The last six months, altcoins have, to put it mildly, had bad optics. Take your pick from downward volatility, the outright fraud of 3 Arrows Capital, or the unwinding of algorithmic stablecoins promising yields from nothing. Alt has lived up to its reputation as the Wild West of Finance.

Personally, I have always drawn a thick black line between Bitcoin and what some might call “other cryptocurrencies.” Although not a Maximalist (I hold altcoins and see some potential in a few projects), the original inception and network effect of Bitcoin have always put it in a different class for me. Simply put, there is Bitcoin and then there is everything else. And some of that ‘else’ may have potential, sure, but it can never be Bitcoin.

This argument has come under attack more recently. One can always point to increased doubt during the (perhaps) deepest part of a bear market. But it’s important to reiterate why lumping Bitcoin in with the Alts is intellectually dishonest.

Firstly, the beginning of Bitcoin involved no pre-mine; There was no gap between the founder and original users. It would have been possible for Satoshi to mine a lot more Bitcoin than he/she/they did. This egalitarian spirit is the biggest difference between Bitcoin and most other decentralized systems. Satoshi allowed the Bitcoin network to grow naturally in a truly decentralized manner and this first-mover advantage cannot be replicated by newer projects.

The second key distinction is that Bitcoin was created to serve only as money and nothing else. This stripped-down purpose stands in stark relief to the claimed functionality of Alts. Terms such as ‘sound money’ and ‘ultra-sound money’ are widely used. Bitcoin is starting to progress through the monetary stages, from store of value, to medium of exchange, and thus to unit of account. This progress is slow, and though yet to achieve the latter two of these money functions, Bitcoin is growing into them in a natural organic manner.

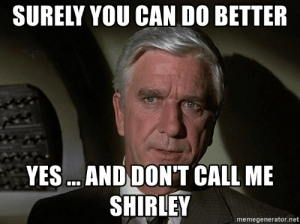

The truth of the matter is that Altcoins are controlled by groups of human beings. These humans can change their project rules as they see fit. They can change the supply of their coins and how they are distributed. Bitcoin is controlled by no one. Any changes to the protocol can only be enacted if 51% of decentralized, equal nodes agree. This is the reason why Bitcoin can never be crypto and vice versa. “But surely there’s a second best”, I hear them say. No, there isn’t, and don’t call me Shirley.