This article is sponsored by Meanwhile

The ancient philosophy of Stoicism is making another comeback in the modern age, and nowhere more so than in the realm of Bitcoin. Emphasizing virtue, resilience, temperance, and justice, it’s a philosophy that resonates strongly with Bitcoiners. An observation of Bitcoiner behavior reveals a strong alignment with the tenets of Stoicism.

What is Stoicism and Why Does it Matter?

Stoicism is a philosophical school of thought founded in Athens in approximately 300 BC. In modern times, it is the most popular of the three philosophical schools of Ancient Greece, the other two being Epicureanism and Skepticism.

Despite already being over 450 years old in his lifetime, the most famous Stoic is perhaps Marcus Aurelius, the “philosopher king.” “Meditations”, the name given to his disordered writings, still sells thousands of copies each year. In fact, in 2019, perhaps fortuitously given the looming pandemic, it sold 100,000 copies.

Stoicism is a philosophy of virtue and emotional resilience, which is why we refer to people who remain cool in the face of emotional stress as “stoic”. The Stoics believe that your own mind can be controlled, but that all other things are external and must simply be accepted. They place great emphasis on natural law, believing that a wise person is one who understands and accepts the rules of the natural order.

Virtue for its own sake is the key to a good life, and the four virtues are wisdom, courage, temperance, and justice. It is an ancient philosophy, but one that has persisted throughout the ages despite the rise and fall of the civilizations that taught it. Ancient Greece, the Roman Empire, the Renaissance, and now the modern age all possess some form of Stoic philosophy.

Now, in the very early days of Bitcoinization, Stoicism is seeing a new revival.

The Stoic Philosophy of Bitcoin

Bitcoiners are Stoics, whether they realize it or not. A core principle in Stoicism is that actions speak louder than words. If you want to know what someone thinks, watch what they do rather than listen to what they say.

If you watch Bitcoiners, you’ll see the Stoic philosophy in action.

For example, the HODL mentality necessitates Stoic principles. Just as Stoicism teaches calm and resilience in the face of both great highs and lows in life, HODLing requires the same characteristics in the face of significant price volatility. A long time preference is essential to be a Bitcoiner. Quick wins, cheap dopamine, being pushed and pulled with the market trends, this is the antithesis of the HODL mantra.

Instead, Bitcoiners must be patient. They must see the bigger picture. They must have a vision of the future that requires some suffering in the short term so that a better world can be realized later down the line.

As the price of bitcoin reaches new all-time highs, Bitcoiners must have the restraint not to cash out for a quick profit. As the price falls back down, Bitcoiners must have the fortitude not to panic and cut their unrealized losses.

Ultimately, Bitcoiners must accept that the price of bitcoin is not in their control. All they can control is their own reaction. In this way, they demonstrate the emotional resilience of Stoicism. Similarly, the virtue of temperance (restraint, moderation) is key to HODLing. Bitcoiners are not day traders. The Bitcoiner mindset does not concern itself with timing the market, trying to maximize profits.

Bitcoiners believe in planning for the future, delaying gratification in the short term so that a more prosperous future can be manifested. Temperance is the trait most critical for delaying gratification, and it is therefore crucial for HODLers.

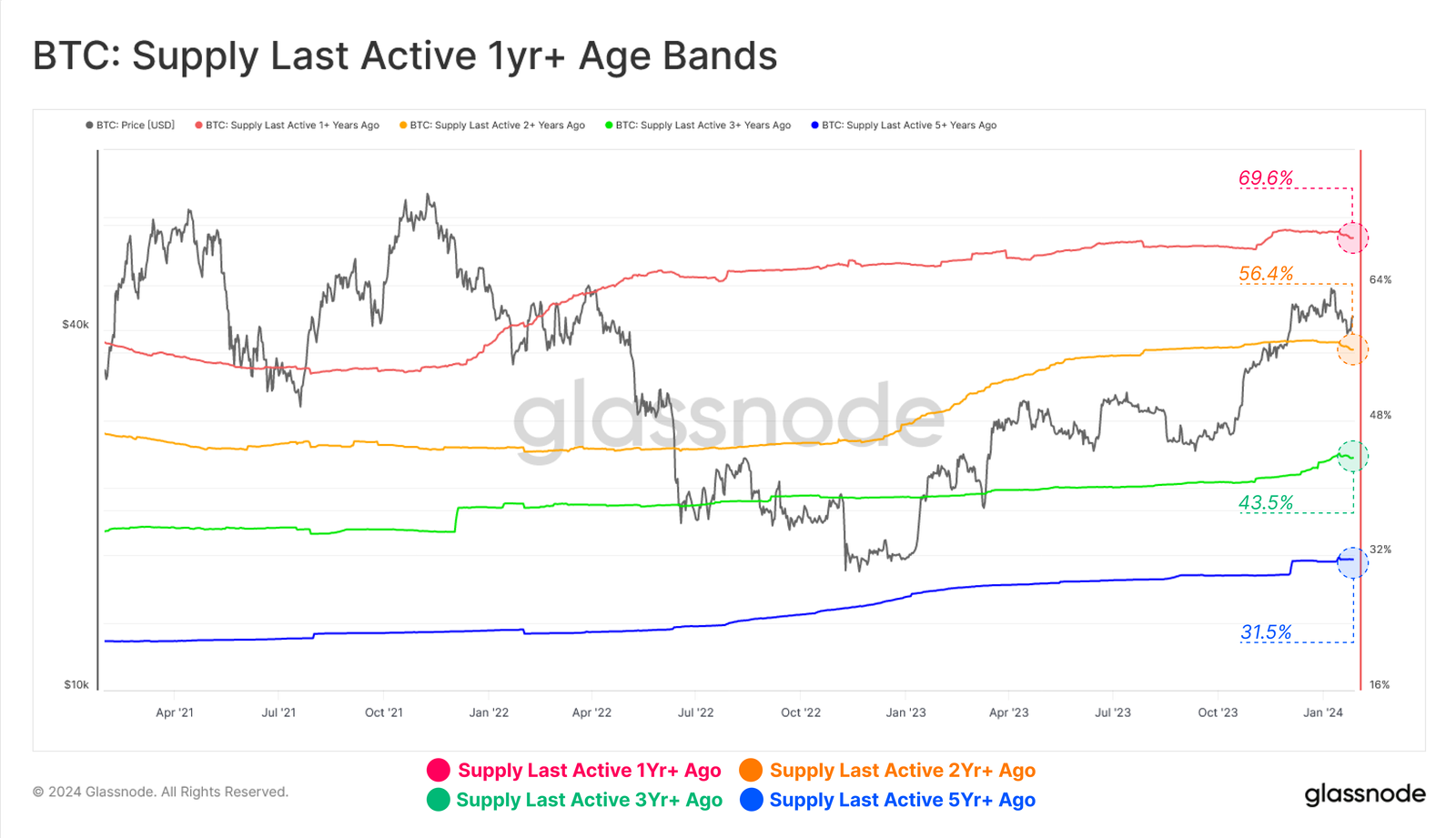

They appear to be demonstrating this characteristic very successfully, as the amount of bitcoin that hasn’t moved in 5 or more years is steadily growing. This is the Stoic philosophy in action.

The Future of Bitcoin

Bitcoiners frequently remind themselves (and each other) that adoption is still in its very early days. While the public is becoming more familiar with Bitcoin, institutional adoption is also accelerating. The recent Bitcoin ETF approvals have seen a wave of new capital enter the Bitcoin ecosystem, fueling price rises.

This in turn sparked a “sell the news” scenario which temporarily brought the price down again. But volatility is nothing new in Bitcoin. On the grandest of scales, we’re right at the beginning of a long upward trend that sees Bitcoinization bear the fruit that Bitcoiners are striving for.

A new global monetary system with sound money and financial incentive structures based on natural law. One where the natural properties of money return, and the synthetic properties of fiat are replaced. In Stoic terms, the future of Bitcoin is a monetary system based on justice, rather than one in which powerful institutions can print money at their leisure and devalue everyone else’s holdings.

But the early days are always the hardest, and it is in the face of these challenges that Bitcoiners must hold fast to their Stoic principles. For every lie that is told about Bitcoin, that it is a Ponzi Scheme, that it is bad for the environment, and that it is favored by criminals, Bitcoiners must accept that they cannot control the words or actions of others, only themselves.

Bitcoiners must remain true to the Stoic philosophy of Bitcoin: by remaining temperate in the face of greed, resilient in the face of struggle, and resolute in the face of criticism. As Marcus Aurelius quoted with approval:

“It is a King’s part to do good and be reviled.”

In these early days, criticism, mockery, and even innocent misunderstanding are a Bitcoiner’s lot, and the Bitcoin philosophy must be a Stoic one to bear it.

How to Unlock the Potential of Your Bitcoin

In Stoicism, the virtues are not random. They are virtues because they are characteristics that lead to a better life. It is no accident that Stoicism places great importance on natural law. It is above all a functional philosophy.

We cannot dictate terms to reality. We can only accept the terms reality dictates to us, and react to them in the way that best suits our aims. For Bitcoiners and HODLers, it is not enough to have bitcoin for its own sake.

Bitcoiners HODL because it is the best strategy for securing financial independence in the future. The fate of our fiat currencies is one of perpetual inflation, making the prospect of hyperinflation seemingly inevitable. Bitcoin offers freedom from the whims of central and commercial banks. But is putting it on a hardware wallet and burying it in the backyard still the best option?

For Bitcoinization to take place, bitcoin must infiltrate traditional finance. It’s a fact that many Bitcoiners are uncomfortable with, but it’s true. Most people don’t want to self-custody, and most people don’t trust themselves to manage their own money—and for good reason, it’s difficult and the cost of mistakes is high. Traditional financial products exist that allow people to insure their future in fiat terms, but now bitcoin is starting to make its way into that arena.

Meanwhile, for example, is a life insurance company that entirely denominates its premiums and claims in bitcoin. Not only does this fulfill the same outcome as HODLing by paying a certain amount of bitcoin (at a certain price) now in return for a payout in bitcoin (at a higher price) later, but it also goes further.

Meanwhile pays more bitcoin out than a Whole Life customer pays in premiums. So a customer paying 10 BTC in premiums could leave 20 BTC to the beneficiaries of their claim. So not only do early adopters get the benefit of paying BTC that is undervalued in fiat terms, but they also get the benefit of growing that stack of BTC.

The important thing to note here is that this is not the pursuit of quick wins or easy profits. Bitcoin-denominated insurance could be the pathway toward normalizing planning for the future in bitcoin. As bitcoin becomes the standard currency in which to plan for the future, adoption will grow and Bitcoinization will accelerate.

Conclusion

Bitcoiners exemplify the Stoic philosophy. With an emphasis on temperance, emotional resilience, the delay of gratification, and the importance of justice and natural law, Bitcoiners share many of the tenets of ancient Stoicism.

The primary reason why Bitcoiners HODL is to secure their future against economic and monetary uncertainty. This long time preference is a key characteristic of Stoicism and separates Bitcoiners from most people in modern society. The long time preference is not only relevant on the individual level. For Bitcoiners as a whole, planning for the future must involve more than simply buying and storing bitcoin.

Bitcoin must become commonplace at the institutional level of finances. Bitcoin-denominated life insurance is perhaps the perfect vehicle to deliver the financial security that Bitcoiners seek as well as achieving the normalizing effect that will lead to greater adoption.