This article was originally published by Mickey Koss on Forbes.com

Mark Yusko Prediction

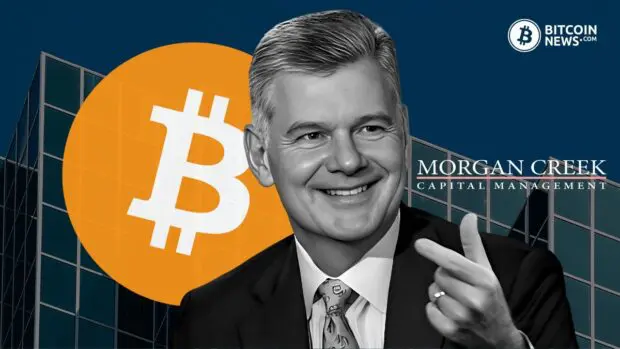

Mark Yusko, CEO of Morgan Creek Capital management predicted $300 billion in inflows once a bitcoin ETF is approved by the SEC. “Institutional investors have been cautious about entering the crypto space due to regulatory uncertainties and concerns about custody,” Yusko offered in an interview.

He posits that a spot ETF would ease those concerns by offering institutions a regulated and secure way to add bitcoin to their portfolios. In the wake of the now approved BlackRock’s bitcoin ETF filing, professional money managers are more optimistic than ever about the odds of an inevitable bitcoin ETF approval.

Cathie Wood, CEO of ARK Invest recently communicated her optimism in an interview with Financial News in early October 2023. She stated that “the odds are going up” that the SEC will approve her firm’s application for a spot bitcoin ETF. According also reported in October that the SEC was actively engaging with spot bitcoin ETF hopefuls, seeing it as a potential sign of positivity after years of disappointment.

Wood has been a long-term bitcoin bull, predicting a $1.5 million price by 2030 earlier this year. Most price predictions however are based on increased long-term acceptance from institutions as a catalyst. As institutions presumably begin entering the space, there are a number of bitcoin companies ramping up their efforts to attract those entities.

Custodia Bank

Politico covered digital asset and banking concerns earlier this year. The article describes a concerted effort to cut off bitcoin companies from the banking system. As conventional banks fire clients in an attempt to mitigate perceived risk, Custodia is stepping in to change the status quo.

Custodia is a full reserve bank based in Wyoming specially positioned to service the bitcoin space. Caitlin Long, the bank’s CEO worked directly with Wyoming legislators in order to shape the legislation under which the bank is chartered.

This charter has some interesting provisions which differentiate Custodia from other institutions. “The Wyoming SPDI operates under the law of bailment. This legal framework ensures clients retain ownership over their assets, even in unforeseen circumstances,” Lisa Hough, Custodia VP of Strategic Relationships explained in our discussion.

Their bitcoin custody service launched earlier this month and was developed in house. “Unlike omnibus structures, Custodia offers segregated custody accounts. The emphasis on segregation enhances transparency and provides for on-chain visibility,” Hough added.

According to Hough, these measures are intended to reduce risks for depositors. The bailment structure ensures that bitcoin held on deposit remains accessible, even in the event of a Custodia bankruptcy. Furthermore, the proprietary technology development reduces cyber-attack surfaces and eliminates reliance on third parties.

Though Custodia’s services are not available in all states yet, their team communicated that they are working diligently to remedy that. The bank may very well become a haven for bitcoin companies who seek to reduce their risk of losing access to banking services.

Unchained

With the ongoing FTX fraud prosecution, companies like Unchained are working to provide a custody solution to earn the trust of institutional investors. “Institutions are interested in adding bitcoin to their treasuries, but with all the news of hacks and losses, many are rightfully nervous about how to secure the bitcoin,” Unchained SVP of Marketing Phil Geiger told me in an interview.

Geiger points to the collapse of Prime Trust and recent Fortress Trust hack as a key factor for the decision to create their “network of institutional key agents.”

Unchained’s solution involves a collaborative custody model where bitcoin private keys are distributed among several qualified custodians as a means to reduce the risk of a single point of failure. Private keys are the cryptographic secret that allow an individual or group to control their bitcoin.

Unchained also leverages bitcoin native capabilities, allowing customers to recover funds without having to use proprietary Unchained tools. “In the event that any key on the network is unavailable or lost, the other key agents can step in to move the bitcoin,” Geiger offered, describing the mechanism behind their disaster recovery feature.

Geiger noted that many companies are interested in the fact that the institutional key agents they launched with are already in different regulatory jurisdictions. Unchained is located in Texas, Coincover in the UK, Kingdom Trust in South Dakota, and New York Department of Financial Services qualified custodian Bakkt in Georgia, though the list will continue to grow.

“With the option to include their own keys, clients can add their jurisdictions of choice to the mix,” Geiger explained. This move will ensure client bitcoin remains available, even in the event of a complete ban in of the jurisdictions.

Swan

While many have said the interest rate hikes have resulted in risk off sentiment, Swan, a bitcoin only exchange is experiencing a different story. “In high interest rate environments, we’ve even observed conservative investors using coupon payments to buy bitcoin, thereby maintaining their principal,” Raphael Zagury, Chief Investment Officer at Swan said in an interview.

In a recent press release, Swan announced that they had raised $205 million of equity and credit funding in order to expand their institutional facing business lines. These efforts include bitcoin backed lending, advisor services, asset management, private equity, and the US’s first Bitcoin-only trust company.

Lending for example will target institutional investors, businesses, and family offices seeking $1-50 million loans. It’s meant to be a practical solution for those who want liquidity without having to sell their bitcoin. Additionally, the advisor service will allow financial advisors to more easily gain access to the asset on behalf of their clients.

Swan noted that their company currently generates $125 million in annualized revenue. With the addition of these new business lines, the company expects to cross the $200 million threshold in the first quarter of 2024. Their expectation for increased institutional participation is driving another $150 million funding effort in 2024 to further expand their efforts.

Zagury concludes that institutions not considering bitcoin are arguably breaching their fiduciary duties to investors. If historical trends continue, bitcoin may become increasingly difficult to ignore as a nascent asset class. The recent price action we see may be an indication that some institutions may already be quietly embracing bitcoin.