VanEck, a leading asset management firm, has predicted that the United States Securities and Exchange Commission (SEC) will approve applications for Spot Bitcoin exchange-traded funds (ETFs) by Q1 2024.

VanEck believes the approval will result in an inflow of $2.4 billion into these investment products. In a series of X posts published on December 7, the asset manager made predictions regarding the future of Bitcoin, the United States economy, and the impact of BTC halving, among other things.

The asset management firm claims that Bitcoin will reach an all-time high in Q4 2024, driven by regulatory developments and the U.S. presidential elections.

VanEck: U.S. Economy to Enter Recession

While BTC is expected to skyrocket in the upcoming months, VanEck noted that the U.S. economy will enter a state of recession. “The US recession will finally arrive, but so will the first spot Bitcoin ETFs,” said the asset manager while adding:

“Over $2.4 billion may flow into these ETFs in Q1 2024 to support Bitcoin’s price.”

Additionally, VanEck said that the upcoming Bitcoin halving in April or May “will see minimal market disruption.” However, it predicted that there would be a post-halving rise in the price of the digital asset.

Looking ahead to 2024, VanEck envisions Bitcoin’s price surge, potentially fueled by political events and regulatory shifts following the U.S. presidential election on November 5, 2024. It stated:

“Bitcoin will make an all-time high in Q4 2024, potentially spurred by political events and regulatory shifts following a US presidential election.”

Notably, multiple pro-Bitcoin candidates, including Florida governor Ron DeSantis, Robert F.Kennedy Jr., and biotech entrepreneur Vivek Ramaswamy, are part of the presidential race.

Related reading: 3 Presidential Candidates For 2024 Openly Support Bitcoin

“Like past cycles, Bitcoin will lead the market to rally, and the value will flow into smaller tokens just after the halving. ETH won’t begin outperforming Bitcoin until post-halving and may outperform for the year, but there will be no ‘flippening,’” VanEck noted.

Binance to Lose the Top Spot

VanEck also made the bold prediction that the world’s largest digital asset exchange, Binance, would lose the top spot in the sector. The trading platform has held the top position by market volume for a long time under the leadership of Changpeng Zhao, also known as “CZ”.

Notably, on November 22, he stepped down as the exchange’s CEO after pleading guilty to charges related to a Bank Secrecy Act violation.

The asset management firm predicted that other exchanges like OKX, Bybit, Coinbase, and Bitget would contend for the top spot. The asset manager noted that “Coinbase’s futures market may exceed $1 billion in daily volume as regulated index inclusion becomes key,” while adding:

“Remittances will boost blockchain use, with “Bitcoin Staking” on the Lightning Network offering yield opportunities through new, user-friendly staking tools.”

Related reading: Why Bitcoin & Lightning Is The Best Blockchain Remittance Model Yet

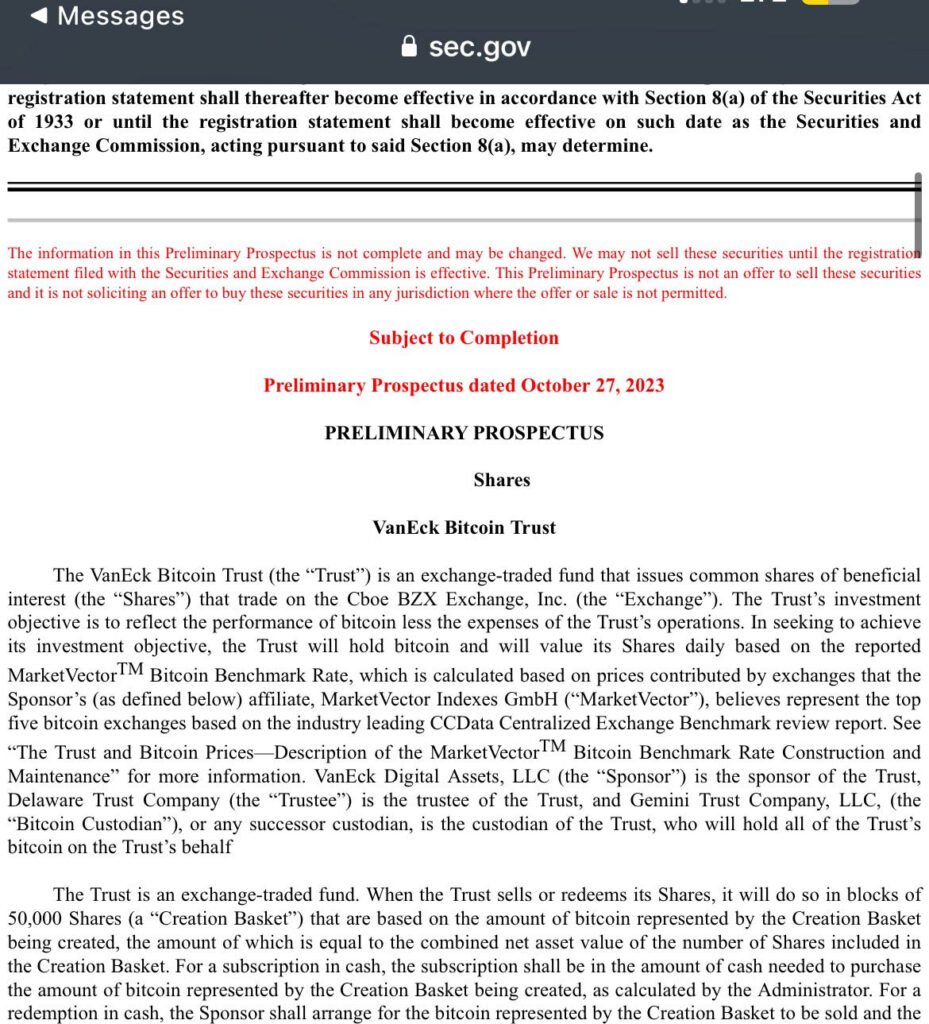

VanEck is one of the multiple applicants waiting for the approval of their Spot Bitcoin applications. Other firms include BlackRock, ARK Invest, Franklin Templeton, and Grayscale.