Renowned author and investor, Robert Kiyosaki, has sounded the alarm on a potential economic downturn that could reshape the global financial landscape. He also signaled potential opportunities in Bitcoin amidst an anticipated market crash.

An ‘Everything’ Crash

Joining him in this dire prediction is finance editor and economic forecasting expert Harry Dent, setting the stage for what they term an “everything” crash looming over the market.

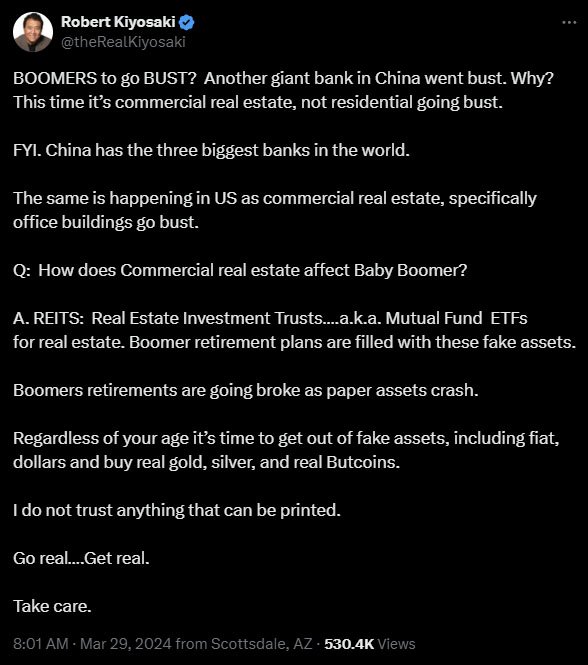

Notably, on April 2, Kiyosaki took to social media platform X to share Dent’s statement, which suggests that investors, particularly the Baby Boomer Generation, would be the most vulnerable group in the event of an economic collapse.

With their real estate holdings and the S&P 500 index both projected to face substantial declines, the impending crisis casts a shadow over traditional investment avenues.

Robert Kiyosaki and Dent’s Prediction of $200 BTC

Kiyosaki further notes Dent’s analysis, which indicates that no asset class, not even digital assets like Bitcoin, will be spared from the turmoil. Dent even speculates that Bitcoin could plummet to as low as $200 per coin, prompting Kiyosaki to express his readiness to seize the opportunity, stating, “If Bitcoin drops to $200 per coin I will buy as many coins as I can.”

In Kiyosaki’s view, those who weather the storm stand to emerge as millionaires or even billionaires, as assets become available at unprecedented discounts. He explains:

“If Harry is right, those who are prepared will soon be multi-millionaires and possibly a few new billionaires. Even if [Dent] isn’t [right], those who are holding gold, silver, and bitcoin will be richer.”

According to him, investors can position themselves to acquire valuable assets at substantial discounts during these times of financial crisis, potentially setting the stage for unprecedented wealth accumulation.

Bitcoin: The ‘People’s Money’ or a ‘Fake Asset?’

Kiyosaki’s investment strategy pivots towards assets he perceives as safe havens during times of financial instability, notably gold, silver, and Bitcoin.

Contrary to viewing Bitcoin solely as a financial investment, Kiyosaki regards it as a critical safeguard against economic volatility, dubbing it “the people’s money” and disparaging traditional paper currencies as “fake money.”

On the other hand, renowned economist Peter Schiff also warned recently of an economic crisis “more devastating” than that of 2008. However, while Kiyosaki champions Bitcoin as a bulwark against financial instability, Schiff does not share his enthusiasm. Amid the recent market downturn, he recently dismissed Bitcoin as a “fake asset,” comparing its inherent volatility to the stability of gold.

BTC Market’s Recent Volatility

Meanwhile, bitcoin is trading at $66,500. While the price has shown a slight decrease in the past few days, it has displayed a relatively stable trend over the past month.

Nevertheless, expert traders foresee a potential future price range for bitcoin between $100,000 and $1 million. Kiyosaki’s endorsement of Bitcoin amidst economic concerns reflects its growing acceptance as a resilient investment option amid market volatility.

Amidst the rising concerns of an impending crisis, investors must navigate the unpredictable market terrain, relying on the insights of financial experts.