Bitcoin total valuation has leapfrogged Meta market cap (formerly Facebook) as it went above $1.3 trillion in net worth. The premier digital asset is posting strong growth at the moment, buoyed by an early onset of the 2024–2025 bull market.

According to companiesmarketcap.com, Meta’s overall market cap is still hovering below $1.3 trillion. Bitcoin’s total valuation, on the other hand, is $1.33 trillion, according to coinmarketcap.com.

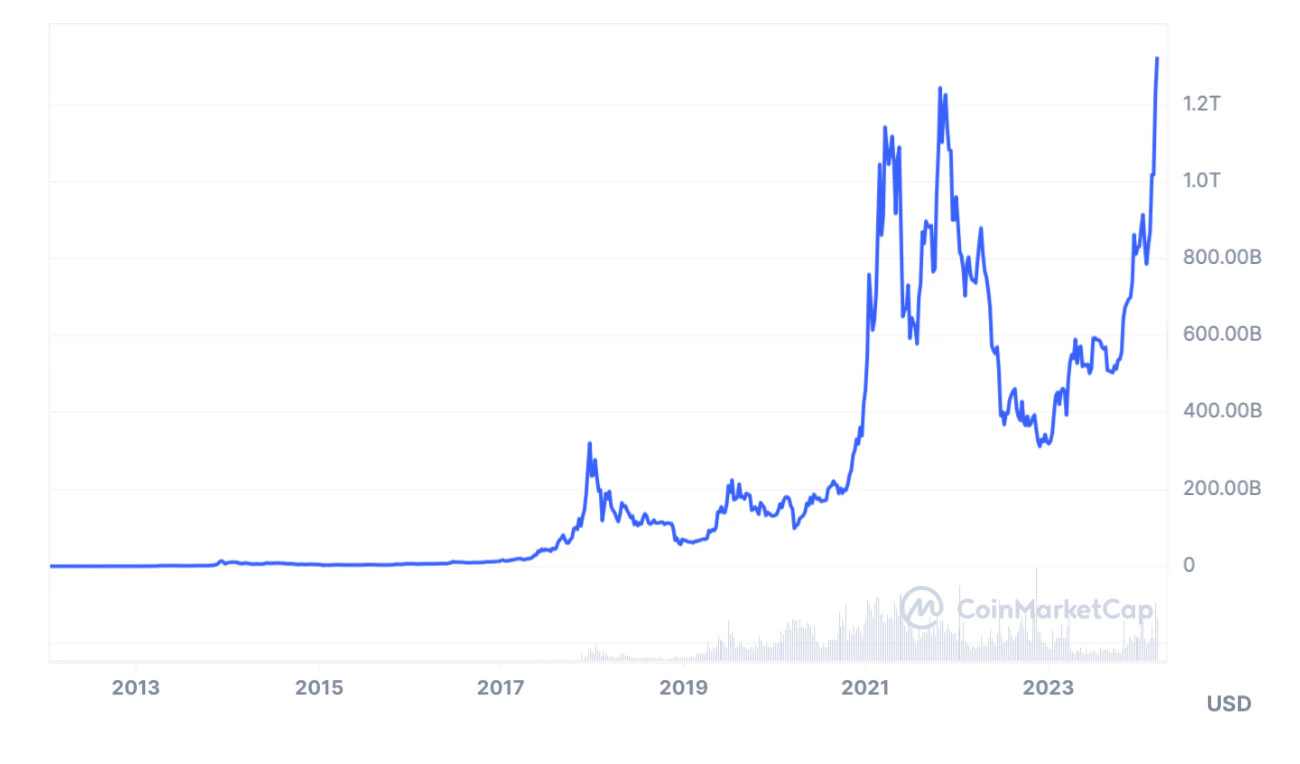

Here is the Bitcoin market capitalization chart since 2012:

Here is the Meta platforms’ market capitalization since 2012:

Bitcoin witnessed a 320% net increase in net value over the last 12 months. It was languishing below $400 billion ($0.4 trillion) back in March 2023 but the digital asset did manage to get out of this tough situation, especially in the last few months. The last two quarters (Q4 2023 and Q1 2024) proved decisive in this regard.

Meta Market Cap Overtaken: What’s Next for Bitcoin?

According to analysts, bitcoin is set to have a major 2024-2025 bull market overall. The popular digital asset now has its eyes set on Alphabet (formerly Google) which is worth $1.65 trillion according to the latest figures from companiesmarketcap.com. However, the premier digital currency is facing some resistance while attempting to break above $69k, its current All-Time High (ATH).

Due to recent price gains, bitcoin only trails behind Microsoft (MSFT, $3.03 trillion), Apple (AAPL, $2.6 trillion), Nvidia (NVDA, $2.3 trillion), Saudi Aramco (2222 R, $2.04 trillion), Amazon (AMZN, $1.8 trillion) and Alphabet (GOOG, $1.65 trillion) in total market capitalization.

This is not the first time BTC has surpassed META’s market cap. It achieved this feat for the first time back in the first quarter of 2021 when BTC’s valuation rose above $800 billion while META closely followed it. Eventually, META was able to beat BTC as the latter entered a long-term bear market during much of 2022-2023. Now, BTC is back near record highs and challenging these tech giants in net valuation once again.

Can Bitcoin be Compared to Tech Companies?

Bitcoin’s comparison with regular tech companies is not a fair one. This is because Meta, Apple, Microsoft, etc are regular businesses with profits, revenues, and defined company structures. Bitcoin on the other hand is a decentralized, scarce digital currency. It is a digital currency with no defined profitability goals and revenues. It is designed to become an effective Peer-to-Peer (P2P) transaction means. It was not meant to engage in endless market cap wars against tech companies that sometimes come and go out of fashion.

While surpassing the overall valuation of Meta is a big achievement unlocked for the top digital asset, there isn’t a lot that is common between these two. The same is the case with the other companies higher up the pecking list.

Verdict

Bitcoin’s total market capitalization has surpassed Meta’s valuation and is expected to increase dramatically during the ongoing 2024-2025 bull market. While the two entities are quite unrelated overall, statistics like these are often seen as an indicator of the bullish character of the underlying asset.

If bitcoin surpasses the $100k valuation, as predicted by some analysts, it will leapfrog Saudi Aramco, Amazon, and Alphabet in market cap. That is provided their value will remain constant by then, which is an unlikely scenario.