Richard Heart, the creator of the shitcoin scam HEX, gained the title “Spam King.” Beginning in 2000, Heart supposedly amassed a fortune through unlawful spam assaults.

Table of Contents

Richard Heart Before Hex

Before launching Hex, Richard Heart claims to have worked as a computer engineer, who specialized in the development of web applications. He was also heavily involved in spamming courses of “how to spam” over the internet.

As a computer engineer, Richard Heart started researching the cryptocurrency space and the potential of blockchain technology to be used for his own benefit.

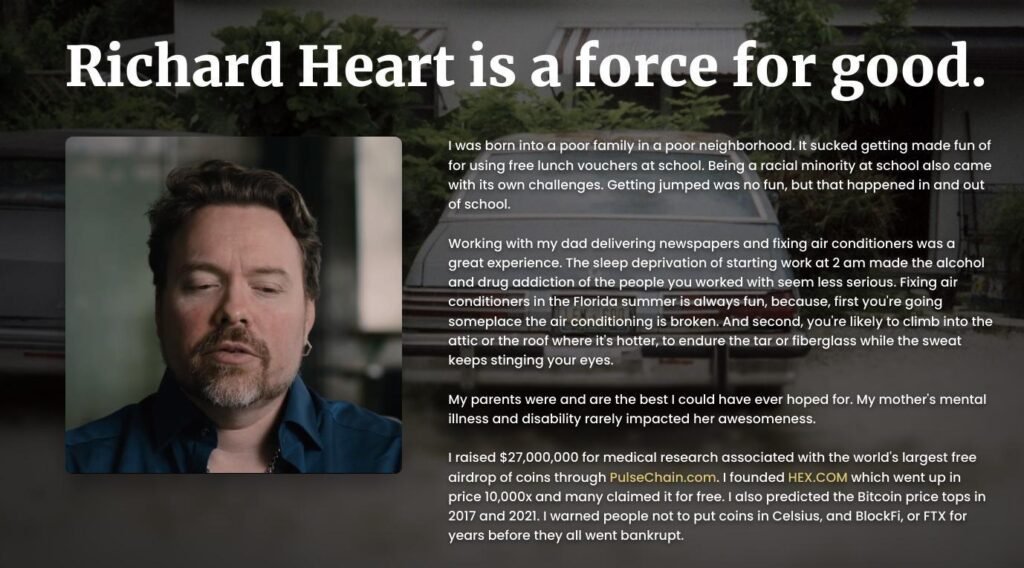

On his website, he presents himself as a good Samaritan who has done more to improve other people’s lives than anyone else.

He brags with his track-record of videos he published on YouTube about social justice topics such as finding agreement in politics, stopping gambling and trading, reducing military spending, fixing schools etc.

He was a strong advocate of blockchain technology and was often vocal about his opinions on the technology and the cryptocurrency market.

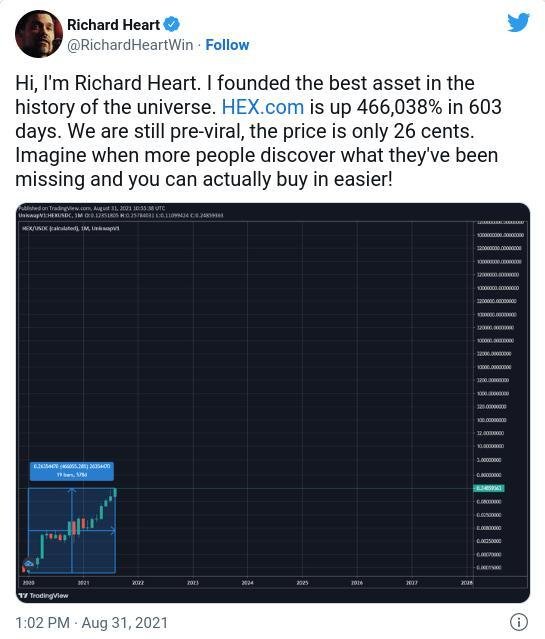

He’s also an active user of Twitter, where he often shared his thoughts on the cryptocurrency market and the development of blockchain technology.

He has built himself a large following on the platform, with over 1 million followers, and is one of the most followed crypto influencers and con artists on Twitter.

Overall, Richard Heart was an influential figure in the cryptocurrency and blockchain space before launching Hex.

His Net Worth

Richard Heart is a crypto charlatan and one of the most well-known figures in the world of blockchain and cryptocurrency scam projects.

He is the founder of the scam coin Hex, a decentralized finance (DeFi) platform, which promises investors high returns. Due to its heavy promotion online it became one of the most known projects in the space. His involvement in the cryptocurrency space has allowed him to accumulate a net worth estimated to be around $200 million.

While Richard Heart’s net worth is not confirmed, it is clear that his millions have been taken from his victims that invested in Hex at the top while he was dumping his tokens on the market.

The Dark Side of Richard Heart: From Spam King to Scam King

In 2002 Heart was sued under Washington State Law for “sending unsolicited commercial messages to Haselton that bore deceptive information such as a forged return e-mail address or misleading subject line.” But Richard Heart the Spam King wanted to become more. He wanted to become the Scam King

From 2005 through 2007, Heart was linked to a criminal network operating in Panama. Laundry crimes, theft, extortion, and blackmail are related to the Heart’s multiple names in Panama during the time.

According to Panama-Guide.com, associates of the HEX founder included robbers, extortionists, and corrupt attorneys and judges.

Peacefire.org successfully sued Heart in 2002 for breaching Washington’s anti-spam statute. However, Heart’s dark background as the “Spam King” is perhaps the most terrifying revelation.

Heart who’s real name is actually Richard Schueler was identified in a 2007 Google Groups post by Miguel Antonio Bernal as belonging to a new generation of robbers. The piece discusses how American criminals flow into Panama to loot, defraud, and extort local business people while taking advantage of Panama’s lax judicial system.

Heart now positions himself as a thought leader in the cryptocurrency field. However, while Satoshi Nakamoto was working on Bitcoin, Richard Heart introduced anti-aging products.

How Richard Heart duped and fooled HEX investors

Because it is actively advertised with a big shilling army, has a high interest rate “hook” to pull investors in, and its major product feature is to build difficulty to getting out of it, the Hex token should go down in “crypto” textbooks as one of the best scams in history.

The fact that 99% of cryptocurrencies are frauds is nothing new, yet most promote themselves to typical “crypto” investors as some utility token for an ecosystem that will be the next big thing (which rarely ever pans out). These buyers are often aware that they are gambling, which is acceptable as long as they accept it.

Hex is distinct in that it is advertised as an investment that provides returns, uses banking lingo, and is actively marketed to the people who haven’t gone into crypto yet and don’t know what to look out for.

It’s the first cryptocurrency I’ve ever heard of that employs marketing in magazines, buses, taxis, physical mail, sketchy airport seminars, and TV to attract a whole new class of victims aside from typical cryptocurrency investors.

Marketing 40% annual “interest” how can it be not a scam?

Hex has been careful with its website marketing language and product design to avoid legal issues.

There’s a whole page on the Hex token explaining why it’s not a fraud and why it’s not a ponzi or pyramid scheme.

Legitimate investment products don’t need a section on scams and why they don’t meet technical standards.

This article may be aimed towards the SEC or financial law enforcement officials to dissuade those who come across the product to dissuade them from conducting an inquiry because it doesn’t fit their 1920 rules of Ponzi or pyramid scams.

Unregulated crypto means a lot of dodgy stuff exists, and decentralized contracts make it hard to bring them down.

Reasons Why Richard Heart’s HEX Is a Ponzi Scheme

This table provides information regarding why Richard Heart’s HEX is considered a ponzi scheme. It outlines criteria such as unsustainable returns, lack of transparency, uneven distribution of profits, and promises of quick riches which suggest that the platform may not be legitimate.

| Criteria | Explanation |

|---|---|

| Unsustainable Returns | HEX promises returns of up to 10,000x and is not backed by any real-world asset. This implies that returns are unsustainable and the platform is likely a ponzi scheme. |

| Lack of Transparency | HEX does not publish any information regarding its operations, making it difficult to verify the legitimacy of the platform. |

| Uneven Distribution of Profits | HEX rewards those who joined the platform earlier, creating an uneven distribution of profits. |

| Promises of Quick Riches | HEX promises quick riches to those who join the platform, which is often indicative of a ponzi scheme. |

The Spam King Has A Broken Heart

Heart’s personality seems to be quiet a mess when you look at his social media appearance on Instagram and Twitter. He constantly buys tasteless luxury goods to show off. Any psychology student would be able to identify a severe disorder and personality complex.

While his social media content is meant to influence his potential victims, any reasonable observer would just be disgusted by the childish decadence Heart presents.

“$5,500 fit. #Prada $1,200 shoes, $650 earrings, $1,150 bracelets. $1,000 #louisvuitton visor. $500 #dolcegabbana shirt. $1,000 #cartier sun glasses.” Heart captions his post. But Richard doesn’t have a job, doesn’t have a business, doesn’t have a big inheritance. So where is all this money coming from? It can only be internet scams, the Spam Kings favorite source of income

What is The Spam King compensating, childhood trauma? Maybe he should seek therapeutic help instead of ripping off ignorant victims?

On his website he writes: “My parents were and are the best I could have ever hoped for. My mother’s mental illness and disability rarely impacted her awesomeness.”

One can only imagine the suffering he must have experienced that turned him into the narcissistic scammer he is today.

The “Get Rich Quick” HEX Media Blitz

Since its start, Hex has been able to persuade enough new customers to increase the token price through its aggressive marketing strategies.

Numerous people have reported receiving Hex spam mail with their identities from the Ledger breach to their homes.

Then, view this humorous TV commercial that played on MSNBC with yachts and money floating through the air and a spokesperson proclaiming “people are getting rich, actually rich” prior to the official debut. Hex is intended to satisfy your avarice.

You must consider the incentives and return on investment for people who are willing to spend millions of dollars promoting a digital coin to you.

The Richard Heart ICO

During the first year’s claim period, you got Hex by sending Ethereum to the “origin address” of the contract.

If you wished to convert Hex tokens back to Ethereum, you would need to go elsewhere.

Schueler’s origin address does not offer refunds, reiterating why the term “Certificate of Deposit” is inappropriate. If you desired to withdraw your funds, you were required to locate an exchange that provided liquidity.

In interviews, he consistently evades the topic of who controls the Hex origin address or claims ignorance. Obviously he has power over it, as it is his own smart contract!

Because the SEC regarded the ICO to be a security and because he operated an illegal ICO for an entire year without filing and registration, he will avoid answering this question.

He received an asset in exchange for his own creation; this is unquestionably an Initial Coin Offering. This is another instance in which Heart attempts to circumvent legal regulations by deception.

A month after HEX introduction

Around $7 million worth of Ethereum were removed from the Hex genesis address. It consisted of 36 transactions totaling 1,337 ETH. 1337 is leetspeak for “elite,” which is leet. In the 1990s, hackers referred to another as elite if they possessed the most advanced hacking skills and were able to penetrate corporate servers and websites.

This appears to be a boastful letter about how he defrauded millions of dollars from gullible individuals.

Also, during the first year, nothing prevented Richard Schueler from creating an infinite loop of sorts by sending Ethereum to the origin address, and receiving Hex, then sending the received Ethereum to a different address (possibly via a laundering mixer to conceal this activity) and then sending it back to the origin address for more Hex.

He could mint as much Hex as he desired, which he did.

So, how does HEX make money?

Simply put, it does not. This is where we reach the heart of the Hex fraud. Let’s contrast two models.

Typical Banking Model

The origin of interest from banks is economic activity. A bank generates loans, makes fees from ATMs and services, and then distributes a portion of its earnings to you. The fundamental business concept of a commercial bank is to collect the differential between short-term and long-term interest rates. They borrow quickly and lend slowly. This is the essence of their company and the reason they offer checking and savings accounts in the first place: they leverage the funds of others.

Everyone is familiar with Certificates of Deposit: you invest money and receive more money in the future. Banks do not give certificates of deposit as an act of generosity; they exist for the bank’s benefit, just as savings and checking accounts do. By penalizing money that departs too quickly, banks may better plan around their legally mandated capital needs and lending portfolios.

This is how actual revenue is made in the real world, despite the fact that CeFI and DeFi platforms offer lending and borrowing. Nexo, BlockFi, and Celsius are CeFi lenders and private equity investors.

Read this page for a more in-depth examination of banking mechanics involving money expansion and the effects of quantitative easing. Richard Heart and Hexican trolls frequently cite the “Bank of England paper” and other sources as proof that Hex “is identical to the financial system,” and this logic is flawed.

The Richard Heart Hex Model

There is no underlying economic activity occurring with Hex. It lacks even genuine interest.

The only thing the Hex contract code does is mint additional inflationary tokens annually and then distribute the inflation to those who have decided to lock up theirs.

This entire scheme could not succeed if the requirement was to secure an asset and receive interest payments on an asset that Richard Schueler did not control and created out of thin air.

Where can I find a certificate of deposit that pays 40% or even 20% in Bitcoin or Ethereum? It is nonexistent.

Those who lock up tokens receive half of the penalty incurred by those who open their funds early or fail to unlock their funds within two weeks of the agreed-upon term. Richard Schueler gives himself the remaining half.

Thus, the sole objective of the Hex contract is to redistribute value from certain token holders to other token holders, sound familiar?

If you bought hex, you’re holding Richard Hearts bags while he as a depressed scammer spends your value on ugly handbags and private jets.

Everything you need to know about Hex Pulsechain

Hex Pulsechain Richard Heart’s next scam project. Since people are losing trust in his first ponzi ‘Hex’ he quickly had to develop a plan-B to continue scamming.

Heart is claiming that Pulsechain will provide a decentralized, and interoperable blockchain solution to companies, organizations, and individuals.

He also says that it’s designed to give users the ability to securely store, trade, and manage digital assets, including cryptocurrency.

What exactly does Hex Crypto do? What is Hex’s function?

What innovation does Hex bring to the table, other than being a self-enrichment scam?

Bitcoin’s sole aim was not to provide its users with investment rewards, as is the case with Hex.

Bitcoin was created to facilitate digital payments and to solve the digital currency double-spending problem. Bitcoin and its pure egalitarian introduction did not entail giving money to its creator. Bitcoin is additionally deflationary and has a finite supply.

It is possible for anyone to clone Hex with a few mouse clicks. See Rex on the Binance Smart Chain, for example (lower gas fees, still a shitcoin).

What does Hex do? Produces more Hex. To do this, anyone can write a contract.

Heart saw that other con artists were becoming wealthy by making scam-coins, and he simply desired to get in on the activity. He merely put more thought into his storyline for why one should purchase.

Be sure to checkout Wantfi’s in-depth investigation into the Hex Scam

Frequently Asked Questions – FAQ

What is Richard Heart’s net worth?

Richard Heart’s net worth is estimated to be around $200 million, mostly due to his involvement in cryptocurrency scams.

What is Hex?

Hex is a crypto ponzi scam, a “decentralized finance (DeFi) platform” founded by Richard Heart. It offers users to earn interest on cryptocurrency investments but does not own any productive assets.

What is Hex PulseChain?

Hex PulseChain is Richard Hearts second scam after Hex. Since people have lost trust in HEX, Heart decided to start a new scam.