The International Monetary Fund (IMF) has been vocal about its concerns regarding El Salvador’s adoption of bitcoin as legal tender, consistently advising the Central American nation to scale back its Bitcoin policies.

Since El Salvador made history in 2021 by becoming the first country in the world to adopt bitcoin as legal tender, the IMF has expressed reservations about the economic and regulatory risks associated with this move.

Despite these warnings, El Salvador continues to push forward with its Bitcoin strategy, with President Nayib Bukele showing no signs of backing down.

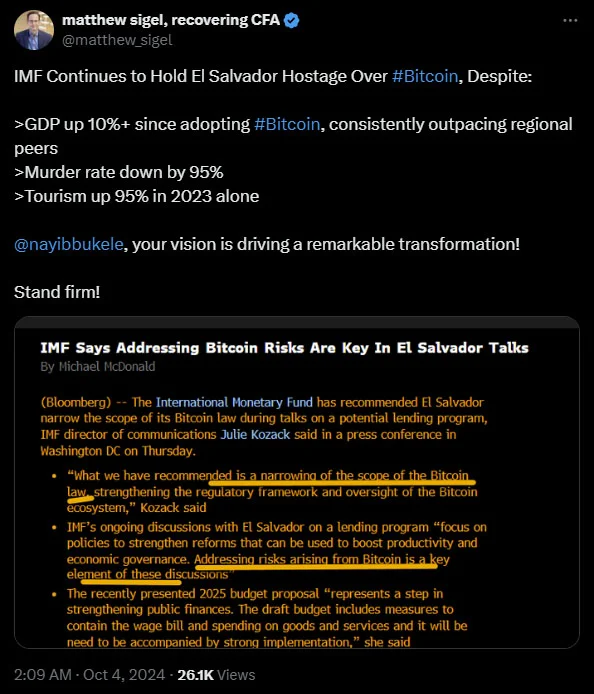

During a press conference on October 3, 2024, Julie Kozack, director of the IMF’s communications department, reiterated the organization’s stance. She stated:

“What we have recommended is a narrowing of the scope of the Bitcoin law, strengthening the regulatory framework and oversight of the Bitcoin ecosystem, and limiting public sector exposure to Bitcoin.”

The IMF has made it clear that while it respects El Salvador’s decision to embrace Bitcoin, it believes the country needs to tighten its regulations to minimize potential risks.

Related: El Salvador Announces Bitcoin Certification Program for 80,000 Civil Servants

The IMF’s latest remarks come after a similar call for reform earlier in August. While the IMF acknowledged that some of the predicted risks of adopting Bitcoin have not yet materialized, they remain cautious.

The organization believes that the current regulatory framework surrounding Bitcoin in El Salvador is too broad and lacks the necessary oversight to ensure the country’s financial stability in the long term.

On October 4, Juan Carlos Reyes, the President of the National Commission on Digital Assets (CNAD) in El Salvador, revealed that lawmakers in the country had approved significant amendments to the CNAD law.

These updates empower the CNAD to oversee Bitcoin businesses, making it the main regulatory authority for the country’s Bitcoin sector. Additionally, it will establish a risk-based framework to enhance El Salvador’s position in digital asset regulation and adoption.

Reyes stated, “Our team [will] combine regulatory knowledge with practical Bitcoin experience, ensuring a balanced and effective approach.”

In a related update, the National Bitcoin Office (ONBTC) within the Office of the President of El Salvador announced that the nation is working on establishing new capital markets centered around the leading digital asset. The ONBTC highlighted:

“Only on bitcoin can an individual ever self-custody their wealth and property. Capital will never form upon chains designed for velocity rather than sovereignty.”

One of the primary reasons behind the IMF’s concern is the exposure of El Salvador’s public sector to Bitcoin. The IMF has consistently urged the country to step away from its reliance on Bitcoin and instead adopt a more traditional financial infrastructure.

While Bitcoin is often seen as an alternative to the traditional fiat currency system, especially for countries with struggling economies, the IMF argues that it could expose El Salvador to financial instability.

Since Bitcoin’s legal adoption, El Salvador’s GDP growth has hovered around 3%, a figure the IMF views as modest but not sufficient to outweigh the potential risks posed by this strategy.

The country’s outstanding loans, estimated at $144 million, also play a part in the IMF’s push for a regulatory overhaul.

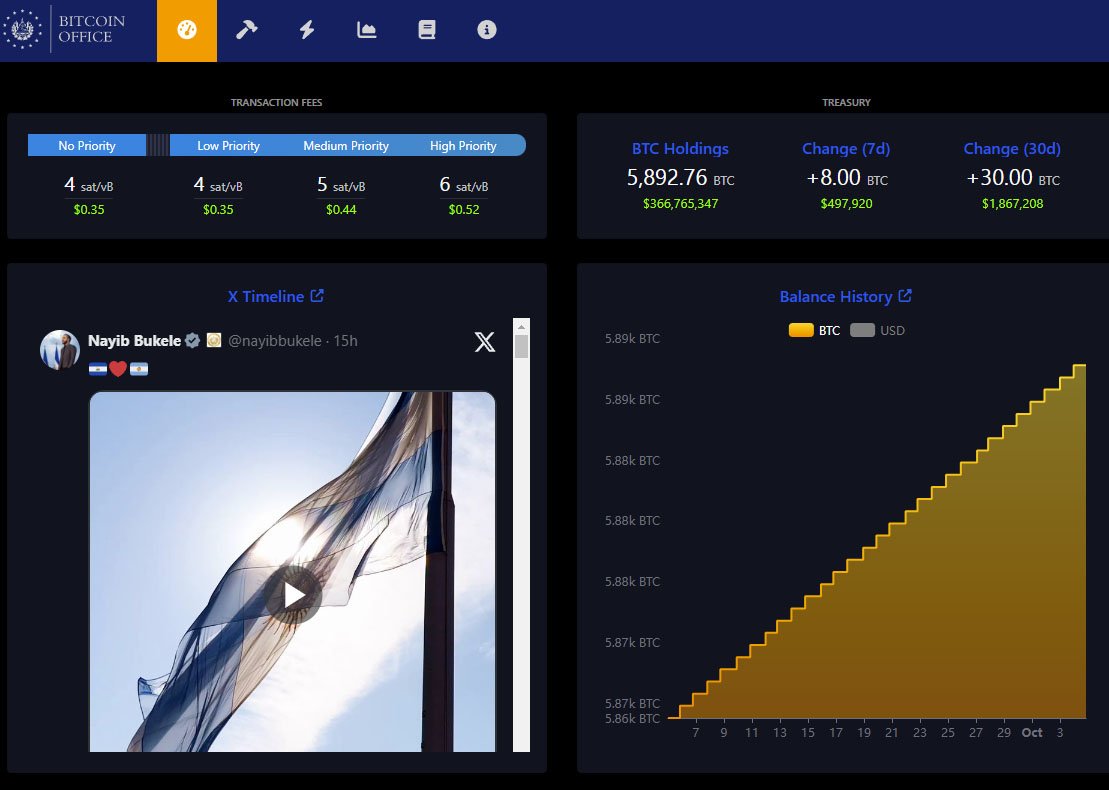

The organization believes that bitcoin’s volatile nature could complicate El Salvador’s ability to manage its debt and finances. At present, it possesses 5,892 BTC, which is approximately valued at $365 million based on the current market price.

While President Bukele and his administration remain committed to their Bitcoin strategy, not everyone in the country is convinced.

Speaking to TIME magazine in August 2024, Bukele admitted that the adoption of Bitcoin is not as widespread as he had expected, but his government left it as a free choice for the Salvadoran people.

Bukele had initially hoped that the country’s citizens would enthusiastically embrace the new currency, but uptake has been slower than anticipated.

Despite this, Bukele has made it clear that he will not force Bitcoin adoption on his people, stressing that it remains a voluntary option.

This pragmatic stance has allowed Salvadorans the freedom to choose whether they want to adopt Bitcoin or stick with the U.S. dollar, the country’s other legal tender.

The IMF’s concerns about Bitcoin are not limited to El Salvador. Globally, the organization has expressed skepticism about decentralized digital assets, particularly Bitcoin.

In recent years, the IMF has worked with other nations, such as Andorra and Pakistan, to develop frameworks for monitoring and taxing digital asset transactions.

The organization has also floated ideas such as taxing the energy consumption used for bitcoin mining, arguing that this could help reduce carbon emissions—a growing concern among climate activists, who believe Bitcoin mining is becoming a troubling issue.

Related: List of Recent Studies Highlighting Bitcoin’s Net-Positive Environmental Impact

At the same time, while the IMF opposes decentralized digital assets like Bitcoin, it is actively promoting Central Bank Digital Currencies (CBDCs). In September, the IMF launched the REDI framework to help central banks around the world implement CBDCs.

This framework focuses on regulation, education, design, and incentives, aiming to make digital currencies more appealing to the public while maintaining control in the hands of governments.

Despite the IMF’s ongoing pressure, President Bukele remains steadfast in his vision for El Salvador. Under his leadership, the country has launched several high-profile projects aimed at integrating Bitcoin into its economy.

These include initiatives like “Bitcoin Beach” and the ambitious “Volcano Bond,” which aims to fund Bitcoin mining using the country’s abundant geothermal energy from its volcanoes.

Bukele’s popularity, both at home and abroad, has surged as a result of his bold policies. Domestically, his leadership has seen improvements in public safety and a stronger economy.

Internationally, he has become a polarizing figure, drawing both praise and criticism for his unorthodox approach to governance.

Bukele has often clashed with international institutions like the IMF and Western nations, positioning himself as a defiant leader who champions the sovereignty of his country.

This isn’t the IMF’s first warning to El Salvador.

In August, the organization issued a similar caution, stating that “while many of the risks have not yet materialized, there is joint recognition that further efforts are needed to enhance transparency and mitigate potential fiscal and financial stability risks from the Bitcoin project.”

The IMF also emphasized that “additional discussions in this and other key areas remain necessary.”

As El Salvador continues its experiment with Bitcoin, the world watches closely. The IMF’s warnings reflect broader concerns in the international community about the risks of embracing a volatile and decentralized asset like bitcoin as legal tender.

However, the results of President Bukele’s initiatives have been positive so far. JPMorgan, in a recent report, increased the country’s growth forecast to 3.9%.

President Bukele and his supporters argue that Bitcoin offers El Salvador a path to financial independence and innovation, particularly in a world where traditional fiat currencies are facing increasing challenges.

In the coming years, the outcome of El Salvador’s Bitcoin experiment could have far-reaching implications, not just for the country, but for the global financial landscape.

While the IMF’s calls for reform are unlikely to disappear, Bukele’s administration seems determined to stay the course.