Key Takeaways

Indiana’s HB 1042 would require public retirement plans to offer at least one digital-asset-related ETF option.

The bill adds protections for digital asset use, mining, and private keys across the state.

A new task force would study statewide blockchain adoption and potential pilot programs.

Indiana Bill Could Reshape Public Pensions and Digital Asset Policy

Indiana lawmakers are working on a new bill that could make bitcoin part of state retirement programs. The goal is to let public workers invest in bitcoin through ETFs.

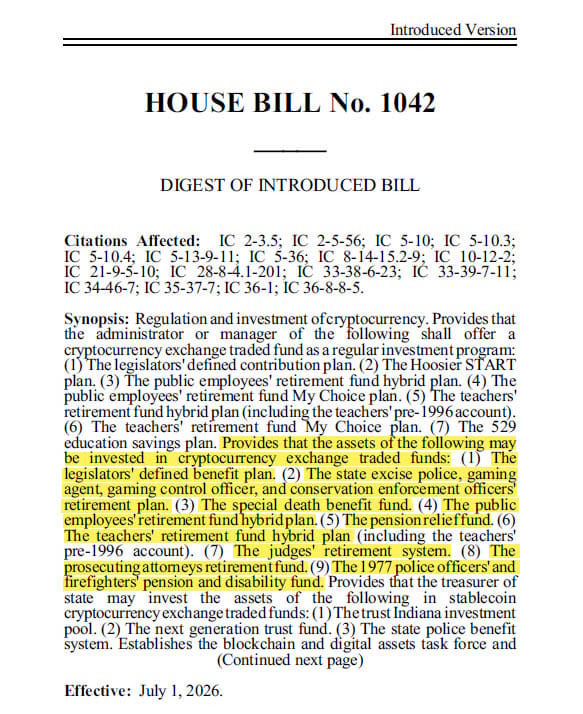

The bill is called House Bill 1042 and was introduced by Rep. Kyle Pierce, a Republican from Anderson. The proposal has gained attention because it shows how serious Indiana is becoming about Bitcoin. Pierce says the plan is about giving people more choices.

Indiana House Bill 1042

“Digital assets are quickly becoming part of everyday finances, and Indiana should be ready to engage in a smart, responsible way,” he said. He wants Indiana to prepare for the growing use of digital money, noting, “This bill gives Hoosiers more investment choices while establishing guardrails and helping us explore how blockchain and digital asset technology can benefit communities across our state.”

If approved, state-managed retirement programs would have to include at least one digital asset ETF option. This means workers could choose to invest part of their retirement money into bitcoin.

This rule would apply to many public programs, including teachers’ pensions, employee plans, lawmakers’ retirement accounts, and Indiana's 529 college savings fund. These plans have never been required to offer bitcoin before.

It’s important to note that the bill does not allow direct buying of bitcoin by the state. Instead, it only allows investments through ETFs. Supporters say this is safer and easier for retirement systems.

The proposal also sets rules to protect everyday digital asset use. It would stop cities and counties from “unreasonable” banning or heavily restricting bitcoin payments, mining, or digital wallets unless similar rules apply to regular financial activities.

The bill also claims it protects private keys. A court could only demand access to someone’s private keys if there is no other way to get the necessary information. This, according to the bill, protects people who store their own bitcoin.

The bill says:

“Provides that a court may compel a person to disclose a digital asset private key only if no other admissible information is sufficient to provide access to the digital asset.”

This could mean if a court decides it needs to gain access to someone’s bitcoin, it can legally require the individual to give up their private keys.

Bitcoin mining would also be protected. Local governments would not be allowed to kick miners out of industrial zones, and home mining would be allowed under normal residential rules, as long as standard noise limits are respected.

The bill also creates a Blockchain and Digital Assets Task Force. This group will study how the state government could use blockchain and may recommend pilot programs for future testing.

Other states have been exploring similar ideas. Texas, Wyoming, Michigan, New Hampshire, and others have already added bitcoin exposure or protections for digital assets.

In the meantime, the Michigan state pension fund increased its bitcoin ETF holdings to $6.6 million in July.

However, Indiana is going further. If the bill passes, it would become the first state to require bitcoin to be offered in public pension plans, not just allow it. This is different from what Michigan did.

Michigan’s pension fund itself made a discretionary investment on behalf of its beneficiaries. But HB 1042 is structured to require administrators of many public-employee or retirement plans to offer bitcoin-ETF options. It means individual public workers or pension members would have the choice to allocate some of their retirement funds to bitcoin ETFs.