On July 23, 2024, Lightning Labs released the first mainnet version of the multi-asset Lightning Network, officially bringing support for Taproot assets to the Bitcoin Lightning Network. This milestone event marks the formal introduction of stablecoins on the Lightning Network.

So, what makes stablecoins on the Bitcoin Lightning Network different from those on other blockchains?

For stablecoins like USDT and USDC running on blockchains such as ETH and Solana, we often see them used primarily as a medium of exchange and a unit of account to value other digital assets, with limited real-world use cases.

The Bitcoin Lightning Network, however, fills this gap. With its settlement speed of up to 1 million transactions per second (1M TPS), ultra-low fees, and high security, the stablecoins on the Lightning Network truly stand out.

Benefits of Stablecoins on the Bitcoin Lightning Network

Here are three use cases that help illustrate the unique benefits of stablecoins on the Lightning Network.

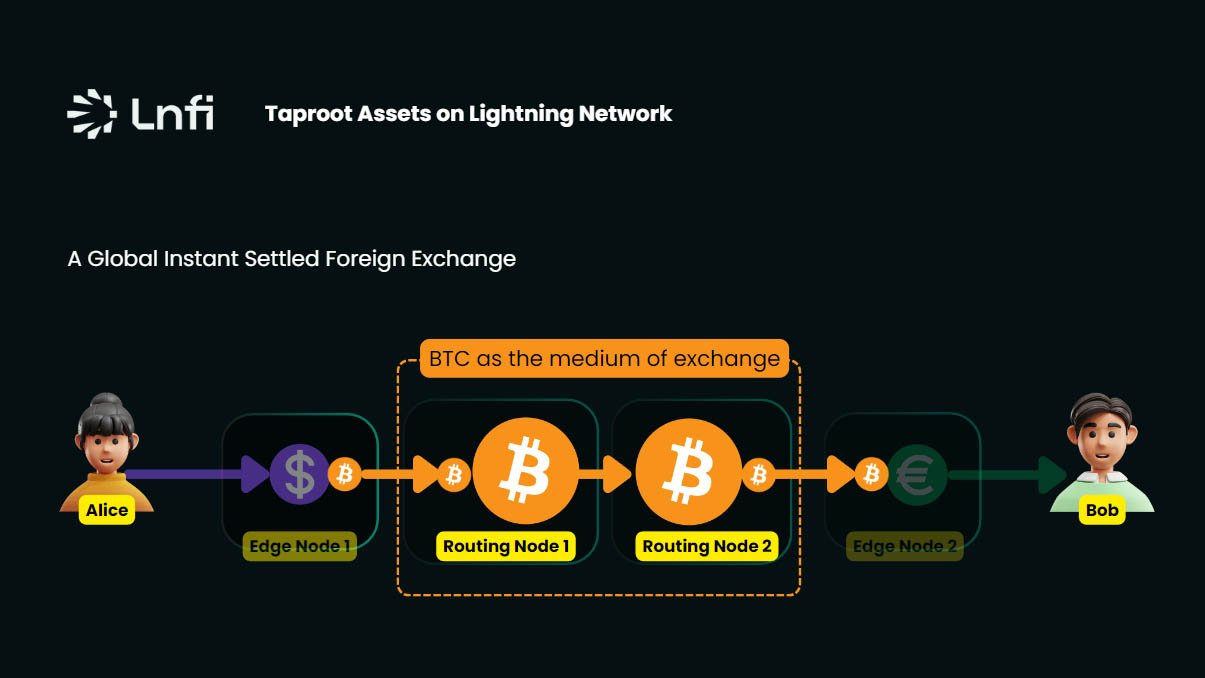

Global Instant Settlement Foreign Exchange

Alice sends USD stablecoins and Bob receives EUR stablecoins.

Using the Bitcoin Lightning Network, Alice and Bob can exchange USD for EUR natively, with the process being atomic, decentralized, secure, and instantaneous. In contrast, traditional financial systems would charge high fees of 2-5% and take several days to settle similar transactions.

The open nature of the Lightning Network allows anyone to become an Edge Node or Routing Node, providing liquidity to earn native yield and driving down spreads and fees to ensure the most competitive rates for end-users.

Direct Payment with Stablecoins Using Lightning Invoices for Purchases

Let’s look at another scenario where stablecoins are combined with real-world payments.

Currently, merchants and platforms like Nubank, Shopify, PickNPay, NCR, Blackhawk, Clove, and Bitrefill already support Lightning Network payments. Even small, interesting businesses like Pubkey@NYC and JooBar@SG have jumped on board with Lightning payments.

Through the existing Lightning Network, with no upgrades on the existing infrastructure required, stablecoins can be easily used for these payments, as in the case of Alice buying a coffee, with the cafe receiving bitcoin.

We can see that using stablecoins like USDT and USDC for real-world payments remains challenging on other blockchains, but this is where stablecoins on the Lightning Network naturally shine.

Stablecoins Will Benefit Bitcoin

Stablecoins in Taproot Assets will align the interests of both Bitcoin miners and Lightning users in several key ways:

- BTC as a Medium of Exchange for Routing Nodes: Stablecoins in Taproot Assets allow Bitcoin to be used as a medium of exchange within the Lightning Network as shown in the first animated image above. This creates utility value for Bitcoin.

- Liquidity Provisioning: Users can earn yield securely by participating in liquidity provisioning on the Lightning Network. This yield is generated through Request For Quote (RFQ) spreads and routing fees, giving Bitcoin a financial value derived from cash flow multiples.

- Increased Network Activity: The presence of stablecoins in Taproot Assets will lead to more frequent channel openings and closures, as well as loop-ins and loop-outs.

The increased network effects on the Lightning Network are expected to drive more Bitcoin transactions on the mainnet, beyond what would occur with purely vanilla transactions without Lightning Network.

These, in turn, are likely to create more demand for Bitcoin for onboarding to the Lightning Network.

However, for the widespread adoption of stablecoins on the Lightning Network, both internal and external challenges need to be addressed.

External: Bridging the Lightning Network with Traditional Finance

To connect with traditional finance, addressing concerns related to regulation and compliance is essential. LightSpark has developed UMA, which supports a comprehensive range of compliance messaging for anti-money laundering, sanctions reviews, and travel rule requirements.

LightSpark has successfully integrated the Lightning Network with several centralized institutions, including Bitso, Bitnob, Coins.ph, Foxbit, Ripio, Xapo Bank, etc.

Related: Lightspark Unveils Instant Bitcoin Lightning To US Banks Payment Solution

On the other hand, Amboss team has developed Reflex, a payment operations platform that offers proactive risk management for compliance policies on the Lightning Network.

This platform enables entities to implement their compliance policies effectively, ensuring they meet regulatory requirements.

In the near future, hundreds of millions of users will have quick access to the Lightning Network.

Internal: Deep Liquidity of Stablecoins on the Lightning Network

To trigger positive flywheel effects, deep liquidity of stablecoins on the Lightning Network is crucial in three areas:

- Demand Liquidity: From a critical mass of end users.

- Supply Liquidity: From Edge Node operators providing RFQs and Routing Node operators facilitating transactions of all sizes. Substantial channel liquidity is essential, especially as the network evolves beyond microtransactions.

- Hedging and Rebalancing Liquidity: Access to deep liquidity sources is vital for Edge Node operators to hedge positions and rebalance inventories on the Lightning Network.

Lnfi Network is well-positioned to bridge these gaps and drive global Lightning adoption by addressing the last mile with the following initiatives:

- LN Exchange: A high-performance order book offering deep liquidity for stablecoin pairs issued via Taproot Assets. It will be the go-to platform for Edge Node operators to hedge and rebalance liquidity. An alpha release is coming soon.

- LN Node: A Nostr-powered service for easy lightning node management, channel handling, and liquidity provision.

LN Node powers Lnfi’s Node, offering RFQ and routing for stablecoins, utilizing LN Exchange’s liquidity to hedge against impermanent losses and rebalance channels 24/7. This feature will soon be available to all Lightning nodes. - LightningFi: A user adoption and liquidity incentive program on the Lightning Network, featuring protocol token rewards.

LightningFi #1, Channel Mining, allows users to set up a cloud-hosted Lightning node, open a channel, and deposit bitcoin to earn token incentives, similar to earning interest in traditional finance.

Through Lnfi Network, you can access global connectivity to leading nodes, including Binance, OKX, Wallet of Satoshi, and many others. This will allow users to seamlessly pay or receive payments in any stablecoins from anyone, anywhere.

Stablecoins on the Bitcoin Lightning Network are poised to be the key to unlocking global adoption by addressing the critical last mile. With their unparalleled transaction speed, low fees, and high security, they offer a unique solution that traditional blockchains have struggled to achieve.

By bridging the gap between digital assets and real-world use cases, stablecoins on the Lightning Network will empower users, merchants, and financial institutions worldwide, driving a new era of financial inclusion, making global payments faster, cheaper, and more secure for everyone.