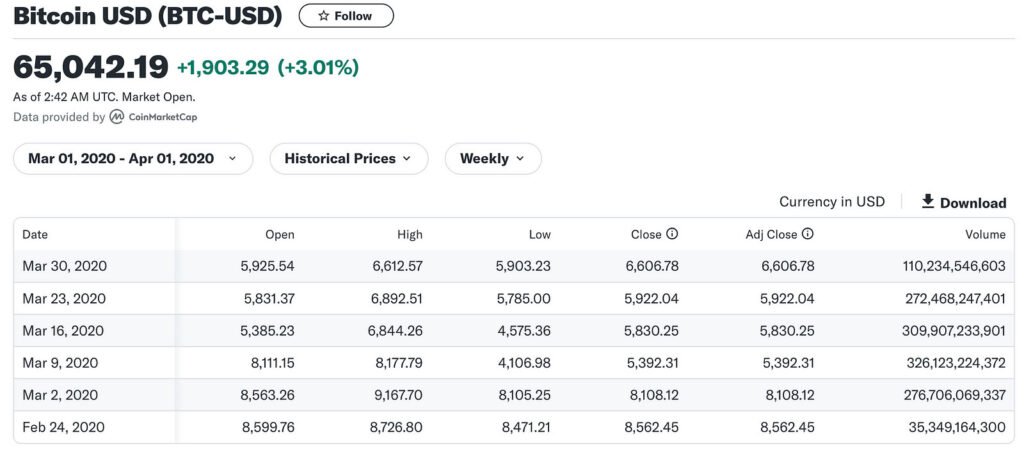

The cheapest way to buy Bitcoin is on the red days when everyone else is scared and selling it. When the COVID-19 pandemic struck, bitcoin’s value briefly plunged to around $4,000 USD, triggering a wave of panic selling. However, those who had the foresight and fortitude to increase their investments during this tumultuous period reaped substantial rewards, as bitcoin’s value skyrocketed from approximately $4,000 to $64,000 by the end of March 2021. It’s not often people can witness a roughly 15-fold return on their investment in a year.

Maintaining a Long-Term Perspective

It’s crucial to maintain a long-term perspective. While the allure of purchasing during periods of euphoric price surges is strong, the most prudent strategy is to accumulate when market sentiment is overwhelmingly negative, and investors are eager to divest their holdings.

The Dual Forces of Fear and Greed

The inherent duality of fear and greed is the driving force behind market cycles, and Bitcoin exemplifies this phenomenon in its purest form. As the world’s most free and open market, operating 24/7 without interruption, bitcoin’s price movements are dictated solely by the collective psychology of its participants. When fear takes hold, panic selling ensues, creating lucrative buying opportunities for those with a level-headed, long-term outlook. Conversely, during periods of unchecked exuberance, irrational buying frenzies push prices to unsustainable heights, ultimately leading to corrections. Navigating this constant ebb and flow of market emotions is nearly impossible and 99.999% of people are better off hodling than trading based on their technical analysis.

A Simple Yet Rewarding Strategy

While attempting to time the market and perfectly execute trades can be an alluring yet arduous endeavor, a simpler and more rewarding strategy is to accumulate bitcoin during periods of heightened fear and market downturns. By adopting a contrarian mindset and making strategic purchases on the red days, one can gradually amass a large bitcoin portfolio without the added stress of trying to catch the absolute bottom or top of market cycles.

True Value: Acquiring Tangible Assets

Ultimately, the true value of Bitcoin lies in its potential to serve as a store of value and a means of acquiring tangible assets or things that hold real, lasting value — a house, a piece of land, or other possessions that enrich one’s life. Rather than constantly trading bitcoin for increasingly worthless fiat currency, a buy-and-hold approach, with strategic accumulation during market dips, can position individuals to leverage their bitcoin holdings for meaningful purchases that bring enduring satisfaction and security.

Cheapest Way to Buy Bitcoin: Lowest Fees

While the primary focus of this article has been on the most opportune times to accumulate bitcoin, another pertinent question arises: where can one purchase bitcoin with the lowest fees? The answer depends on various factors, including the size of the purchase, the knowledge and reputation of the seller, and the jurisdiction involved.

For many individuals, a service like Swan Bitcoin can be an attractive option, as the company recently introduced a zero-fee offering for both existing and new clients’ purchases up to $10,000 worth of bitcoin. Swan’s mission statement is to do what’s best for both Bitcoin and Bitcoiners.

Disclaimer: It’s important to note that the author of this piece is an employee of Swan Bitcoin.

While this affiliation has been disclosed for transparency, the views and opinions expressed here are the author’s own and do not necessarily reflect the official stance of Swan Bitcoin or any associated entities.

Regardless of the platform or service chosen, the key principles outlined earlier — maintaining a long-term perspective, cultivating emotional discipline, and using Bitcoin as a vehicle for acquiring tangible assets — remain paramount. By combining these strategies with a judicious approach to minimizing fees, individuals can increase their stack in the world’s most scarce money.