Popular Dutch analyst Michael Van de Poppe has predicted that bitcoin is likely to experience a 30% price correction in the near future. He tweeted this out yesterday but today, just a few hours before press time, the premier digital asset posted a new All-Time High (ATH) of $70k on coinmarketcap.com.

This is what he had to say on X (formerly Twitter):

Basically Van De Poppe is trying to establish that if the ETF-inspired pump is taken out of the equation, a price correction is quite likely and historically proven.

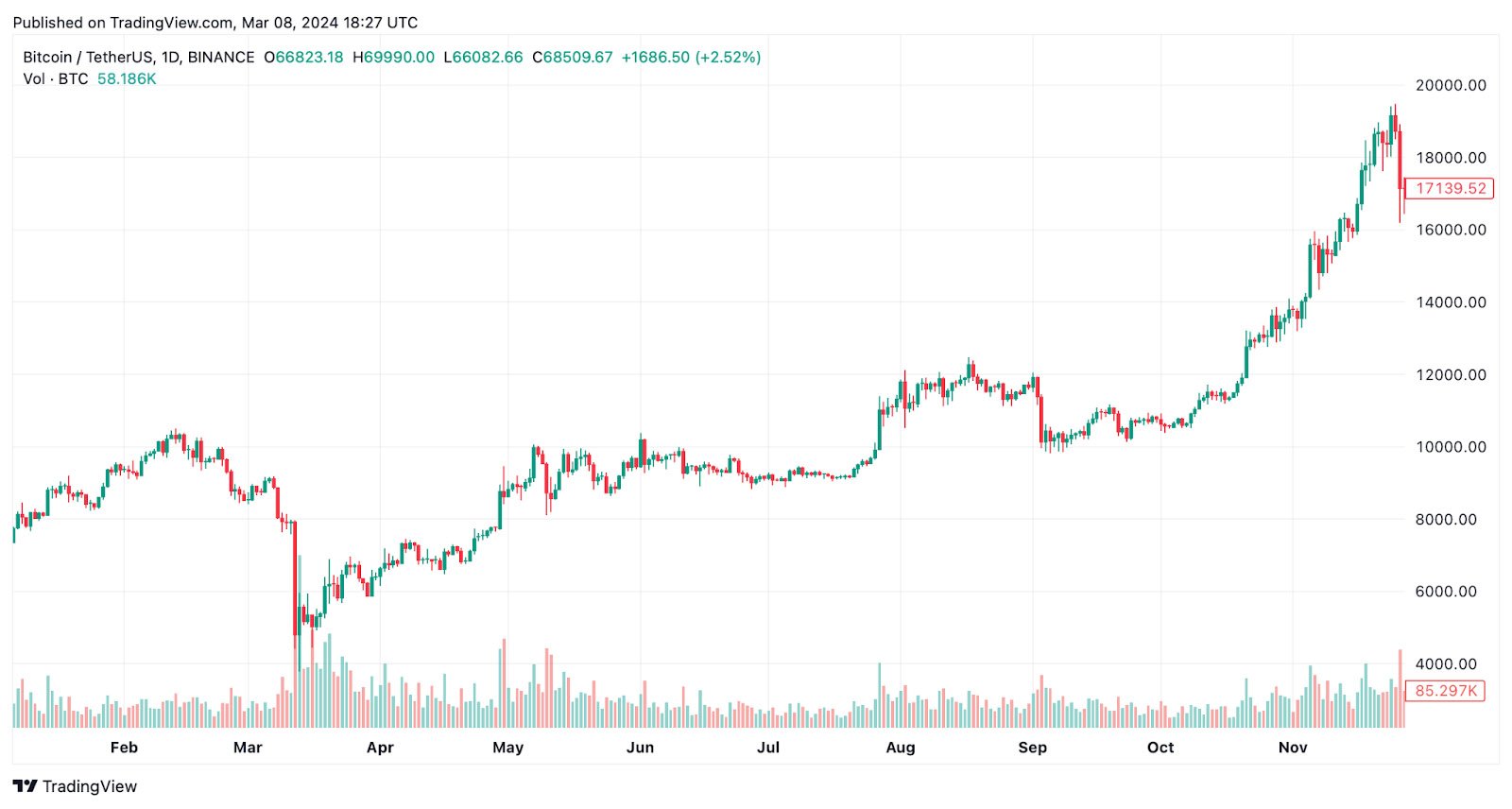

What Happened During the 2020 Halving

This is what happened during the last halving of bitcoin back in 2020:

We can see that the first two months and the first half of March witnessed some price gains. The index rose from $6000 to $8000 in a couple of months. But, the end of March saw a big price correction in which the top digital currency recorded a flash drop from $8000 to $5000. It managed to recover back to $8000 in the ensuing months and the second half of the year witnessed some strong gains.

Bitcoin Posts New ATH in Buildup to 2024 Halving

This time around, the situation is a little different as we are witnessing a major pump in the first quarter of 2024. The index has risen around 70% from the start of the calendar year and already posted a new ATH of $70k in the process. Analysts relate this price increase to the approval of Bitcoin Exchange Traded Funds (ETFs) in January.

But, as it can be seen, bitcoin is nearing the point in time when it witnessed a substantial price decrease back in 2020. Due to the sheer strength of the ongoing rally, a similar 50% price decrease might be unlikely but an eventual price drop cannot be ruled out.

Van de Poppe hasn’t issued a retraction and for many analysts like him, such price correction is quite possible. However, it is pertinent to mention that many of them have been predicting a price pullback for the last couple of months and a slowing down of money pouring into the ETFs. Neither of these predictions came true and the bulls have canceled out any such moves so far.

Analyzing Van de Poppe’s Prediction

Bitcoin has two major bullish occurrences fueling its price gain at the moment. The first one is the spot ETF approval which has pumped a massive $19 billion into the market in the first two months. Analysts like Van de Poppe are betting on a slowdown of the ETF juggernaut in the coming weeks which in turn can create some pressure on the market.

Related reading: Bitcoin Shortage Looms Post-Halving as ETFs Eat Up Mined Supply

The second is the incoming block reward halving. This is a major episode in the 14-year history of the digital asset and its importance cannot be downplayed at all. However, a price correction is quite natural in buildup to the halving or even post halving. But, the magnitude of a possible drop isn’t likely to be as severe as the one witnessed in 2020.

Disclaimer: The information provided here is for informational purposes only and should not be considered as investment advice. Any investment decisions should be made after careful consideration of individual financial circumstances and consultation with a qualified financial advisor.