“There are weeks when nothing happens, and weeks when decades happen”.

This week was the latter, as asset managers and Wall Street titans finally began offering their clients real Bitcoin exposure.

Newsworthy events this week include:

China swings the ban hammer at Bitcoin (yet again).

Spot Bitcoin begins trading directly on the floor of the CME.

Charles Schwab signals it will undercut crypto exchanges on fees.

Latest News

Adoption

Spar, one of Europe's largest supermarket chains, accepts bitcoin and other crypto directly through its Swiss app, replacing third-party processors with fully integrated on-chain QR payments.

Moodring integrates with TradingView so your ring can give you real-time haptic feedback on Bitcoin's movements.

Lamborghini is partnering with Ledger on an exclusive Ledger Stax hardware wallet arriving in early 2026 with custom packaging and a branded Magnet Folio.

Legal

Japan plans to introduce a flat twenty percent tax on crypto gains in its 2026 reform outline, aligning digital assets with equities and replacing the current system, under which BTC taxes can reach fifty-five percent.

CFTC-regulated exchanges like the Chicago Mercantile Exchange can provide spot bitcoin trading under updated rules that bring the market onshore and provide equal treatment for traders.

China's central authority reaffirmed its ban on digital assets, declaring virtual currencies illegal and citing risks like laundering and fraud, pledging continued crackdowns after a Nov. 28 meeting.

Markets

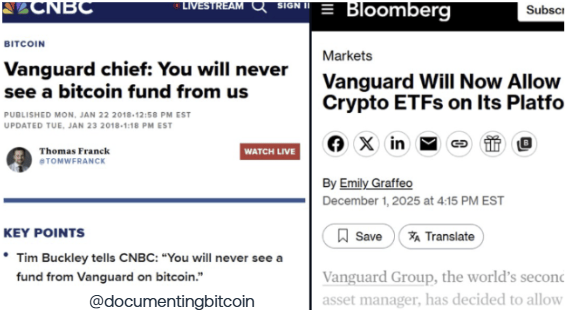

Vanguard shifts its long-held stance and allows trading of regulated Bitcoin ETFs and mutual funds, giving 50M clients exposure as growing demand drives the policy change.

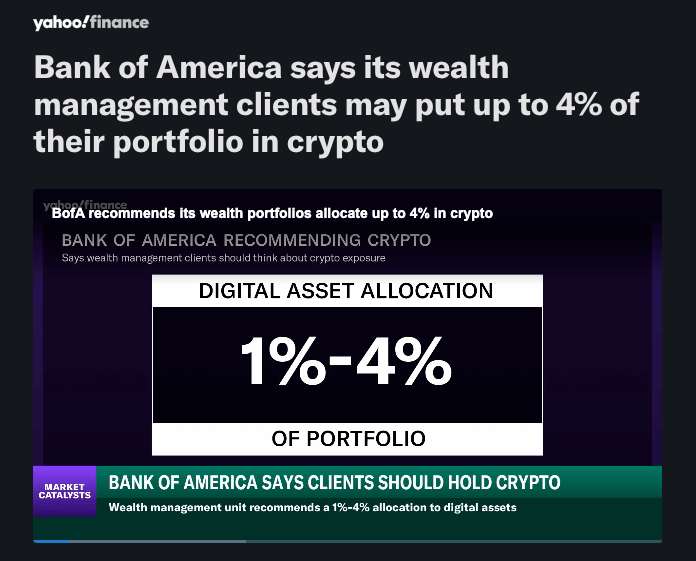

BoA's Private Wealth and Management arm (valued over two trillion) will allow wealth advisers to recommend a 1-4 percent crypto allocation starting in January, focusing on four spot bitcoin ETFs.

Charles Schwab will launch spot bitcoin trading in early 2026, its CEO confirmed, and analysts say fees below half a percent could pressure crypto exchanges that rely on higher trading charges.

Treasury

Strategy establishes a 1.4B reserve funded through its ATM share offering to support preferred-stock dividends and interest obligations, with plans to expand the reserve to cover at least 24 months of payments.

Cantor Equity Partners shareholders have approved a merger with Jack Mallers' Twenty One Capital, which will begin trading on the NYSE as "XXI" on December 9 with auditable proof of reserves.

Strive is urging MSCI to drop its proposal to exclude companies with digital-asset holdings above half of assets, calling the rule unworkable and harmful to passive investors.

Mining

Japan launches a 4.5 MW, state-backed Bitcoin mining initiative via a partnership between Canaan Inc. and a utility company, becoming the 11th country globally to use government resources for BTC mining.

Bitcoin's decline has driven hashprice to a record low of $35 per PH/s, below the forty-four dollar median production figure, extending rig payback periods past 1,000 days.

Malaysian authorities have launched a crackdown on nearly 14,000 illegal Bitcoin mining rigs that have taken 1.1B in electricity since 2020.

Politics

Indiana's HB 1042 would require state retirement plans to include digital-asset ETFs, allowing workers to allocate retirement savings to BTC while adding protections for mining, payments, and private keys.

Polish President Karol Nawrocki vetoes a bill that would regulate the crypto-assets market under EU rules, arguing it threatens citizens' freedoms and state stability.

President Trump has seen his net worth decline $1B since the summer as his family's crypto ventures (American Bitcoin and World LibertyFi etc.), have taken substantial losses in recent months.

Bitcoin Trivia

If Vanguard's clients allocated just 1% to Bitcoin, how much would that represent?

Recommended Take

Every cycle ends the same way: funds are safe (until they aren't).

FTX had “bulletproof” custody too. I've been using the Blockstream Jade Plus for six months.

Setup took 10 minutes, it's air-gapped (no WiFi, no Bluetooth), and it works with Sparrow and Specter (the apps that I already use).

Code "BitcoinNews" takes 21 % off.

Bam’s 2 Sats

How Vanguard and BofA Surrendered to the BTC Standard

This November looked set to close on a positive note after Bitcoin climbed fifteen percent from the 80K dip, but it rolled over at month's end and finished with a brutal negative seventeen percent return (the second-worst November on record).

And yet, the market movement ended up feeling like the least interesting part of the week. Something began to shift deep in the boardrooms that have historically wanted nothing to do with Bitcoin. It felt like one of those moments where everything starts falling into place.

Institutions aren't a surprise anymore. They're present, and as Bitcoin matures, they're the ones bringing deep capital. But even if their presence is expected, the headlines were enough to raise eyebrows.

Relief began with the Vanguard news. One of the world's largest and most influential asset managers, with more than $ 9 trillion under management, finally reversed its long-held stance and opened its platform to Bitcoin ETFs.

Vanguard represents a massive pool of capital, but if you're outside the US like myself, it's easy to miss just how big it is. Vanguard is where disciplined, long-term savers keep their retirement portfolios, not speculators.

In practical reality, almost every American over 30 has some type of long-term savings with them. And those people can get Bitcoin exposure.

Then came BoA. Starting in 2026, its wealth division will formally recommend a one to four percent Bitcoin allocation to high-net-worth clients. Another clear signal that the mainstream lens is shifting.

Both moves reshape Bitcoin's image. They may not spark immediate rallies, but they push Bitcoin out of the "speculative toy" bucket in the minds of normies. The hope is that curiosity follows, that people don't just add a slice to their retirement portfolios but eventually learn enough to hold their own keys.

But Bitcoin's institutional image rehabilitation tour didn't end there. BlackRock CEO Larry Fink took the stage at the NYT DealBook Summit and openly admitted he had been wrong about Bitcoin.

Then Jensen Huang, CEO of the world's largest company by market cap, offered public support for Bitcoin, calling it "energy currency" live on stage at the Bipartisan Policy Center.

Who knows what the short term brings. But the foundation on Wall Street is being laid piece by piece, and the narrative inside the world's largest pools of capital is clearly shifting for the better.

Bitcoin's long-term path looks as strong as ever. Tuesday's bounce after both announcements was a nice reminder of that — and, honestly, pretty lovely to watch.

Stay safe and keep on stacking!

-Bam

P.S. What's the most interesting story you'd like me to dig in to next week? Reply to this email (I read every response).

This Week on Bitcoin News [Live]

Join Rob Wallace as he goes live with Unchained’s Trey Sellers to discuss Bitcoin’s massive week of institutional adoption.