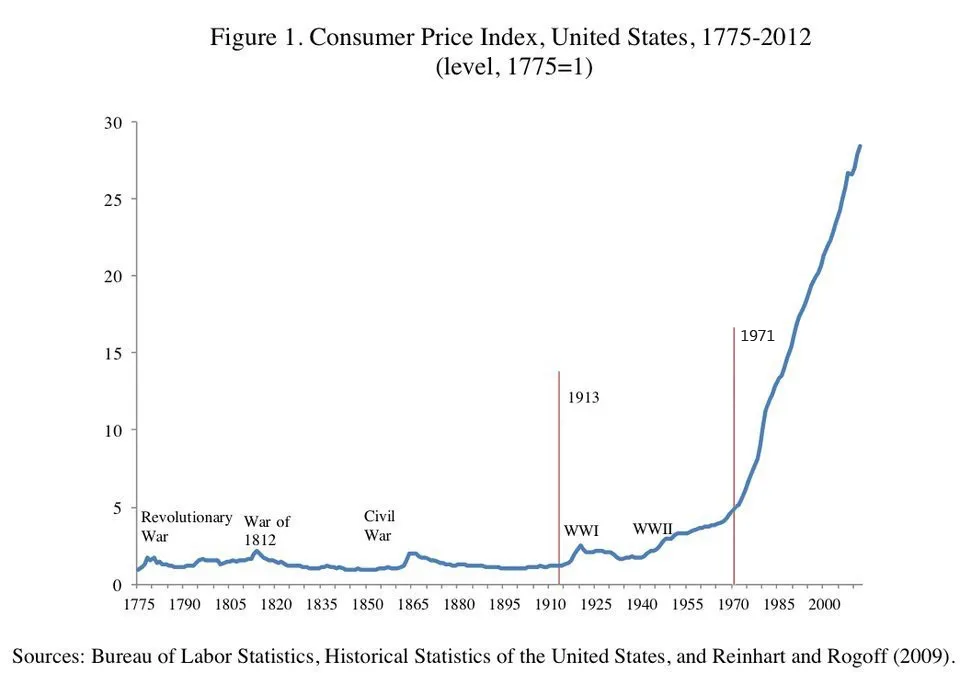

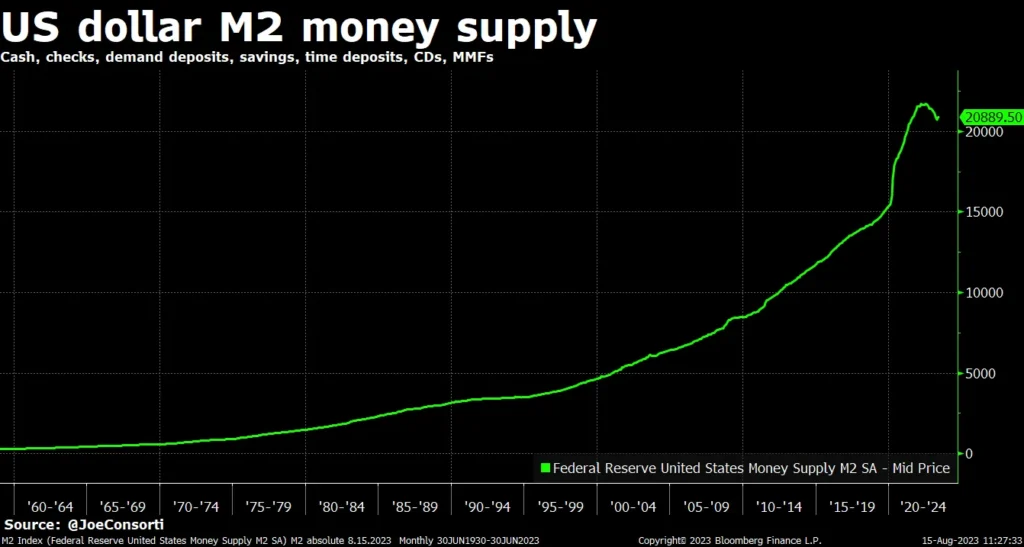

It all boils down to the US de-pegging the dollar from gold on August 15th, 1971, the day on which we just so happen to be writing this. Money is the standard unit of measurement that denominates everything around the world; if you create new money in excess of the rate that goods and services are rendered, prices go up. While the internationalization of dollar creation began a few decades prior, removing the US dollar’s peg to gold allowed for even faster creation that far and away exceeded the economic output of the country, leading to the overall price level exploding over the last 52 years.

Said differently—when you detach money from physical reality & print to your heart’s content, prices are the release valve:

Zooming out further, it is staggering how the price level didn’t materially rise from our nation’s founding in 1776 until World War I, yet after the post-war period when we stopped treating dollars as gold receipts, the price level exploded:

Prices are soaring but compensation growth is unchanged—this means that prices are rising due to the money getting debased, not because people are buying more things.

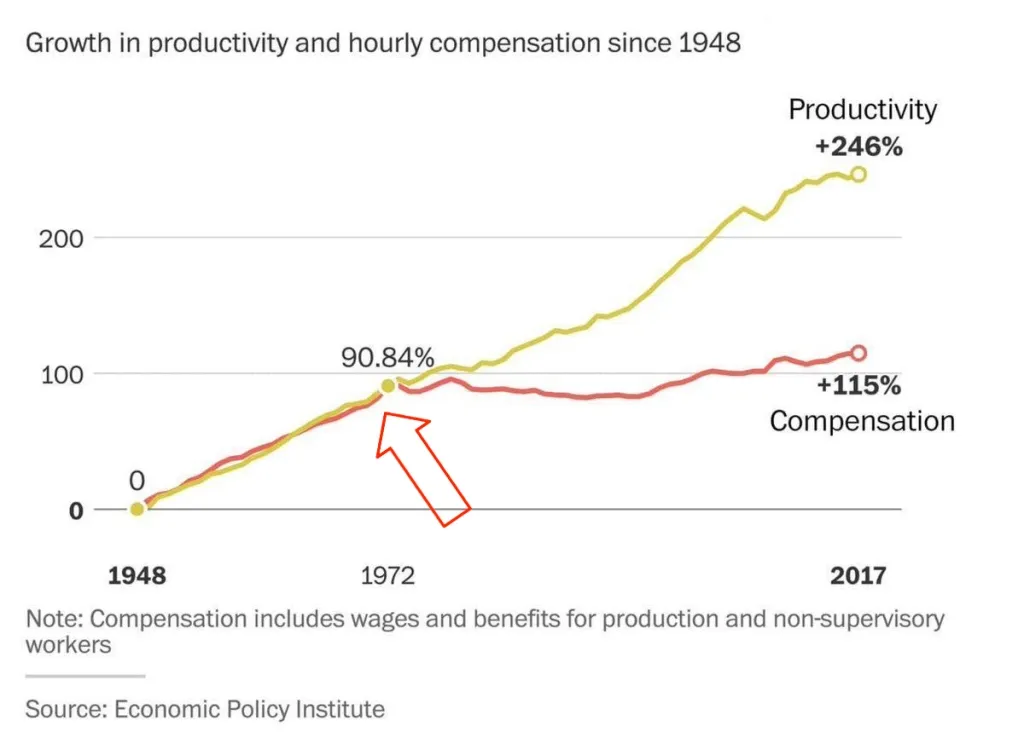

Productivity is rising but goods and services aren’t getting cheaper; that’s because the money is getting cheaper too. As productivity has risen some 246% since 1948, the growth of compensation in real terms is mostly unchanged since 1971, the year we de-pegged our money from physical reality.

You can print money but you can’t print prosperity:

Speaking of prosperity, 7-in-10 Americans today say that saving for the future, paying for college, and buying a home is more difficult for young adults today than it was for their parents:

The number of Americans who reported difficulty paying bills increased by 42% over the last two years, while more than one in three Americans who make more than $100,000 a year live paycheck to paycheck. Half of Americans say that affordability is a major problem where they live, up from 39% in early 2018.

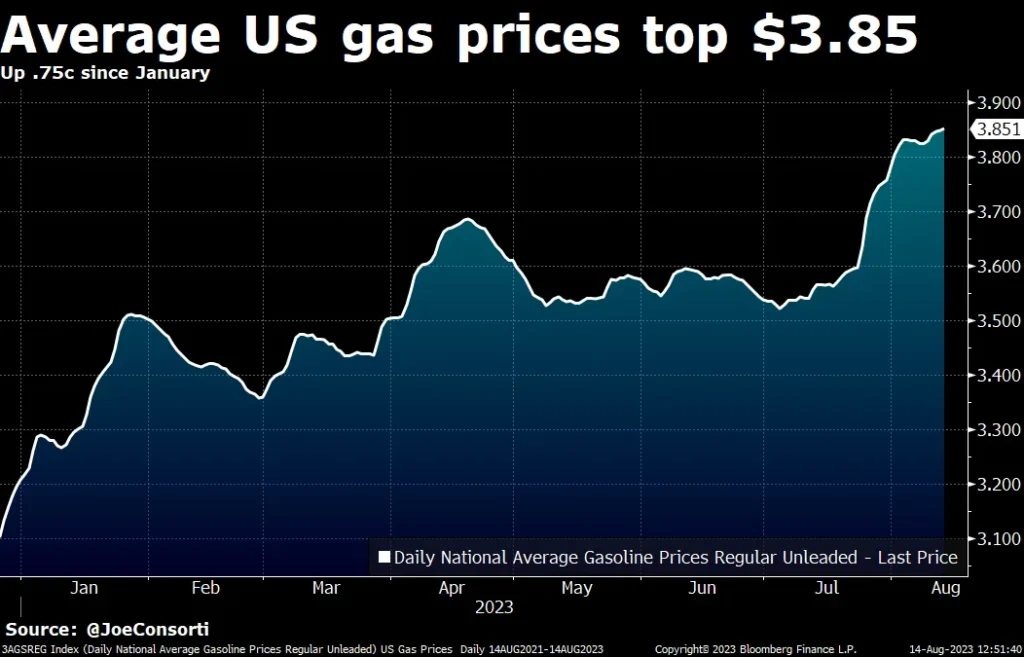

Gasoline is understandably a price that people care deeply about—given how travel for both work and leisure consumes a large portion of peoples’ time and therefore gasoline consumes a large portion of their paychecks. Average US gas prices have risen to $3.85, up by 75 cents since January and showing no signs of falling due to ongoing global production cuts from major oil-producing nations:

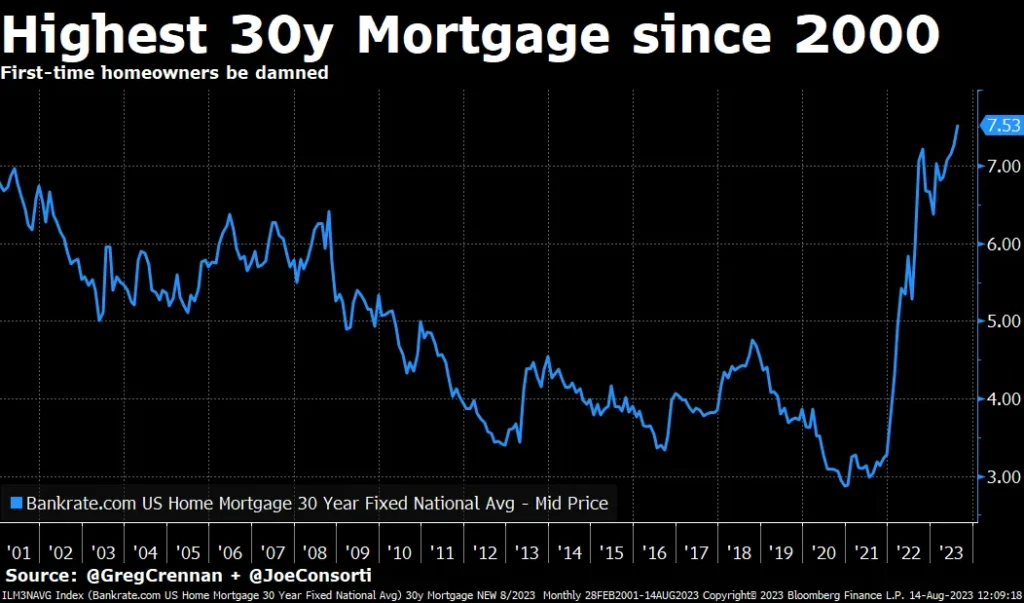

Mortgage rates have also risen to a 23-year high of 7.53%, discouraging many first-time home buyers from even attempting to purchase a home:

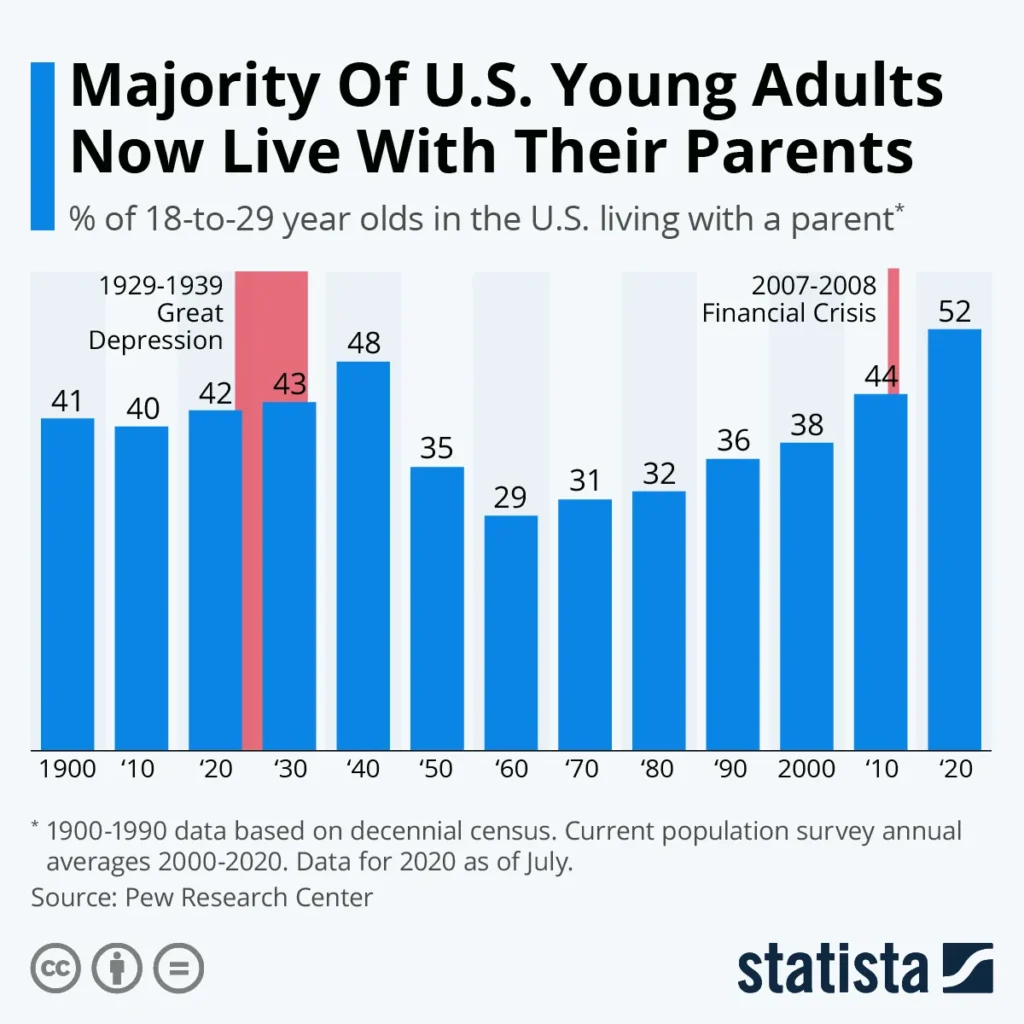

It is not difficult to see why the majority of young adults in the US are destitute. The highest percentage of 18-29-year-olds in the US are living with their parents since the Great Depression, some 52% as of July 2020:

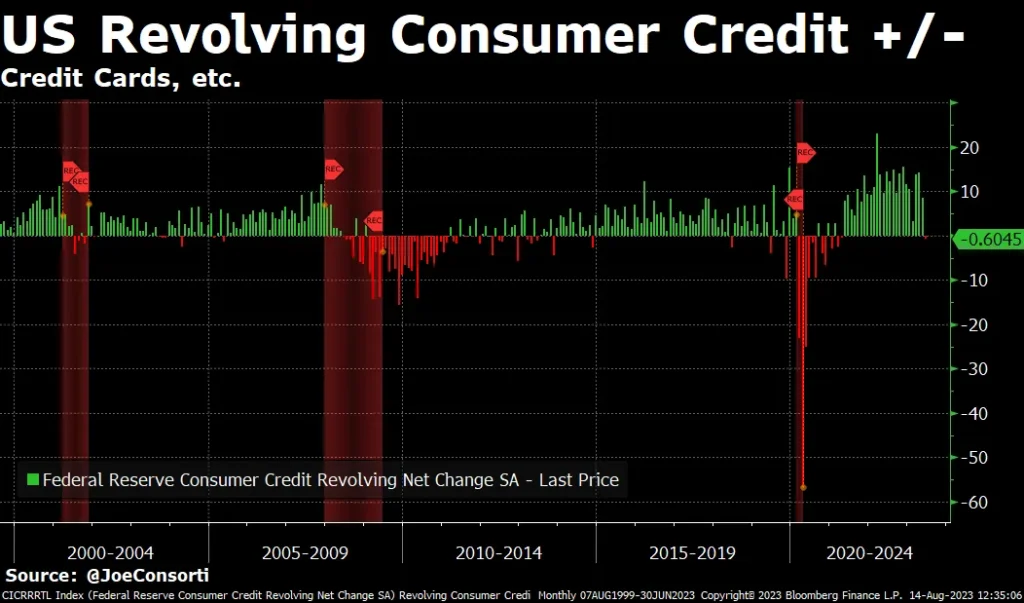

Higher prices are also inevitably recessionary. As the Fed tries to reign in CPI and price inflation succumbs to higher interest rates, it’s just shifting the burden for the US consumer from expensive prices to expensive interest rates. The net effect is a reduction in spending, seen here with consumer credit falling for the first time in 28 months, eventually leading to a slowdown in the economy:

So, why not just let prices come down?

If the uber-wealthy in the 1970s would be lucky to afford a medium-sized apartment in a US city in 2023, wouldn’t it be in the Fed’s best interest to allow prices to fall?

The Fed is fighting a credibility battle in 2023. It doesn’t want to go down in history as the Fed that got inflation bafflingly wrong with its “transitory” call, and Jerome Powell doesn’t want to be known as the fickle Fed Chairman who pivoted at the first sign of financial stress in 2019.

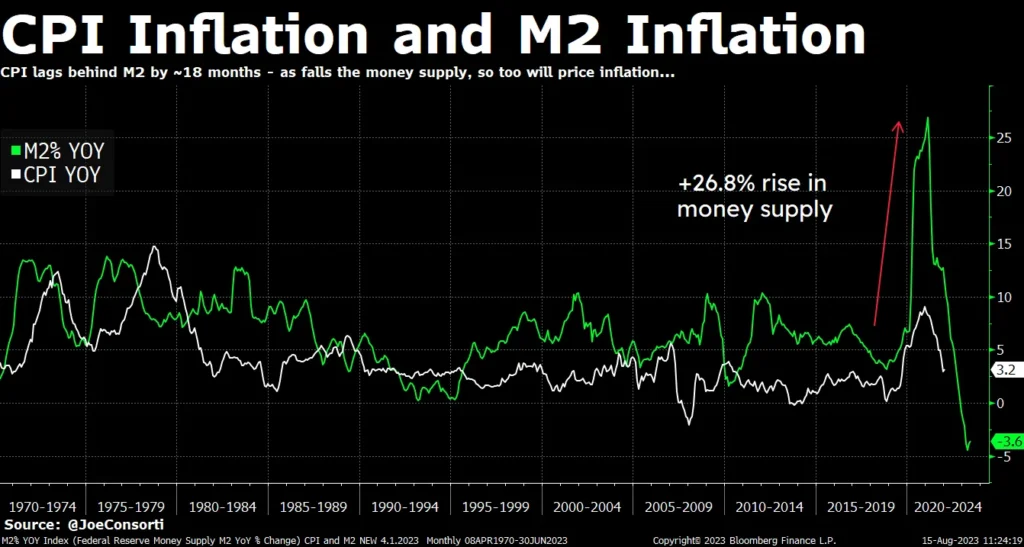

The Federal Reserve can only effectively conduct monetary policy insofar as it maintains a level of mutual trust with Americans. It loses that trust, and it quickly loses its influence too. As the Fed’s tightening has sucked money supply from the system, price disinflation follows. Its public trust was decimated in 2021 with its wildly-incorrect call that inflation was a non-issue, and now the Fed is course-correcting sharply in the opposite direction and risking, and we believe ensuring, recession as a result:

The Fed will maintain its credibility by bringing the pace of price increases down, but not letting prices go down.

We live in a credit-based world economy, where constant extension of new credit from banks to consumers fuels economic growth, largely driven by consumption spending. If that consumption spending were to fall, say, because people think prices will fall and want to wait to buy things until they are cheaper, then economic activity falls as well and we may enter a recession.

You see, in a post-1971 world, economic growth is no longer about productive investment, but rather perpetual spending at any and all costs, including the ability of US citizens to afford life’s necessities. The Fed will not allow for price deflation because it will mean a recession, and a recession means the US risks its foothold at the top of the global economic mountain.

The Fed wants you to spend so the economy keeps expanding, and they light the value of your money on fire to incentivize it. Inflation is a rate of change. It will go up and it will go down, but the price level only has one direction—up. You can see money supply falling as the Fed attempts to land the proverbial plane (inflation and the economy) without crashing it (deflation and recession) by influencing both the price (interest rate) and the quantity of money, pictured here:

You will grow increasingly unable to pay your bills, your mortgage payments, and your children’s college education, but at least the US’ position on the world economic stage will remain unchallenged.

The Fed and US Treasury aren’t incompetent, they just don’t work for you.