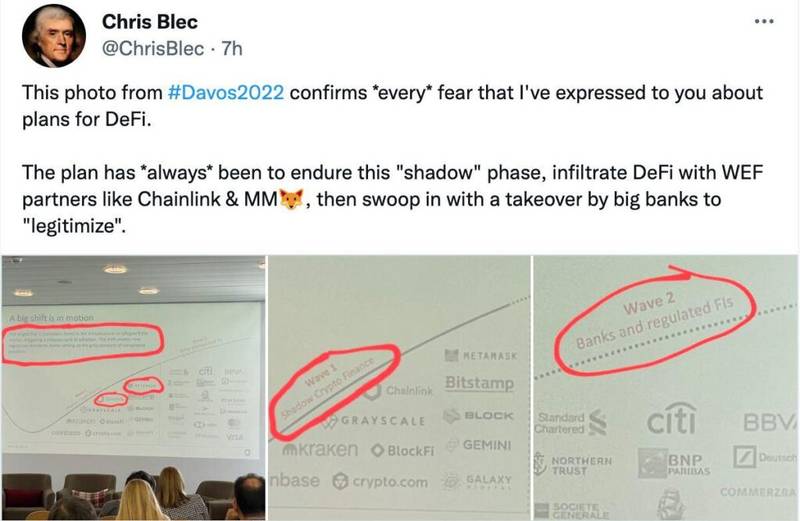

A powerpoint slide leaked at the World Economic Forum’s annual meeting went viral on Twitter. It depicts a centralized future for ‘crypto’, alarming users around the word. Bitcoin is not part of the plan.

Is the transformation of the bitcoin industry towards regulated big players plotted in Davos? As the World Economic Forum annual meeting takes place in Davos, Switzerland, ‘defi’ users are alarmed.

A slide shared on social media suggests that major corporations in the financial industry have set everything in place to take over via regulation and rollups. Is Davos ready to fight the beast?

The global planners in Davos have been caught discussing to transform the crypto industry. This could be good for bitcoin as millions of users potentially realize the key differences between bitcoin and ‘crypto’. Bitcoin is decentralized, ‘crypto’ and ‘defi’ isn’t.

The proposed roadmap foresees a regulatory capture of the entire sector that many thought would be decentralized. Is it just pathetic whishful thinking, or does legacy finance have feasible plan? The harsh reality is that Ethereum is already a centralized ‘JPMorgan protocol’.

DEFI will be regulated, Bitcoin cannot be regulated

Could the WEF agenda bring ‘crypto’ to and end? Many ‘DEFI’ users are concerned. Regulation has been sabre-rattling for years, following recent developments, it seems that things could change drastically and suddenly.

The slide revealed at the WEF conference in Davos reveals a shockingly accurate roadmap how the industry could be captured.

The slide is filled with logos separated into two groups. The left group is is titled “Shadow Crypto Finance” and filled with shitcoin logos such as chainlink and metamask but also exchanges like Kraken and Bitstamp. The right group is titled “Banks and regulated Fis” and contains logos of large (and corrupt) banks like HSBC, JPMorgan, Citi etc.

The slide further suggest the following:

“The largest Tier 1 custodians invest in the infrastructure to safeguard the market, triggering a virtuous cycle of adoption. This shift creates new regulatory standards, banks setting up the gold-standard of compliance practices”

Are we just a matter of weeks ahead of a fundamental shift? Regulation is not a new trend and has worsened user experience since the advent of bitcoin and permissionless money. Within the U.S., states tried different regulatory approaches whereas states such as New York have eliminated the free market and forced entities to move out.

When new technology gets invented, the cartel wants a cut. Following a wave of regulation, the market gets consolidated and the corporates buy up small players. The same can happen to the ‘crypto industry’ as most projects can be centrally controlled hence forces to implement compliance measures.

In Europe only a handful of EU member states provided a useful regulatory framework to attract business. Fegulated bitcoin finance such as exchanges are struggling to find welcoming jurisdictions and have to go country by country to apply for licenses. Friendlier spheres such as Switzerland or Wymoning are rare.

Is the corporate takeover about to launch?

Bitcoin proponents from the corporate world such as Michael Saylor are positive about regulation. They believe regulation is the only way to bring institutional adoption. Is this the corporate takeover that Michael Saylor has mentioned?

Michael Saylor advocates in favor of regulation for years as he believes regulatory clarity is is a positive event and will benefit bitcoin.

The question remains what value regulation ads. Michael Saylor keeps room for interpretation to what his statement means. Is he part of the agenda to fully regulate Bitcoin or does he strategically play both sides knowing that Bitcoin is a troyan horse.

Bitcoin regulates itself, crypto gets regulated

The Bitcoin protocol regulates itself by the law of code and does not require external ‘safeguarding’, auditing or regulation. Regulation and compliance proposed by the WEF will affect only “the innocent and the idiots” but does not prevent actually abuse or crime.

To fight crime more competence inside our police would be needed. Or a privatization of protection as a whole, since state run services always fall behind innovation.

If the measures the cartel seeks to implement are ineffective, then what is the true reason to have them?

Financial central planners are in panic mode as their business model gets disrupted. ECB president Lagarde, a known criminal made the most powerful sales pitch for bitcoin ever when she explained that “if there is an escape that escape will be used”.

Terms such as “new regulatory standards” or “compliance practices” are newspeak to cover up the deeper meaning. The cartel in Davos wants their cut without working or adding real value. The result for the end user will be tracking, tracing and KYC. Or in other words more paper work a.k.a. communism. It could mean that metamask, uniswap and other defi platorms will ask you to provide the following:

– passport or ID

– home address

– proof of address

– utility bill

– bank statement

– source of wealth declaration

– proof of source of wealth

– anti money laundering declaration

The cartel wants to to create a system of control. But they cannot alter the bitcoin protocol. The slide presented at the WEF does not reveal how bitcoin would be externally regulated on a protocol level. Is that because the think tanks and consultants that Klaus hired couldn’t figure it out?

Shitcoins love Davos, Klaus Schwab loves centralization

For years, the WEF’s annual meeting has been criticized by activists and journalists. Similar to the infamous bilderberg conference, the gathering is seen as the epicenter of corruption. The lack of transparency about back door agreements and keeping true intentions hidden from the public, suggest that it’s not for the best of humanity.

Big corporate meets big government in Davos alongside dubious NGOs. The agenda is about sharing best practices for social engineering and global central planning, which gives reason to suspect conspiracy.

The list of attendees is impressive (Full list of attendees) yet nothing new. Nevertheless, a new trend at this years conference is that shitcoiners are onboard and happy about it.

Perhaps the shitcoiners are unware that their protocols might not survive upcoming regulatory pressure. Or they are simply looking forward to make some money together with the legacy finance cartel. When is comes to money laundering, nobody is a better mentor than the HSBC, right?

Shitcoins like polygon are proud to attend Davos and of course they are. Shitcoins have CEOs who want to be rich and famous. Shitcoins are centralized tech startups (tech ponzi scams) with founders (frausters) who control the protocol.

This is the key difference to Bitcoin which had an inventor or inventors who left the project so it could flourish on its own. Shitcoins are only successful because of the leaders and teams who build, market and develop the network. Without these people, nobody would care.

Davos is powered by fiat money

The WEF benefits massively from the fiat standard as its corporate members and network of power (governments) is built upon the seignorage scam. It’s no wonder that seignorage scammers are welcomed. They already internalized the mindset of corruption and don’t need extra training in the WEF’s young leaders program.

Some members of the shitcoin and ‘DEFI’ sphere seem to be a good fit in the club of billionaire child molesters too.

Digitalization is a double-edged sword. The internet and Bitcoin powers free speech. But when put in the wrong hands, technology can be rather dehumanizing.

Davos is the summit of shit where government and corporate leaders receive their briefing from the godfather Klaus Schwab:

While many shitcoins proudly attended the Davos shitshow, Bitcoiners didn’t. With Bitcoin, there is no CEO or representative that could be invited, awarded or otherwise bribed. Bitcoiners are not interested in power or influence, neither do they want to force transformation upon the world. They seek a peaceful opt-out of what they believe is a system of injustice and unfair privileges.

Davos is separating wheat from chaff which is good for bitcoin.

Stakeholder capitalism actually is stakeholder communism

The idea of stakeholder capitalism, a term allegedly developed by Klaus Schwab sounds great. Of course we all want to live in a peaceful world. So isn’t it a good idea to align big corporations, governments and NGOs to work on global problems?

What Klaus isn’t telling you is that his actions and proposals stem from a rather marxist mindset. He uses well sounding language to appear like a capitalist. But his vision is a communist world where the committee organizes the economy.

Unable to understand the natural and spontaneous order, planners at the WEF think their virtuous interventionism can create a flawless and perfect world.

On its website, the WEF informs us that the goal is “global cooperation”. What it actually means is global compliance, governance and control or in other words — communism.

How can ‘sustainable development goals’ (to own nothing, eat insects and soy, live in a pod) be achieved if not forcefully?

If the WEF would be about free market capitalism they would promote “global competition”. But communists prefer “cooperation” because their own ideas suck and they have to force people to follow them. Communists are bureaucrats and central planners who are unable to compete against the creativity the free market brings about. Stakeholder capitalism is economic fascism.

Cooperation does not require any legitimacy other than the voluntariness with which it is entered into. The moral disapproval by outside third parties gives no impartial reason to stop them, since the incantation of moral standards in a pluralistic world is no ace that trump all other cards.

Rolf. W. Puster

But the tide is turning. The fiat empire cannot be continued forever as every paper currency ultimately turns to its original value of zero. The century of central planning, enabled by central banking and debt based currency is coming to an end.

Bitcoin is challenging the dollar monopoly and is reviving sound economics and sound monetary policy. The role of ‘the international community‘ (powers that be) and what they adhere to is rendered obsolete as their ‘parameters of action‘ are impotent against Bitcoin.

You cannot control Bitcoin, Bitcoin controls you.

Davos is good for bitcoin, bad for crypto

So what’s next in the agenda of Davos? Conspiracy theories such as the idea of a global internet shutdown have been circulating for many years. Although the likeliness that we see a netsplit or mandatory internet licenses and passports for consumers might be rather low, the WEF has already urged to prepare for an even bigger crisis (attack) than COVID.

An internet virus could bring our global economies to halt, devastating nations and causing uprise and chaos. That very chaos that is needed to cover-up the financial meltdown that was cause by the very same central planners that attended the WEF year after year?

Will the nightmare the WEF predicts be a similar self-fulfilling prophecy like COVID? It’s hard to believe that the internet could be shut down yet bitcoin would continue to exist. Your favorite ‘Crypto’ on the other hand, will probably snap before that, when the WEFs efforts to regulate the industry take effect.

Bitcoin is antifragile, Crypto is not

If you are afraid of Davos and coming regulation, you probably have Bitcoin left on a regulated exchange or other custodian. Bitcoin is antifragile which means it gains strength from attacks. After China banned bitcoin mining, the hashrate first dropped but then recovered. 22% of global hashrate is now back in China.

Regulation unless privatized is of course useless and stupid. It’s the cartel fighting against the market and disuptive technology that undermines their global scam. Bitcoin will need to survive all of these attacks in order to prove its robustness. It is an inevitable stress test that will challenge Bitcoin and its users around the world.

So how can this be good for Bitcoin?

By its very nature, Bitcoin cannot be stopped. Bitcoin would survive and apocalypse better than your local cockroach. That being said, central planners will have a very hard time to capture the Bitcoin network itself through regulation and compliance.

Would the millions of users and ten thousands of node operators simply turn in their bitcoin to the government and shut down the network?

Regulation takes away the edge of crypto and means the death sentence for many ‘defi’ projects. But it can’t stop bitcoin from doing its thing. Crypto users would learn the difference of real decentralization vs half-decentralized.

Since newspeak terms such as ‘non-custodial’ and ‘unhosted wallet’ are already common, we can expect an attempt to make bitcoin non-fungible and force all exchanges to blacklist ‘tainted coins’ is a matter of time.

This would be like a banning rolex watches to exist but much to accomplish. Such scenarios have been discussed by bitcoin experts for years but nobody can predict the future and we will have to wait and see how it will play out.

If you are looking to prepare yourself for any kind of scenario, you want to learn to secure your own private keys. Everyday is a great day to take bitcoin from exchanges and prepare for the apocalypse.

As the saying goes, “First they ignore you, then they laugh at you, then they fight you, then you win.”

People in Davos will talk a lot about crypto but not about bitcoin. The power of the central planners is fading as Bitcoin separates the state from the money. Davos might take down crypto. But Bitcoin will ultimately take down Davos. It’s a win-win.

Cheers