Peter Schiff, a renowned economist and gold bug, has criticized Bitcoin’s role and utility in today’s economy. According to his remarks, Bitcoin is “useless”, and its advocates are “like a cult”, trying to convince people to buy bitcoin after buying it themselves.

Unpacking ‘Luxury Beliefs’

Before delving into Schiff’s criticisms, it’s essential to clarify the concept of ‘luxury beliefs’. These are perspectives held predominantly by the elite, often as a means to showcase their societal status, rather than rooted in genuine belief. Such views allow the privileged to stand out by voicing contentious and morally charged opinions, prioritizing virtue signaling over making a real societal impact.

Schiff’s Stance on Bitcoin

In a recent tweet, Schiff articulated his belief that Bitcoin is more of a commodity to be sold rather than bought. He emphasizes the idea that people are drawn into buying bitcoin only after being persuaded by its advocates.

Finally @novogratz got something right about #Bitcoin. He admitted that it's not bought, but sold. No one needs Bitcoin. So people only buy it after someone else talks them into doing so. Then once they buy, they immediately try to convince others to buy too. It's like a cult.

— Peter Schiff (@PeterSchiff) October 18, 2023

Counterarguments – Recognizing Bitcoin’s Utility

In response to Schiff’s skepticism, Dan Victor highlighted Bitcoin’s inherent value in a tweet. He describes Bitcoin as ‘digital gold‘, emphasizing its finite nature and the potential for its price to rise as demand increases. Victor envisions Bitcoin as a pioneering asset class, suggesting that it can coexist harmoniously with traditional precious metals.

Related reading: Bitcoin Has Intrinsic Value: Beyond the Ponzi Scheme Narrative

The ‘Dollar Cult’ Perspective

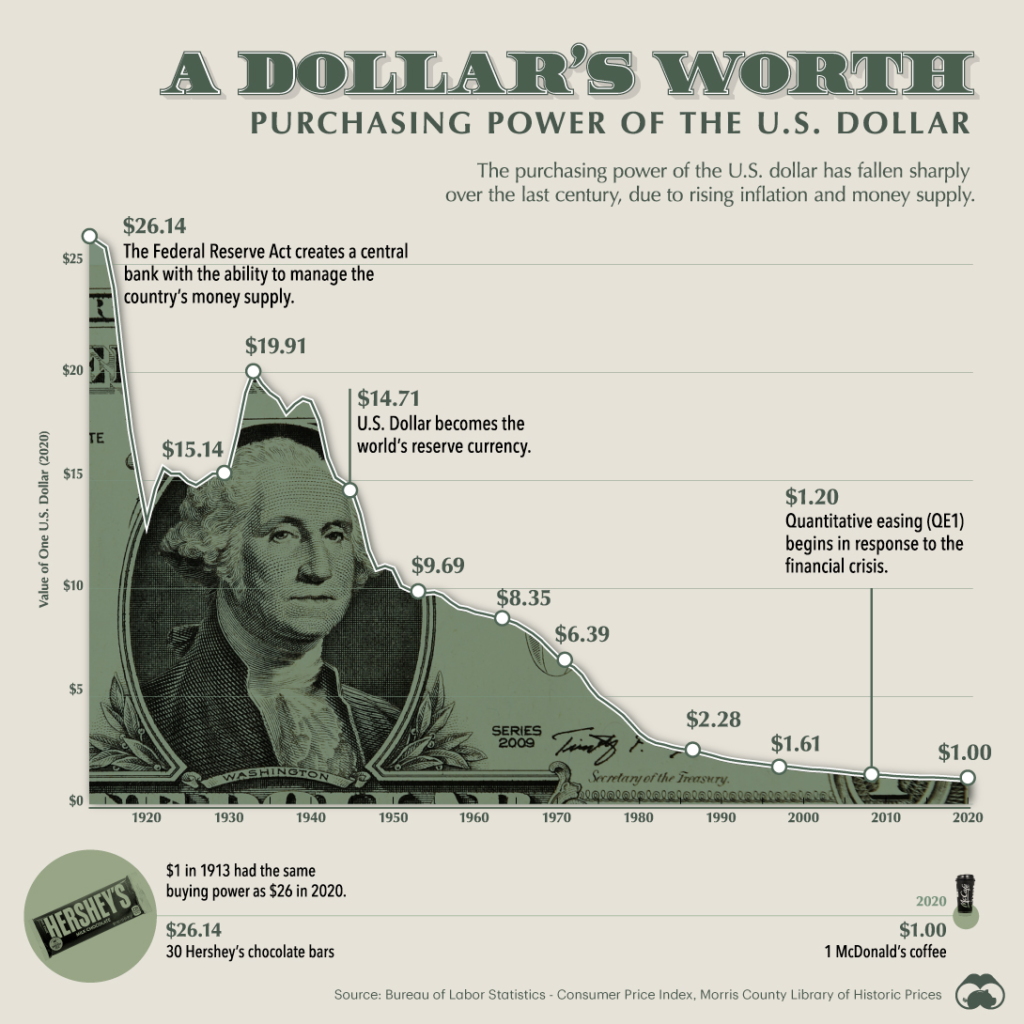

Schiff‘s criticism of Bitcoin raises eyebrows when considering the modern miracle of the U.S. dollar. The widespread acceptance of paper currency in exchange for tangible assets showcases the ‘cult-like’ trust in the dollar.

Despite its declining purchasing power over the years, the U.S. dollar remains the primary global reserve currency. This sentiment is humorously echoed in a user’s comment, highlighting the ‘cult’ status of the dollar.

Defending Bitcoin’s Value

Contrary to Schiff‘s views, negating Bitcoin’s importance is not only an oversimplification but potentially harmful. When gauged against unstable fiat currencies, like the Argentine peso, Bitcoin’s value is reaching new all time highs.

Critiquing Bitcoin is easy for those with unfettered access to U.S. dollars and stable markets, shielded from the immediate threats of hyperinflation.

Gold, while historically a trusted store of value, falls short in terms of portability, especially in crises like fleeing a country due to geopolitical unrest. Bitcoin, on the other hand, offers multifaceted benefits as it can be stored via 12 words on paper or in your head. If held for long periods of time, it has proven itself as a secure savings option, and for many with failing currencies, it can act as a medium of exchange.

It can be used to do business with people in many countries, so it’s not just for those in countries with failing currencies. Its limited use as a unit of account underscores the final challenge it faces as an emerging currency, and many Bitcoiners believe this shift will occur if inflation of fiat currencies becomes so severe that it ceases to be a reliable unit of account.

Related reading: Michael Saylor Says Bitcoin is a Shield Against Inflation

Schiff’s Decade-Long Bitcoin Misstep

A decade ago, when Bitcoin was trading just above $200, Peter Schiff confidently compared its rise to the 17th-century tulip mania on live television and CNBC wrote an article titled “Bitcoin is tulip mania 2.0—not gold 2.0: Schiff”.

Dismissing it as a passing “bubble” and a mere “source of gambling,” Schiff predicted its imminent downfall. Fast forward to today, Bitcoin’s tenacity and sustained growth starkly contrast Schiff’s early assessments. Given his prolonged misjudgment, it’s understandable if Schiff feels a tad “salty” about missing the mark so consistently over the years.