This article was originally published by Beautyon on Medium

As Bitcoin continues to grow, and countries like El Salvador successfully integrate it into their economies with over a third of their population adopting it without any problems, the people with the most to lose, the infinitesimally small number of Luddites who are resistant to any change, are becoming more and more shrill in their irrational pronouncements about Bitcoin.

Latest in a string of “DON’T TURN ON THE TURBINIUM REACTOR, OR MARS WILL MELT!” pronouncements comes from a senior policy maker at the Bank of England. The irony of this is not lost on people who know their history; it was the extraordinary genius of the British that invented the Tally Stick, the longest running form of fiat money in history.

£11,000,000 in sterling has been allocated to the rubbishing of the idea of Bitcoin, so everyone should be prepared for an onslaught of lies and propaganda. Of course, none of it will work. Everyone who has a phone knows Bitcoin works exactly as described, and it is now not possible to prevent the inevitable outcome.

A senior Bank of England policymaker has warned that digital currencies such as bitcoin could trigger a financial meltdown unless governments step forward with tough regulations.

This is FALSE. Bitcoin is not money; it is a way of accounting for money. It can be used in lieu of money, but that’s solely a contractual agreement between individuals. A financial meltdown (a phrase which has no meaning because it isn’t a number) cannot happen if a country accepts bitcoin for the payment of taxes, which the Swiss are doing, or if it is declared legal tender as the El Salvadorans have done.

Collapses of entire industries have been predicted by fearmongers in the past for many other services, and sometimes the collapse is entirely beneficial for society. The Lake Ice cutting and delivery economy was wiped out by the electric refrigerator, yes no one made the claim that there would be a meltdown of that industry, and everyone benefits from inexpensive devices that keep food fresh, preventing waste and stomach illnesses.

Likening the growth of cryptocurrencies to the spiraling value of U.S. sub-prime mortgages before the 2008 financial crash, the deputy governor Sir Jon Cunliffe said there was danger financial markets could be rocked in a few years by an event of similar magnitude.

This is FALSE. The sub-prime mortgage crisis was a direct result of low interest rates set by central banks. In Bitcoin, there is no central controller to say what the parameters are of the money supply; it is all controlled by an emotionless and independent program that people volunteer to run. This is why everyone trusts it; they know that the sub-prime mortgage crisis happened in a 100% regulated environment where the central banks and “regulators” had total control of everything.

That anyone could believe that a statement like this would be taken seriously is in itself, beyond belief. People from every walk of society, from billionaires to bumpkins are buying and using bitcoin for their own purposes and they all know it can be relied upon absolutely to be the same every day, day after day.

Bitcoin and its nearest rival, Ethereum, tumbled in value earlier this year but have recovered ground to reach towards all-time highs. Only five years ago a single bitcoin was worth about $700 (£513) compared with $56,000 (£41,000) today. Ethereum has almost doubled in value since July to $3,500.

Bitcoin is not a rival of Ethereum, and this statement shows that the journalist doesn’t understand anything about Bitcoin or why it was written or what Ethereum is. Also, the price of Bitcoin in fiat dollars is actually infinity. Fiat money has no value, and its supply is unbounded. Bitcoin has a permanently bounded supply and so you are dividing a whole number by 0, which is infinity. This is the true situation; Bitcoin behaves just like sound money, and because it is absolutely transparent and free from central control, it can be absolutely relied upon as a form of money.

The understanding of this is spreading globally and at the very least, Bitcoin will replace all fiat transactions on the internet. El Salvador and other South American nation states are going to adopt it also, starting with Brazil. These are the places that are going to benefit dramatically and prosper extraordinarily by accepting the discipline of Bitcoin.

Cunliffe has played a central role in monitoring cryptocurrencies over recent years as an adviser to the G20’s financial stability board and the central banks’ overarching advisory body, the Geneva-based Bank of International Settlements.

This is the Appeal to Authority Fallacy.

A highly respected former Whitehall mandarin with contacts in political and central bank circles, his warning is likely to grab the attention of senior treasury officials in the UK, Washington and Tokyo.

Japan is starting to accept bitcoin widely, and the USA is now the global centre for Bitcoin mining, with senators openly conceding that they are buying and storing their wealth in bitcoin as a hedge against their own profligate government that they claim to run. You couldn’t make it up if you tried.

Cryptocurrency coins have grown in value by about 200% this year, from just under $800 billion to $2.3 trillion, and have risen from $16 billion five years ago.

There is no such thing as “cryptocurrency coins”. This is bad journalism.

Cunliffe said that while the finance industry was more robust than in 2008 and that governments should be wary of overreacting to financial innovations, there were reasons to be concerned about traders using digital currencies that could be worthless overnight.

This is pure HOGWASH and the Appeal to Fear Fallacy. There is no reason to believe that bitcoin will go to a price of 0 after almost 11 years of uninterrupted uptime, and even if it went to $1, the utility of bitcoin will remain exactly the same, because it is DATA and not MONEY.

“Of course $2.3 trillion needs to be seen in the context of the $250 trillionglobal financial system. But as the financial crisis showed us, you don’t have to account for a large proportion of the financial sector to trigger financial stability problems — sub-prime was valued at about $1.2 trillion in 2008,” he said.

This is just the beginning. I can assure you now, that every country in the entire South American continent will be introducing Bitcoin legal tender laws, and even if they do not, every phone user will have a Bitcoin wallet on it. That’s somewhere under 385,742,554 users.

Now think of the continent of Africa. Nigeria is now the leading country per capita for Bitcoin adoption in the world. If the Nigerian government decides to embrace the future rather than fight it, it can begin to accept bitcoin for the payment of taxes, and watch its national treasure gain in value as Bitcoin adoption goes global.

Speculation in sub-prime mortgages in the U.S. was driven by low-income households using mortgages with ultra-low interest rates.

And of course, what this leaves out is that interest rates are not set by the market; they are set by the central banks; they were the cause of the sub-prime mortgage debacle, not the free market. For them to now turn around and claim that Bitcoin, that has no owner or controller, will be the cause of a disaster is laughable, and everyone knows it, and is laughing at it.

Cunliffe said there was evidence that speculators were beginning to borrow money to buy crypto assets, heightening the risk of a crash infecting the broader financial system.

This is FUD and even if it is true, you would have to be a fool not to go all in on bitcoin, since the fiat musical chairs party is about to end. 40% of U.S. dollars in existence were printed in the last 12 months: Is America repeating the same mistake of 1921 Weimar Germany?

At the moment surveys suggested that spending on cryptocurrencies was backed with only about $40 billion of borrowed funds. But there was evidence traders were increasingly speculating on the future value of digital currencies.

This sentence doesn’t make any sense.

- Who made these surveys, and why are they not linked or published?

- Cryptocurrencies are not “backed with borrowed funds”. That’s a lie.

- Where is the evidence that traders are “increasingly speculating on the future value” and even if they are, that’s exactly what happens in stock markets.

This is also an extraordinarily myopic point of view, and it excludes the example of El Salvador and the city of Lugano, Switzerland, where bitcoin has been made legal tender, and the potential of bringing in a billion unbanked people into the global ecommerce system, through a payment rail that totally eliminates payer fraud and that is 100% reliable.

He said traders on the Chicago Mercantile Exchange were handling $2 billion of cryptocurrency purchases a day and the popularity of futures trading was attracting hedge funds and other speculators.

This is just the beginning and is a tiny fraction of the total use case scenario that is unfolding in front of your eyes.

“The bulk of these assets have no intrinsic value and are vulnerable to major price corrections. The crypto world is beginning to connect to the traditional financial system and we are seeing the emergence of leveraged players. And, crucially, this is happening in largely unregulated space,” Cunliffe said.

This is FALSE, and asinine. The paper fiat money of the West has no intrinsic value. That is an absolute fact. Also, the the fact that the market is unregulated is a very good thing; it means that business models can be experimented upon just as how a website should work was a matter of pure free-market experimentation for decades. Remember; Bitcoin is software only, and it is indistinguishable from any other software tool or service. I order for the correct business models to be built on it, entrepreneurs need to be free to innovate; this is happening in the USA, China and other free jurisdiction where software development is not a restricted activity.

Bitcoin mining which was very successful in China has just moved to Texas because the government there cannot lead the world and can only follow. They opted to move to the USA because it is a free jurisdiction. The British were warned about this, and it appears that they are not minded to listen.

“Financial stability risks currently are relatively limited but they could grow very rapidly if, as I expect, this area continues to develop and expand at pace. How large those risks could grow will depend in no small part on the nature and on the speed of the response by regulatory and supervisory authorities,” he added.

This is FALSE. The Bitcoin economic system is totally stable; it is the fiat system that is unreliable and unstable. 1BTC = 1BTC and that is always true. It is the fiat system that has a money that has no measurable value, that decreases over time and which is guaranteed to steal your spending power from you by design.

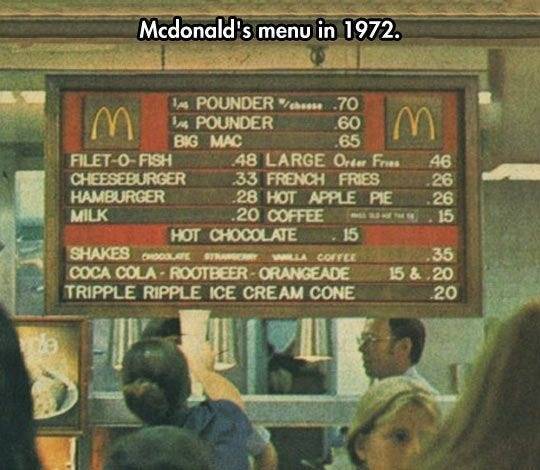

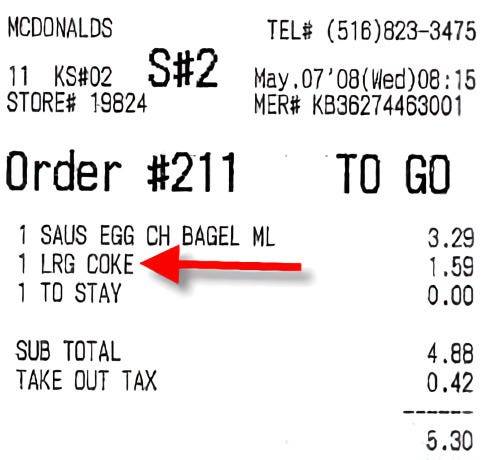

The prices in this photo from 1972 show the effect of central bank money on prices. Because the supply of money is increasing year on year, it takes a higher amount of money year on year to buy the same goods. A coke in 1972 cost 15 cents; today it’s $1.59, over ten times as much in fiat.

The explanation for this is that the amount of money in circulation has been increased by the Federal Reserve. Everyone who is piling into bitcoin knows this and knows that even if it takes another generation for the fiat system to collapse, they can escape right now by saving their money in bitcoin. In 20 years the fiat will have increased in supply — this is guaranteed — and their bitcoin will not. The bitcoin you buy today will not lose it’s value because its supply cannot be increased arbitrarily. People storing their wealth in bitcoin today will benefit greatly, and this is an incontrovertible fact.

There was also a growing conflict between the need to develop standards in “a painstaking, careful process” and the rapid growth of digital trading.

Bitcoin has standards built into it; this is why it can do what it does. It cannot and will never accept standards imposed upon it by central banks; that’s why everyone wants it, from George Soros to George in Peckham. What these people cannot stand is that Bitcoin was released and is being adopted without consultation with them.

Cunliffe said guidance drafted by the bodies that regulate global financial markets had taken two years to write, during which time trading platforms for digital currencies had expanded sixteen fold.

Countries run by prudent leaders are now competing for entrepreneurs to settle in their jurisdictions to serve the public with Bitcoin. Brazil and all other South Americas are onboarding, Nigeria is going full throttle and soon it will not be possible to find a place where Bitcoin is not being accepted, and all laggard countries will eventually adopt it.

The £11,000,000 Sterling budget will be “outspend” by the many Bitcoiners who are spreading it peer to peer; most of these people are outside of the UK and many of them don’t speak English, and so will never be poisoned. Even the ones that do speak English will very probably never be harmed by the false stories being cooked up to try and dissuade people from using bitcoin. Then there are the legions of fanatical “Bitcoin Hodlers” who will never ever ever ever give up and never ever ever sell. They will buy all dips and laugh out loud at the lies being trotted about to dissuade them that water is wet.

Then there are the users who instantly see bitcoin as a super useful extra tool on their phones because they have a need to send money from A to B. Nothing you can say to them after they’ve received their first bitcoin and sent it across the world instantly will dissuade them that it doesn’t work or that it is no good.

The intelligent Wall Street insiders know the jig is up for fiat, and they’ve realized that bitcoin is their safe way out of the system. They are secretly and in public, moving their treasuries to Bitcoin, because the numbers add up.

The only people talking against bitcoin are the ignorant (Nouriel Roubini, Nassim Taleb and others) or the people who have something to lose; the businessmen running the fiat system that bitcoin is set to replace.

The horse and cart was replaced by the internal combustion engine…

The ice box was replaced by the electric refrigerator…

The ice man got another job.

This is going to happen to everyone who makes a living off of the fiat system. It is going to be replaced by bitcoin.

And there is nothing you can do about it.