Bitcoin was nearing the previous record high of $69k yesterday. This sudden boom in value resulted in many ETFs posting positive inflows apart from a few exceptions. They included some of the smaller bitcoin ETFs that haven’t done so well since the financial instruments were allowed by the United States Securities and Exchange Commission (SEC).

Bitcoin reached as high as $68.6k earlier today, give or take a few hundred dollars depending on the exchange. However, the premier digital asset has receded slightly earlier today, going below $63k. Therefore, the ETF flow table for tomorrow will be quite interesting as well.

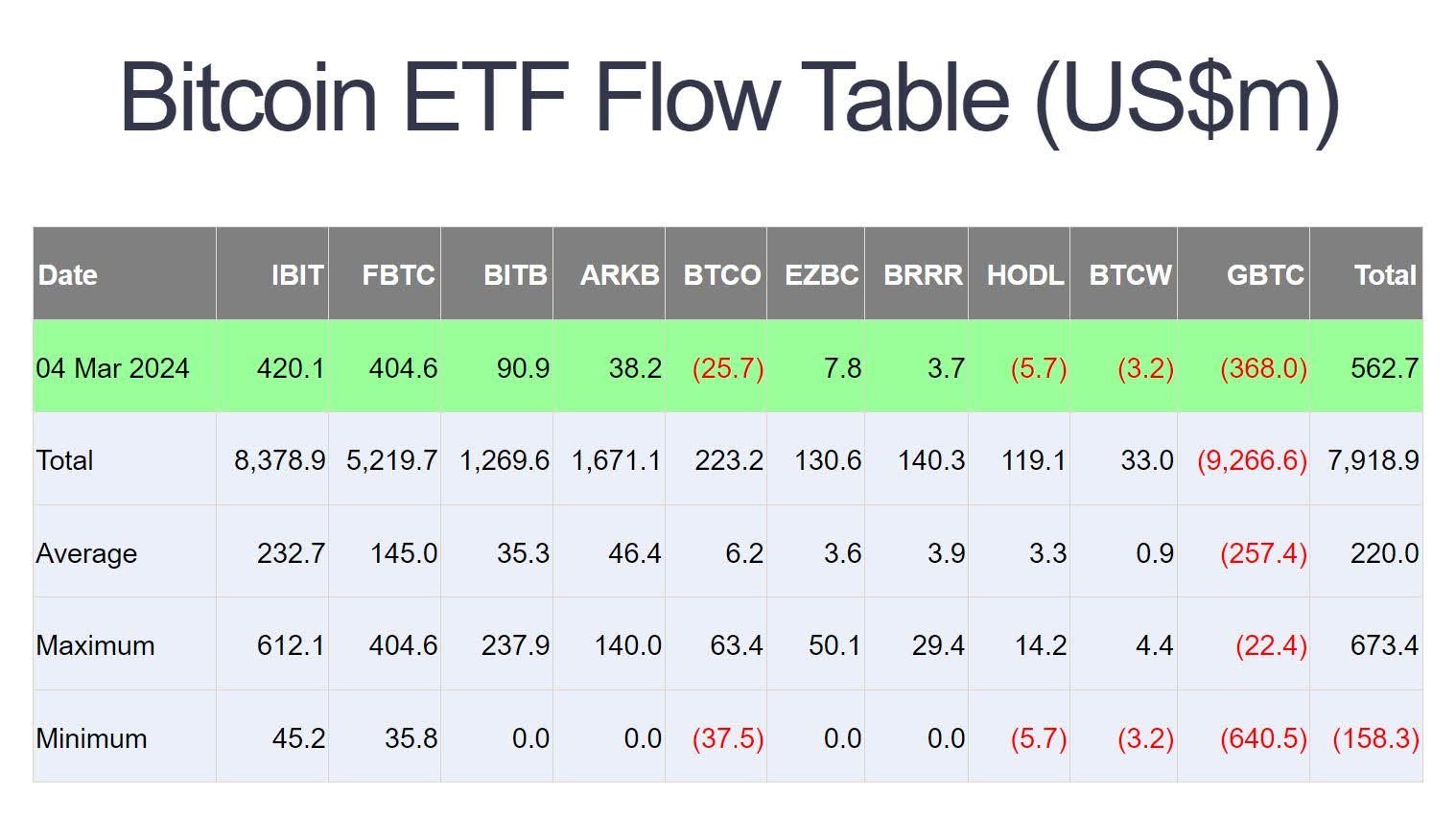

Here is a complete breakdown of the net ETF flow table:

Bitcoin ETF Analysis

The overall market witnessed a net inflow of $562.7 million which is on the higher side. This is despite some of the smaller ETFs (HODL, BTCW, BTCO) and Grayscale (GBTC) posting net outflows.

These outflows are a cause of concern for these ETFs as it is indicating a pattern of investor behavior. They are coinciding with the bullish nature of the underlying digital asset.

Winners

The biggest winners were BlackRock (IBIT, $420 million), Fidelity (FBTC, $404 million), Bitwise (BITB, $90.9 million), Franklin Bitcoin (EZBC, $7.8 million) and Valkyrie (BRRR, $3.7 million). BlackRock and Fidelity are the clear leaders of the ETF market with a lion’s share of the market. Bitwise is showing some competition but Valkyrie and Franklin have a lot of catching up to do. BlackRock’s main driving force is its own investment fund which is the largest one in the world with a whopping $9.1 trillion in Assets Under Management (AUM). It has also claimed the third spot among commodity giants.

Losers

The losers included Grayscale Bitcoin Trust (GBTC, -$368 million), Invesco Galaxy (BTCO, -$25.7 million), Van Eck (HODL, -$5.7 million), and Wisdom Tree (BTCW, -$3.2 million).

Grayscale has been reporting net outflows ever since it was approved as an ETF along with the eight other funds. It is still one of the largest spot ETFs with AUM of over $9.2 billion, but it is bleeding fast.

Three of the smallest ETFs i.e. Wisdom Tree, Van Eck, and Invesco posted net outflows despite BTC heading toward record highs. This shows that the future is going to be tough for them.

Verdict

The overall ETF market posted a net inflow of $562 million which is encouraging for the nascent exchange-based financial instruments. However, three of the smallest ETFs are expected to struggle to try and remain liquid.

Likewise, Grayscale might need to do something about its outflows as they have picked up pace once again after leveling out in the last couple of weeks. But, for the winners like BlackRock, Fidelity, and to some extent BitWise, the situation is encouraging. Some of the smaller winners like Franklin and Valkyrie also need to keep up with the pace or risk going illiquid too.

The correlation between ETF flows and BTC price movements is of great interest to industry observers at the moment.