This article was originally published by Niko Jilch on FixTheMoney.net in March 2023.

Surprise, surprise, we haven’t learned a single thing since 2008.

We knew back then bailing out the banks would lead to moral hazard and (eventually) inflation. We know these facts to be true today. But we just don’t care. As a society, we are troubled by other things like the war in Ukraine and, ironically, inflation.

Very few people connect the dots. This is important to remember, especially for those who have already gone down the Bitcoin route and are by now comfortable thinking about concepts like “decentralization” and “counterparty risk.”

The masses don’t care!

At least they didn’t. Until this current banking crisis kicked off. Now more people do care.

All Your Models for Monetary Policy are Destroyed

I don’t think it’s any coincidence that the U.S. government is clamping down on “crypto” and fiat on-ramps for Bitcoin, just as these masses might need them the most. Like Christine Lagarde said: “If there is an escape, it will be used.”

And to paraphrase Michael Saylor: If there is an escape, all your precious models for monetary policy are destroyed.

Remember, these are the same people who want to ban cash in order to force negative interest rates down our throats. They have zero incentive to “think outside the box,” for they are the kings of the box. The box has been good to them and that’s why they can’t imagine anyone wanting to get out.

Now they try to lock the doors of a burning building.

History will not be kind to them.

But there is a positive story here as well. Bitcoiners around the world spent last weekend being totally relaxed and joking about silly fiat bros storing their money using totally outdated technology (banks). Counterparty risk is now a thing. As banks get bailed out again, all roads lead to Bitcoin.

The Narrative Has Gone in Bitcoins Favour

The collapse of FTX has firmly established the (correct) narrative that Bitcoin is the only truly decentralized and therefore trustless “crypto.” Us pesky Bitcoin Maxis have done a good job representing this truth. As a story it’s easy to grasp. It’s also a narrative that doesn’t actually rely on price and focuses on the technology of Bitcoin.

Now, that this narrative is established in the mainstream, the banks begin to fail.

Bitcoin was literally built for this moment. When Satoshi Nakamoto included a warning about bank bailouts in the Genesis block, he wasn’t just referring to the dangers of inflation — but to the dangers of centralized banking and currency systems in general.

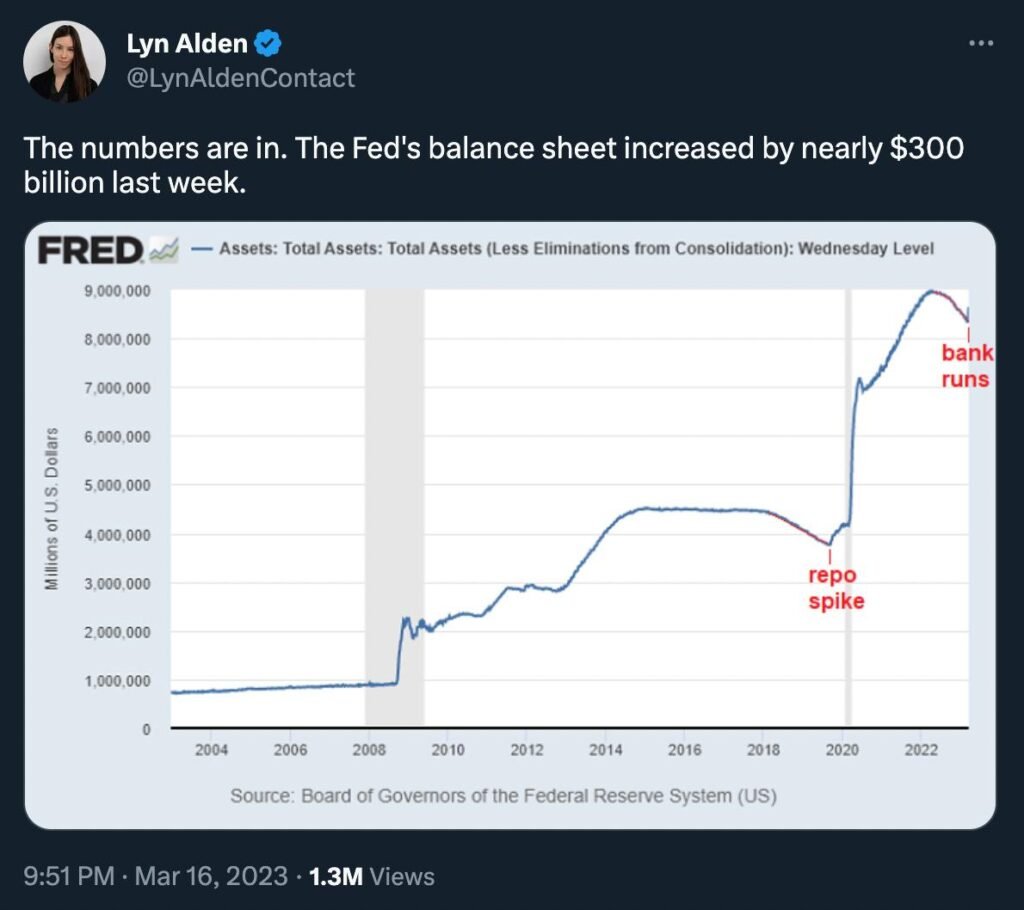

The market seems to suss this out as well. Bitcoin seems like a pretty good bet here, no? Look how quickly the price of bitcoin reacts to a new round of monetary debasement. It’s stunning, really.

When banks fail, people will need to turn to Bitcoin as a new technology that can safeguard their money. In Bitcoin they have access 24/7, without ever waiting in a queue.

And if banks get bailed out again, the pressure is transferred to the currency. The debasement picks up again and people will need to turn to Bitcoin as a new technology that can safeguard the value of their money in the long term.

All roads lead to Bitcoin.