Key Takeaways

Digital asset theft is turning physical, with kidnappings, torture, and home invasions replacing traditional hacks.

Rising bitcoin prices strongly correlate with more frequent and more violent attacks.

Overall risk per holder is lower, but visible or high-value individuals face extreme danger.

When Bitcoin Theft Moves From Screens to the Streets

As Bitcoin becomes more popular, a dangerous trend is growing alongside it. Criminals are increasingly using physical violence to steal digital assets from ordinary people. These crimes are known as “wrench attacks”; situations where attackers threaten or harm someone to force them to hand over passwords, phones, or private keys.

Instead of hacking computers, criminals are now attacking people in their homes, on the street, or while traveling. Experts say these attacks are happening more often and are becoming more violent.

Bitcoin security researcher Jameson Lopp has tracked physical digital asset attacks for years in a public database. His data was recently analyzed by Haseeb Qureshi, a managing partner at digital assets investment firm Dragonfly, and the results were alarming. Qureshi wrote:

“You’re not imagining it: the number of attacks has been increasing over time. Not only that, the attacks are getting more violent.”

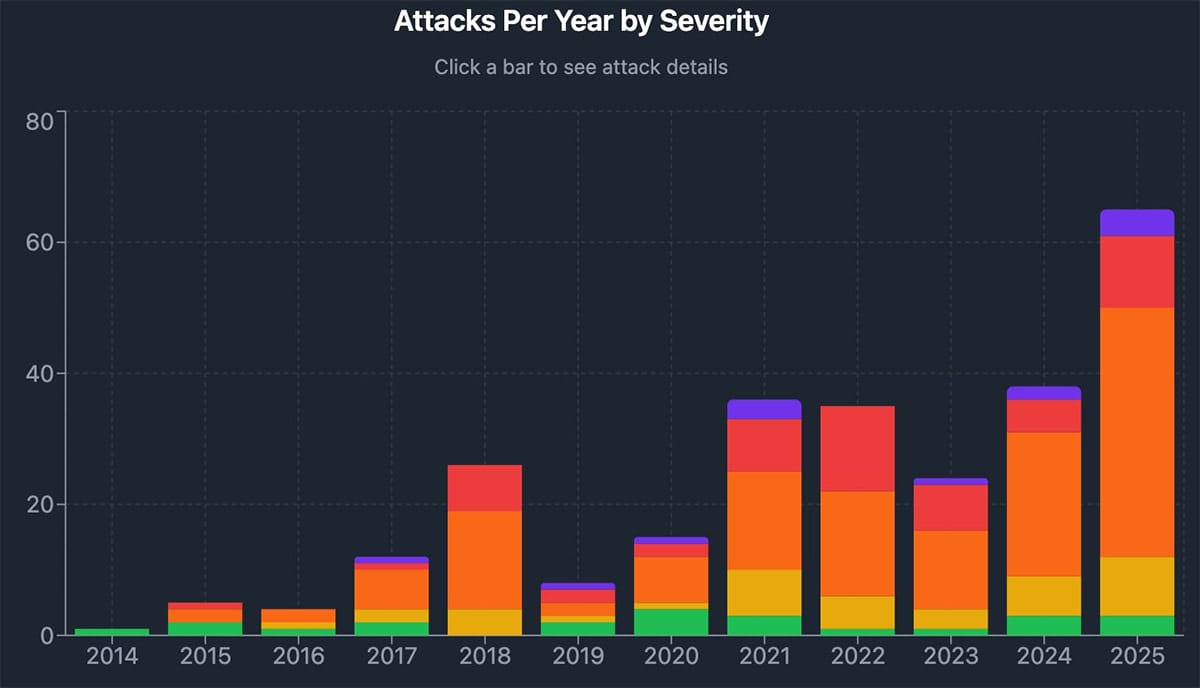

Graph of “wrench attacks” per year by severity — Haseeb Qureshi on X

According to the data, dozens of wrench attacks happen every year, and many more likely go unreported. Victims often stay silent because they fear being targeted again or don’t trust law enforcement to help.

One major reason for these attacks is price. When bitcoin’s prices rise, criminals see a bigger opportunity. Qureshi found that about “45% of the variance in violence is explained simply by price.” In simple terms: when bitcoin is worth more, it attracts more criminals.

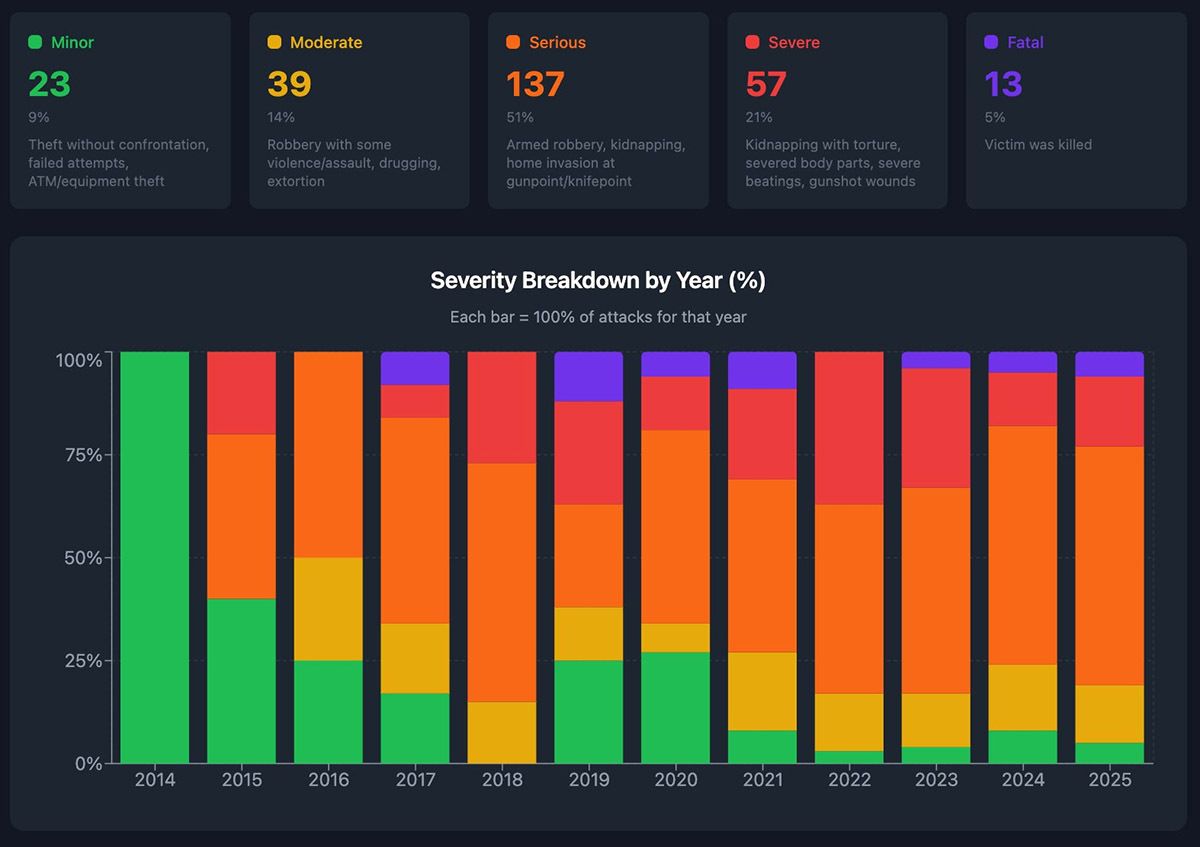

Severity breakdown by year — Haseeb Qureshi on X

Geography also plays a role. Western Europe and parts of Asia have seen the sharpest rise in attacks. North America is still safer by comparison, but even there, the total number of incidents has gone up.

Wrench attacks’ severity by region — Haseeb Queshi on X

At first glance, the trend looks terrifying. But the data also shows something important: ownership of digital assets has grown much faster than violence. When attacks are adjusted for how many people actually own digital assets, the risk per person has gone down.

Qureshi noted, “Crypto was actually more dangerous in 2015 and in 2018, back when crypto was very small.” There were fewer attacks then, but exponentially fewer holders. There are more attacks today, but there are also many more holders.

This means the average person is not necessarily more likely to be attacked, but some people are. Experts describe this as a “paradox of scale.” Bitcoin is safer overall, but risk is becoming concentrated on visible individuals, people who appear wealthy, talk publicly about their holdings, or are known to control large amounts themselves.

As Bitcoin grows, attackers are less interested in breaking systems and more interested in finding people they can pressure. “This is serious,” Qureshi warned. “There’s a lot you can do to invest in your own personal security if you’re high-risk.”

Behind the data are real stories. One case, reported by Bloomberg, involved a retired woman in Florida named “Julia,” who invested heavily in digital assets after learning about it online. After losing most of her savings to a hack, she later survived a violent home invasion.

Masked men broke into her house, held guns to her head, and demanded her digital assets’ passwords. “We’re going to kill you if you don’t give it to us,” one attacker said.

Her experience is not unique. In 2025, several horrifying cases made headlines. In France, a digital assets’ industry executive was kidnapped, and one of his fingers was cut off to pressure ransom payments.

In Canada, attackers waterboarded parents and sexually assaulted their daughter. In Austria, a young man was beaten, burned, and killed for his digital asset holdings.

These crimes show how far attackers are willing to go.

As Bitcoin security improves with hardware wallets, two-factor authentication, and better monitoring, traditional hacking has become harder, and now, criminals are adapting.

Per Bloomberg, one gang member summed it up bluntly during a U.S. court case: “If we cannot hack them, we rob them.” In other words, risk is moving from the internet into the real world.